Daily Market Outlook, October 4, 2019

Daily Market Outlook, October 4, 2019

Main Market Themes

Stocks rebounded on refreshed Fed rate-cut hope; treasuries rallied and dollar came under pressure. US stocks recovered parts of its two-day losses overnight as investors turned hopeful that the Federal Reserve would cut rate again this year to stem an ongoing slowdown. Stocks had slipped initially in the immediate response to a disappointing ISM services index that printed a three year low reading, the latest key barometer to join a string of poor macroeconomic indicators this week.

Stocks rebounded as traders raised their bets on more rate cuts in 2019- money market futures show that markets now price in an 85% chance of 25bps cut in the Fed funds rate at the end of this month (versus just 40% at the start of the week) and another similar cut in the Fed’s last meeting in December. Rally in US treasuries extended as investors piled into the safe havens, leaving yields at 6-9bps higher across the curve. Yield on benchmark 2Y notes, a proxy for short term interest rate outlook fell the most by 9bps to 1.39%, reflecting higher rate cut expectations. Crude oil prices were steady – Brent finished little changed at $57.71/barrel and WTI slipped a little (- 0.4%) to $52.45/barrel.

As far as US economic data is concerned, the focus on Friday will be on the most important data release of the week – the September US labor market report. According to the latest Bloomberg polls (as of 3 October), nonfarm payrolls are expected to increase by 145,000 in September (an improvement from 130,000 in August) whilst the unemployment rate is likely to hold at 3.7%. US wage growth is likely to stay robust at 0.3% m/m, 3.2% y/y (from +0.4% m/m, 3.2% y/y in August). The other key US data will be the August trade balance data and the trade is expected to widen to US$54.5bn (from a deficit of US$54bn in July).

Attention will also remain on several Fed Reserve officials speaking in public forums, especially FOMC Chair Jerome Powell who will be making opening remarks at a “Fed Listens” event (Saturday, 2am SGT). This is usually a routine speech but some are hoping Powell will use this opportunity to comment on the recent batch of soft US economic data. Other notable Fed speakers today include Boston Fed President Eric Rosengren (voter in 2019 FOMC), Atlanta Fed President Raphael Bostic (voter in 2019 FOMC), Minneapolis Fed President Neel Kashkari (non-voter in 2019 FOMC), Fed Governor Lael Brainard (permanent FOMC voter) and Fed Vice Chair for Supervision, Randall Quarles (permanent FOMC voter).

