Trade of the Day

Trade of the Day

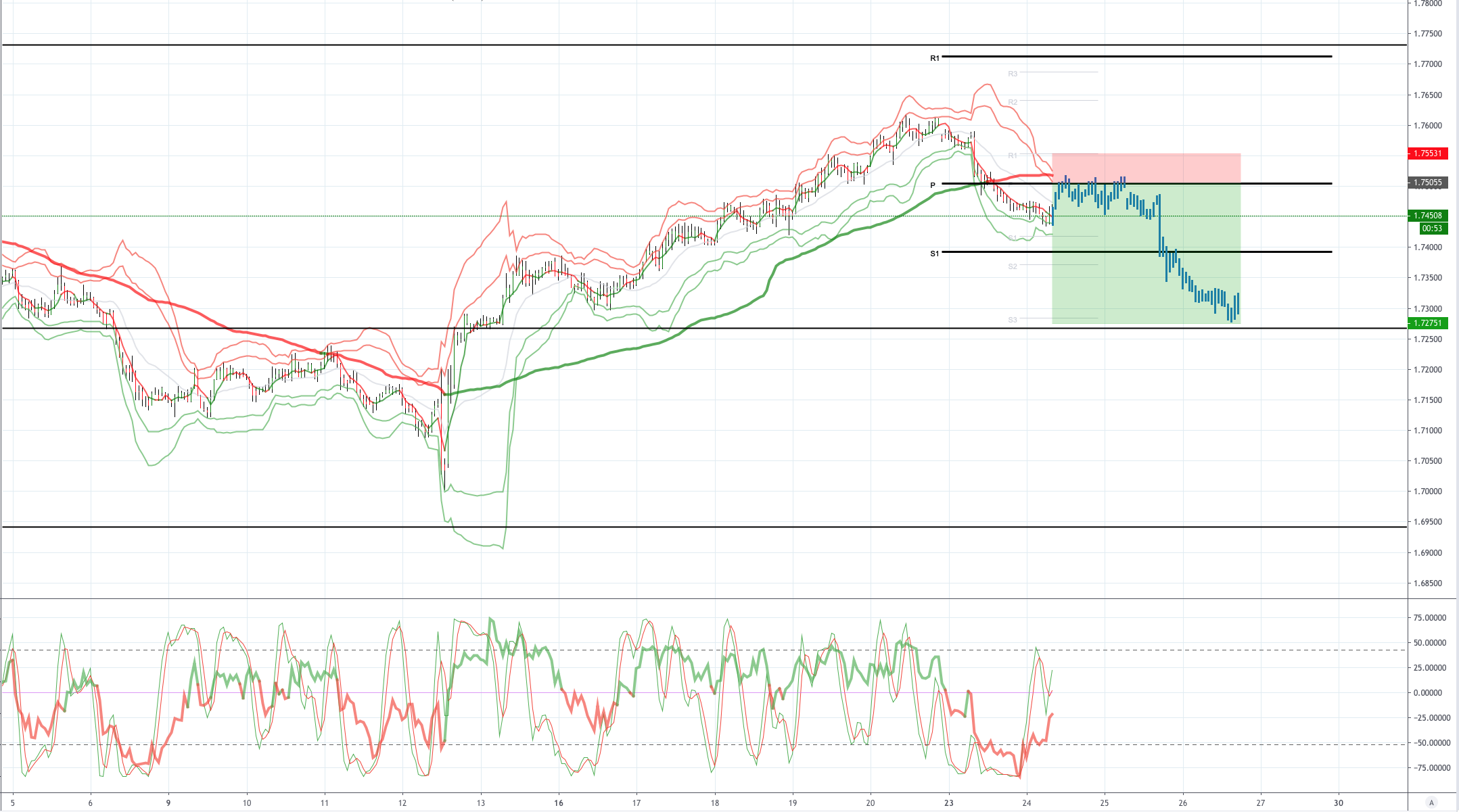

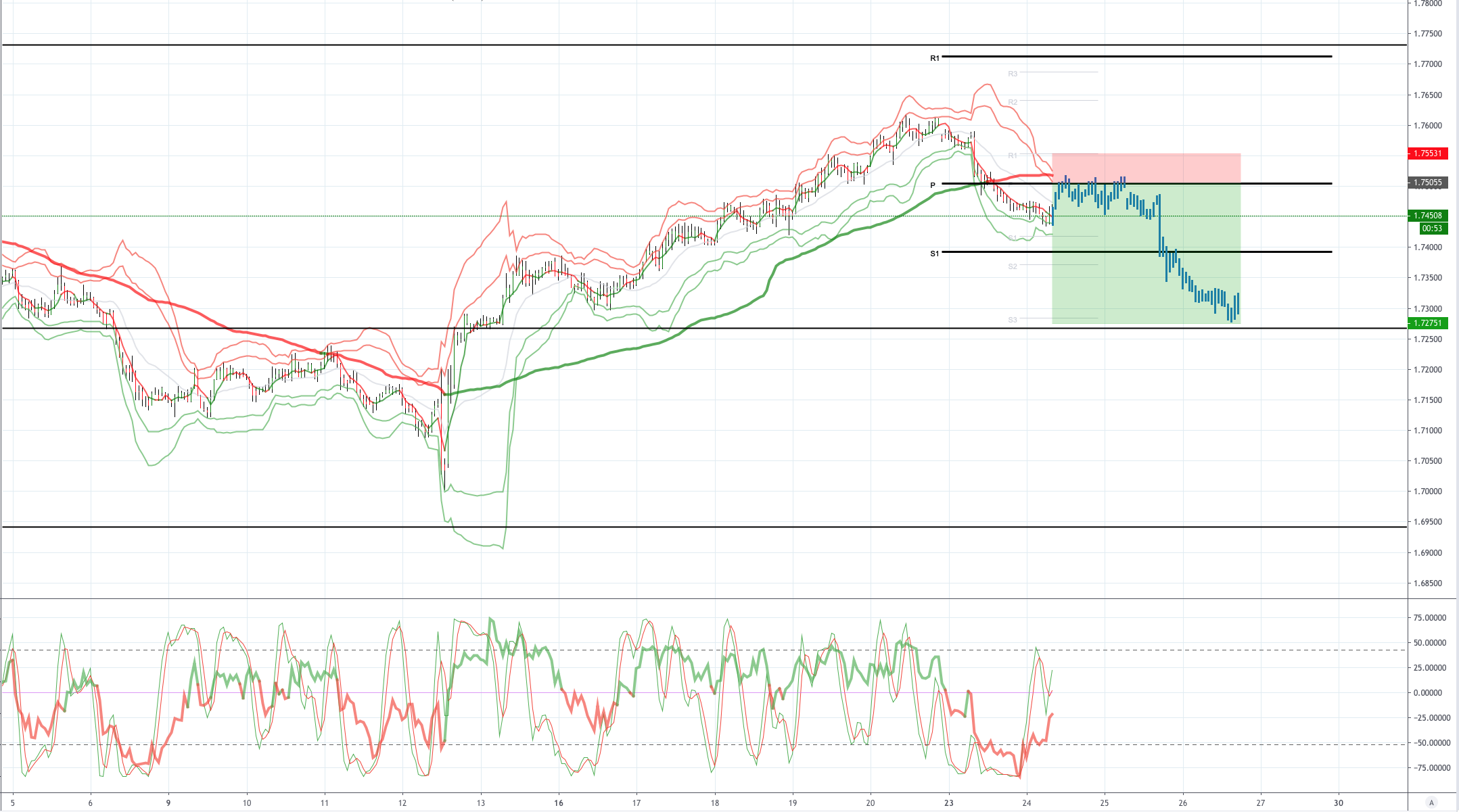

SELL EURNZD 1.7505 STOP 175.65 TARGET 172.75 (RISK 0.50%)

EUR: Very weak Eurozone PMI data. Eurozone manufacturing sentiment fell in September to the worst level in nearly seven years. The flash Eurozone manufacturing PMI fell to an 83-month low of 45.6 in September, down from 47.0 in August. German manufacturing PMI fell to 41.4 in September from 43.5, the worst reading in more than a decade. The flash Eurozone services PMI fell to an 8 month low of 52.0 from 53.5 in August, which was below the 53.2 reading expected.

NZD: The New Zealand Dollar is trying to hold onto positive news relating to US-China trade, while on Monday, we heard that President Trump had discussed expanding trade and defence cooperation with New Zealand, in a conversation with PM Ardern. We've also seen some profit taking on Kiwi shorts ahead of Wednesday's anticipated RBNZ decision.

From a technical and trading perspective the EURNZD posted a key day reversal yesterday and a potential double top at the 1.76 level, note the momentum divergence on the daily chart which suggests that we may be entering a phase of consolidation/correction, overnight the EURNZD has printed fresh lows as such I am going to enter short positions on a pullback to test offers at the 1.75 level targeting a move to test bids below 1.73 as per the chart below

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!