What Do The UK Elections Mean For The Pound?

Conservative Party Win

The results of the 2019 UK general elections showed confirmed the Conservative majority suggested by many of the recent polls heading into the vote. The latest count shows the Conservative party with a majority of 364 seats in parliament, well above Labour’s 203 seats. Once again, the UK’s first-pass-the-post voting systems has come under scrutiny as, despite the majority in parliament, the Conservative party only secured 43.6% of the national vote. Nevertheless, with a working majority of 38, the Conservative party will now form the government. The vast surge in support for the Conservative party, which saw many former Labour stronghold constituencies switching to Conservative, marks the biggest win for the party since the Thatcher election in 1987.

With the Conservative party confirmed victorious, Sterling was immediately higher, extending the rally seen in the days heading up to the elections, to trade to its highest level since May 2018. The move was largely predicted by the aggregate polling results over recent days though, in light of the shock-results seen over recent years, there was still some hesitance over a surprise result.

The Conservative party majority has two key implications for the Pound, Firstly, via its impact on Brexit and, secondly, via the outlook for the economy as a result of Conservative party policies.

Brexit and the Pound

The main priority for the new government will now be delivering Brexit. Johnson said during his campaign that he wanted to move quickly on Brexit with a view to passing his deal through parliament and pushing ahead with an official departure date, which could come ahead of the January 31st 2020 deadline. With a clear majority in government, Johnson shouldn’t struggle like before and the chances of his deal going through are heavily increased.

If a deal is agreed, the Pound is likely to continue higher in the medium term. The uncertainty around Brexit over the last two years has been the key factor causing so much damage to the UK economy and the Pound. With a deal in place, the UK would avoid the mass-capital outflow and investor panic that would have occurred as a result of a no-deal Brexit.

Once Brexit has been delivered and the UK has entered the transitional phase, the course of trade negotiations with the EU will be the main focal point. Johnson has said that he will not extend negotiations beyond the current December 2020 endpoint. Consequently, this does raise some risks for the Pound later in the year. If talks prove fruitless over the year we could easily see the Pound weakening into the back end of next year as traders fear that a trade deal will not be agreed, meaning that the UK will leave the single customs union without any mutually beneficial trading terms in place.

On the other hand, if talks proceed well and a deal looks likely, then Sterling has plenty of room to recover over 2020 with focus shifting back to UK fundamentals. With a Brexit deal agreed, and both sides working on a future trade deal, the prospect of BOE rate hikes comes back onto the radar next year which should further support the Pound.

The Economy and The Pound

While a wealth of recent indicators have been flashing recessionary warning signs, this is largely attributable to the damaging impact of Brexit uncertainty this year. With a much clearer view on Brexit and with the UK negotiating trade terms during the transitional phase, there is much room for economic recovery. With the US and China have signed off on phase one trade deal, there is also room for recovery in the global picture.

The Conservative party has not been too specific about its economic policy plans though given the likelihood that the UK continues with a business-friendly environment not too-dissimilar to recent economic policy, the main focus will be on the reduction of risks around Brexit and how the BOE responds. Later into next year, uncertainty could begin to stifle business once again if the market fears that a trade deal will not be completed ahead of the December 2020 deadline and that Johnson will not extend the date.