Technical & Trade Views

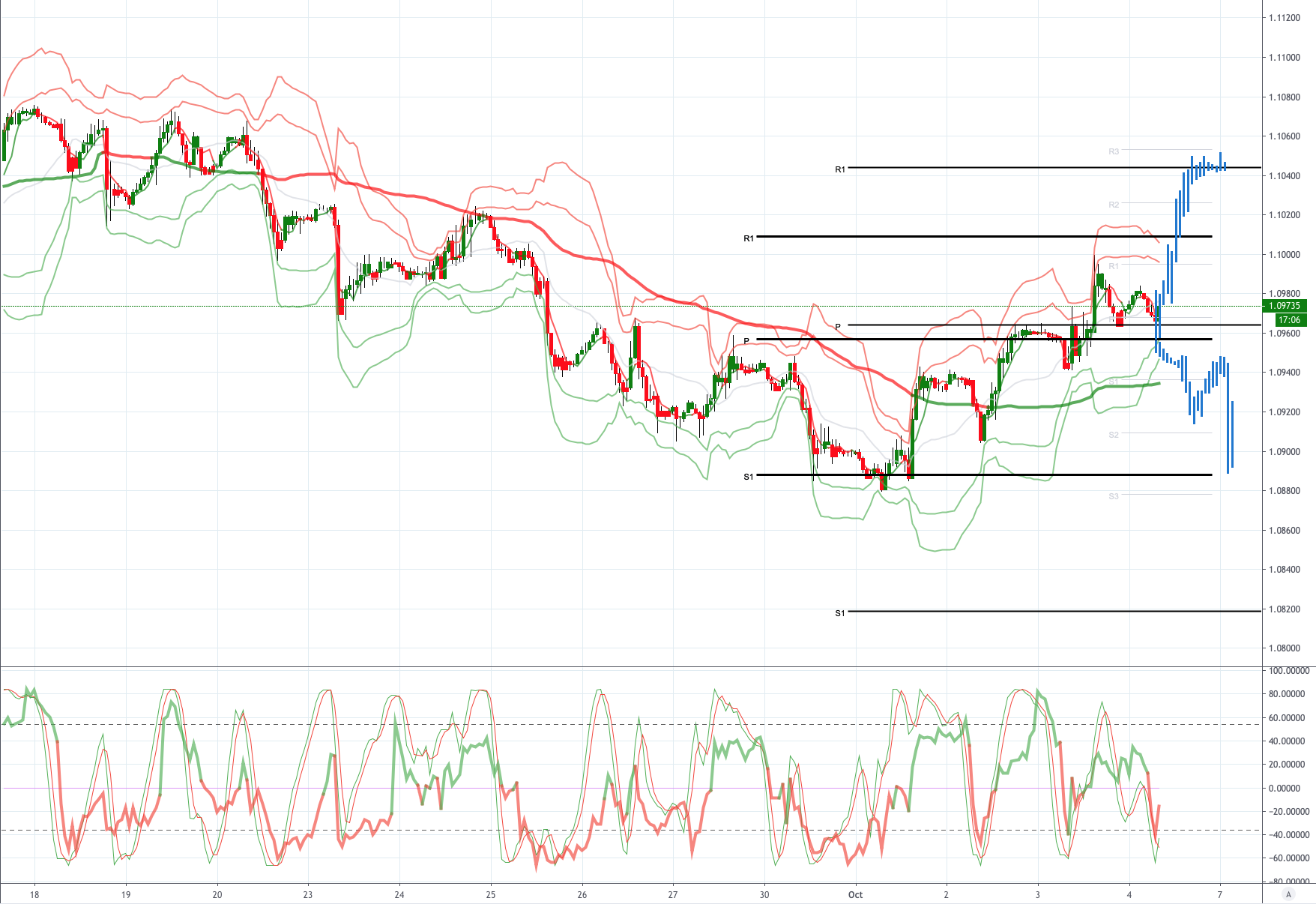

EURUSD (Intraday bias: Bullish above 1.0920, targeting 1.1010 & 1.1045 in extension)

EURUSD From a technical and trading perspective pivotal 1.0960 test underway, newly minted long positions may be vulnerable here as on the intraday price pattern suggests the current correction may be complete. A drive through 1.0970 is needed to inject further upside impetus. EURUSD...UPDATE as suggested we cleared 1.0970 and have renewed bullish sentiments offers & stops over 1.10 now look vulnerable, on the day we look for 1.0950 to provide support, a failure below 1.0940 would concern the bullish bias and open another run to test bids at 1.09. I am running weekly & daily long positions with decent profits and now risk free.

