BOJ Risks Seen AS USDJPY Breaks 150

Yen Selling Continues

Those who sold USDJPY short into the YTD lows are continuing to sweat this week as the pair’s recovery makes further headway. Price is now up almost 8% off the lows printed in September and shows little sign of resuming the prior bear move anytime soon. Following the hawkish double measures taken by the BOJ at the end of July, the bank has yet to follow up with any further policy tightening, despite continuing to reaffirm its commitment to tightening as needed. Alongside this, a hawkish shift in the market’s Fed outlook has boosted USD, created ample room for USDJPY to recover off the lows.

BOJ Expectations

Looking ahead, USDJPY bears will be hoping for the BOJ to take action when it meets next week. On the back of the recent JPY slide we’ve heard policymakers warning against one-sided moves in the Yen. With the pair still down around 7.5% from YTD highs, the BOJ might look to wait it out a little longer, particularly with the Fed expected to ease again next month. However, with USDJPY back above 150 now, risks of a fresh intervention from the BOJ are growing, creating plenty of volatility risks in USDJPY through the next couple of weeks.

Technical Views

USDJPY

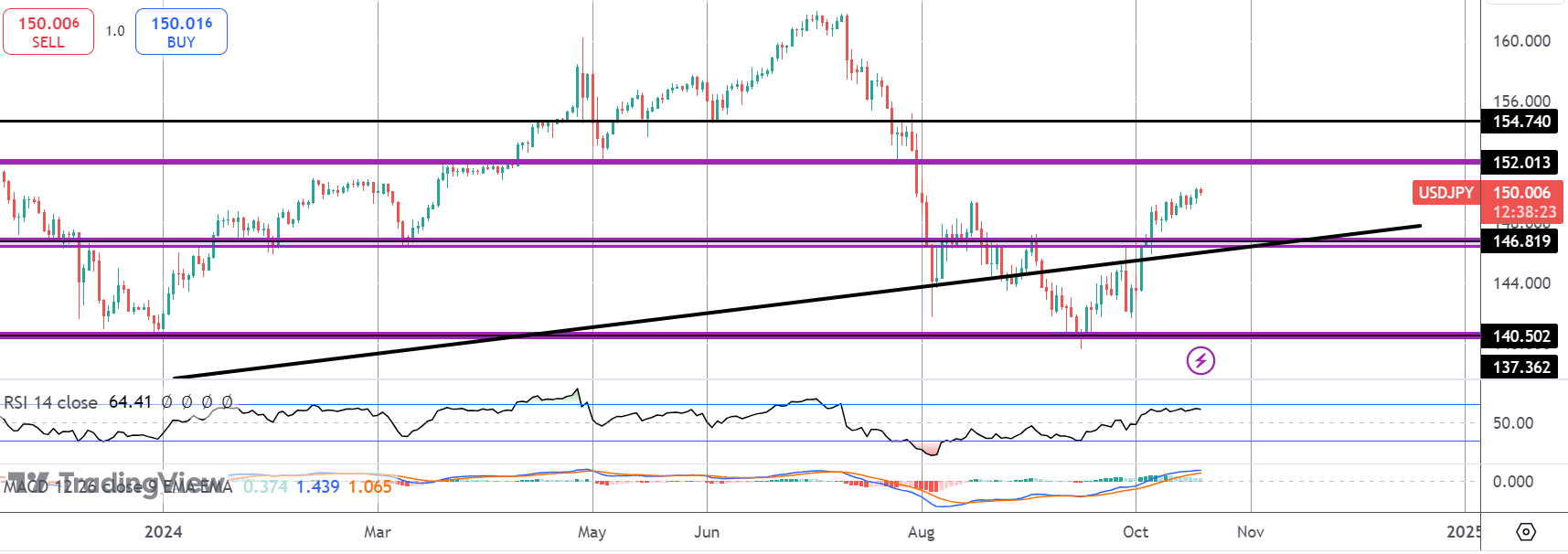

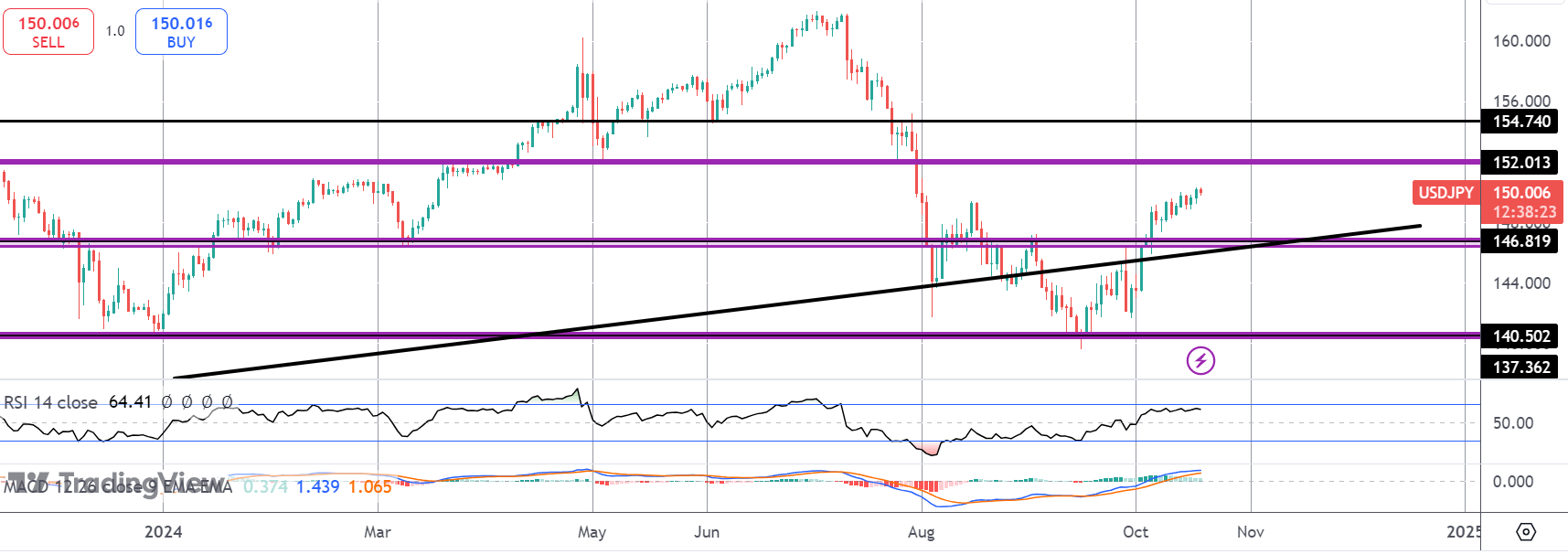

The rally off the 140.50 lows has seen the market breaking back above the bull channel lows and back above 146.81. With momentum studies bullish, focus is on a continuation higher and a test of the 152-level next with 154.74 above as a higher target. Downside, 137.36 remains key support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.