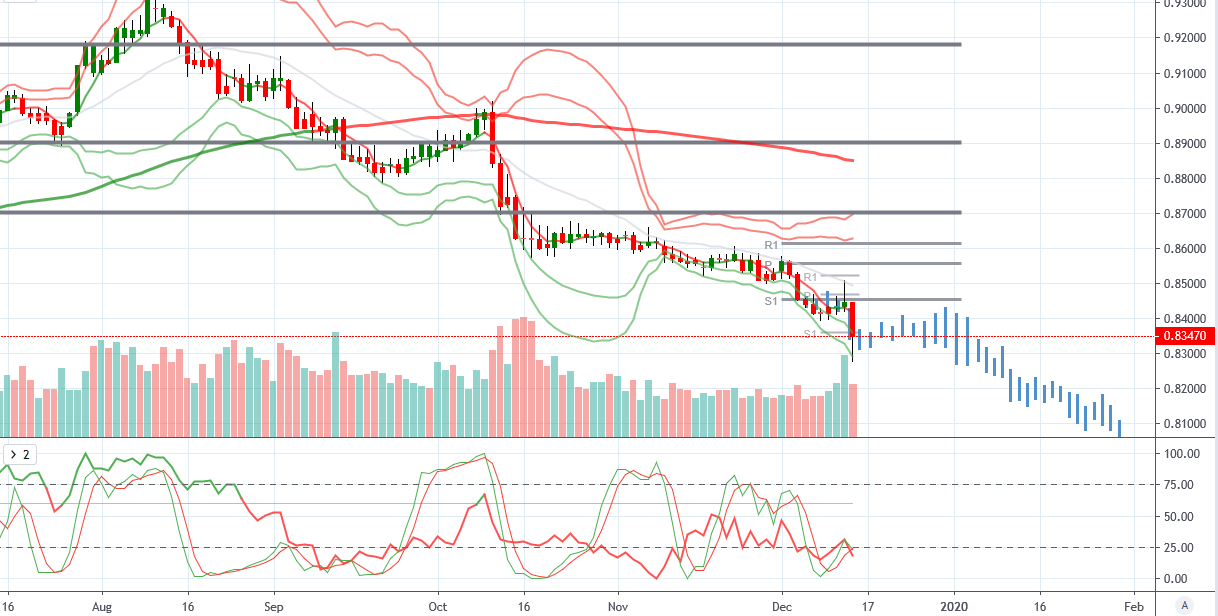

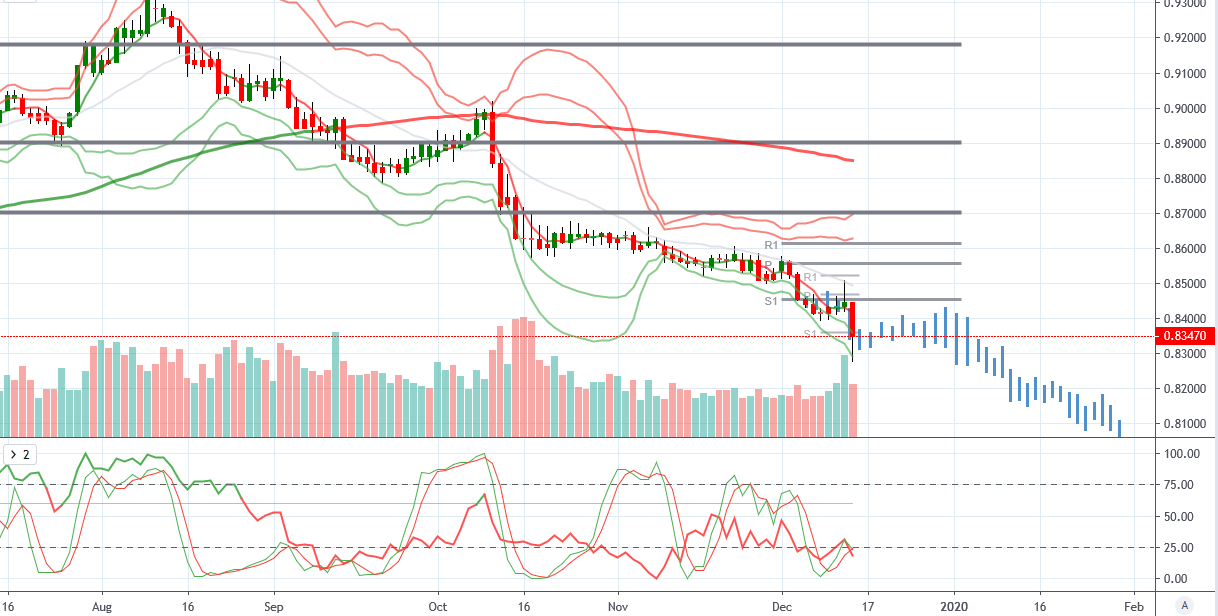

EURGBP (Bearish, below .8450)

EURGBP From a technical and trading perspective. There was plenty of volume on the retest of the broken monthly S1 at .8450. With the level holding as resistance, and longer-term VWAP negative, the bias remains bearish. Some consolidation likely in the near term but further losses expected.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!