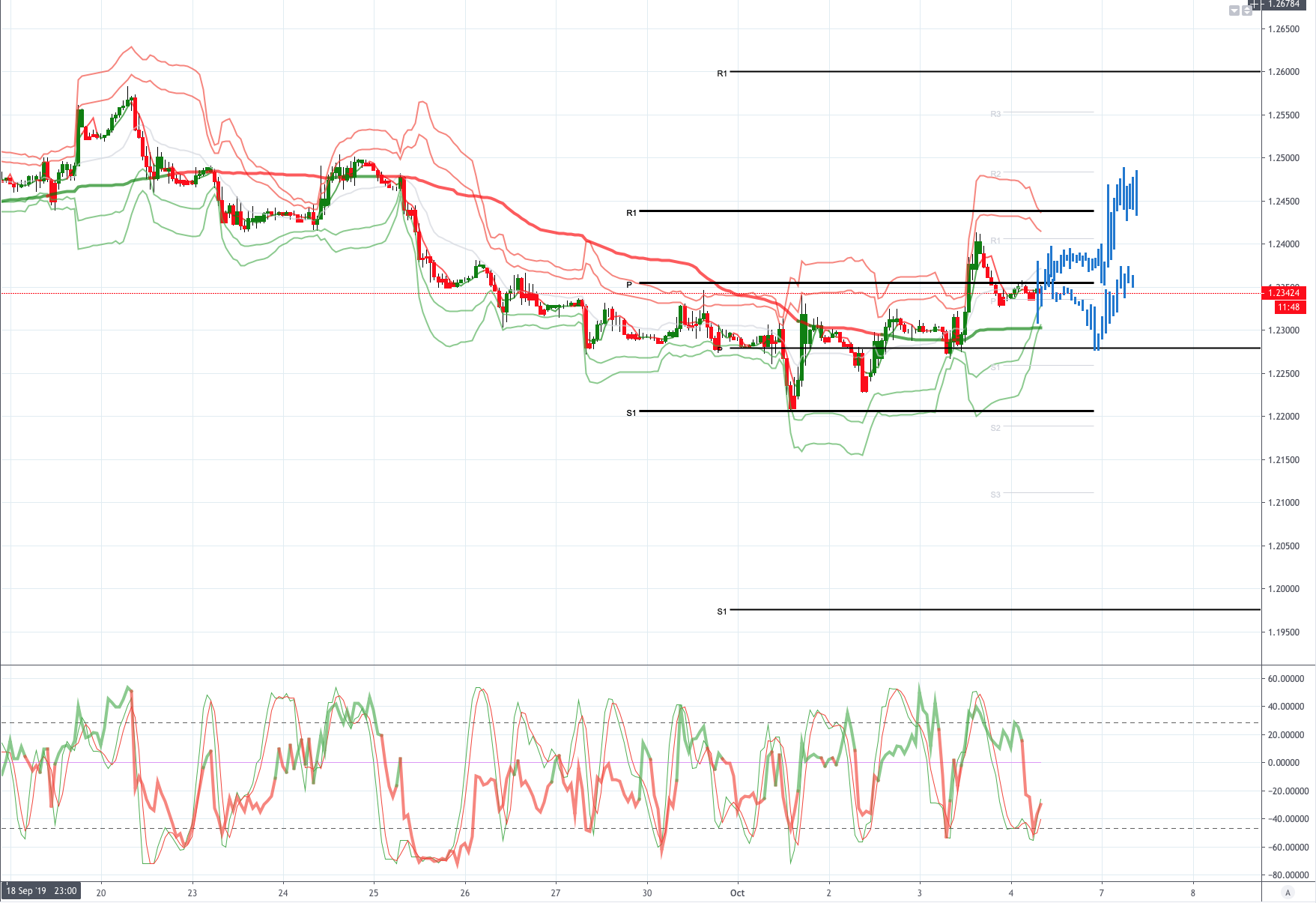

GBPUSD (Intraday bias: Bullish above 1.2250 1.22 targeting 1.2440)

GBPUSD From a technical and trading perspective intraday reversal from my 1.22 target plays out as 1.2240 supports look for the next leg higher to challenge 1.2350 offers, only a breach of yesterday's lows would concern the corrective bias and suggest a false break opening 1.2150/30. Note decent options expire at 1.2210 today.GBPUSD...UPDATE 1.2350 stops taken out as we spiked 1.24 in standard sterling style trade we duly retreated late in the day, look for 1.2330 to support today to provide the platform to my target, however, a failure below 1.2285 would negate upside objectives and open a retest of 1.22 bids

USDJPY (intraday bias: Bearish below 107.50 targeting 106.40)

USDJPY From a technical and trading perspective anticipated 107 test plays out potential for a pullback from current level to test 107.50 from below as this area acts as resistance now look for another leg lower to test bids below 106.50 . USDJPY UPDATE... all roads lead to 106.40 today as 107.30 caps any upside attempts, through 107.50 would delay downside objectives.

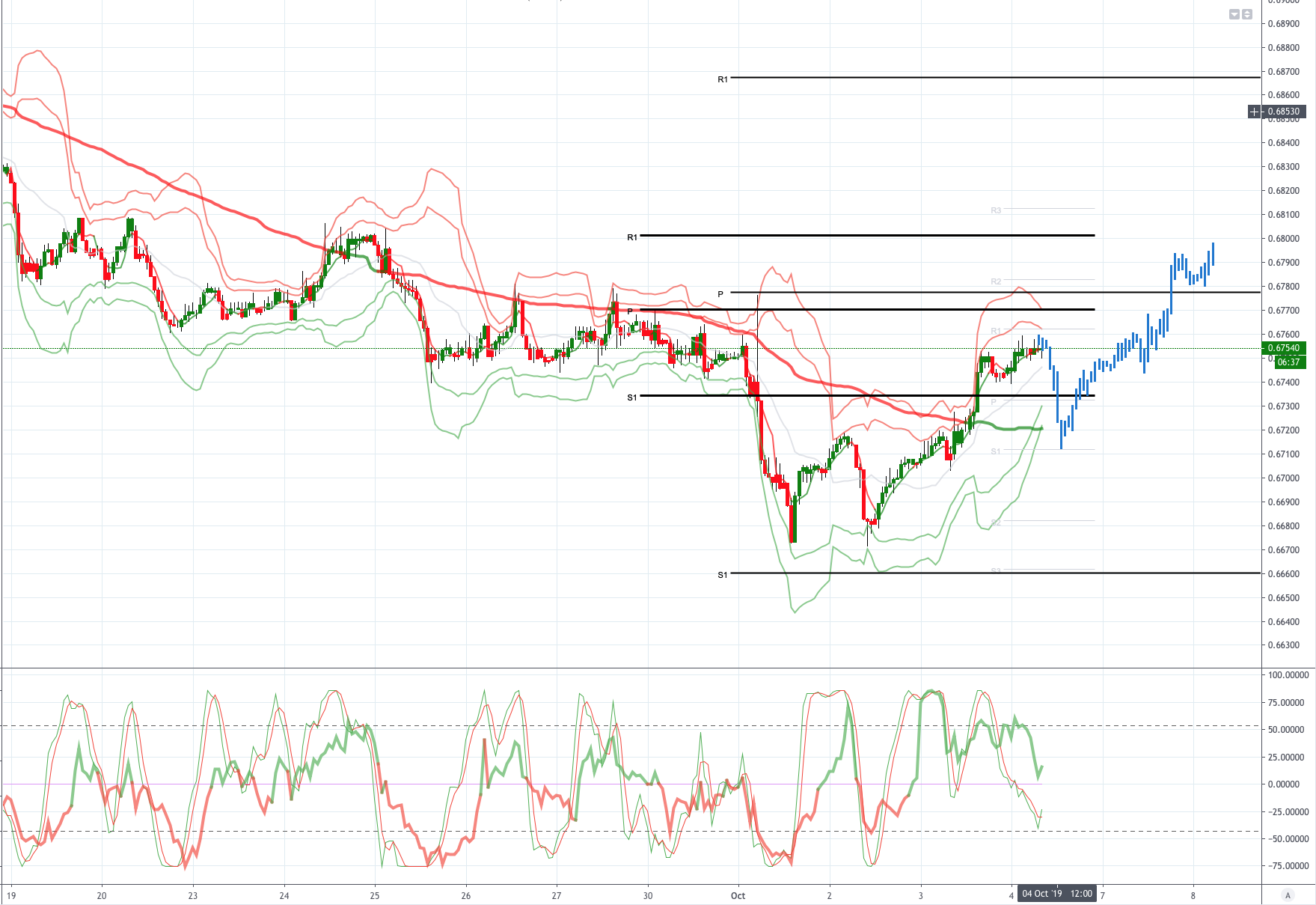

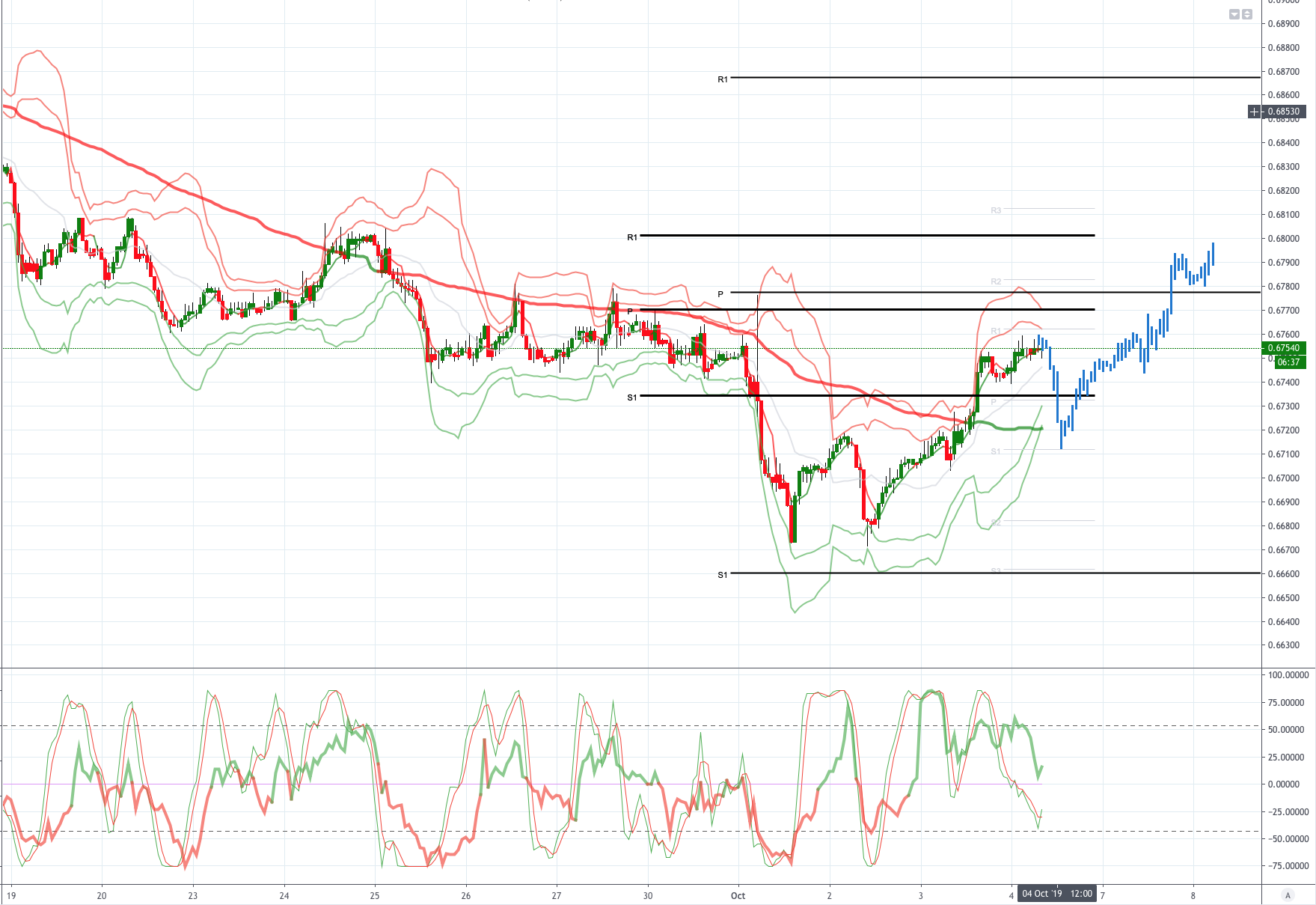

AUDUSD (Intraday bias:Bullish above .6710 target .6800)

AUDUSD From a technical and trading perspective the move back through .6750 has renewed bullish aspirations, however expect heavy going as the market tries to chew through thick offers towards .6775, however, as .6720 supports look for another impulsive move to gun stops ahead of .6800 challenge

Please note that this material is provided for informational purposes only and should not be considered as investment advice. The views discussed in the above article are those of our analysts and are not shared by Tickmill. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!