Covid-19 Epidemic Tightens its Grip Over Asia as Cases in Japan Surge

The Japanese equity market went into defence on Friday, interrupting an eight-day rally amid concerns over rising coronavirus cases both domestically and globally.

The Nikkei was down 0.53%, finding support at 25,385.87 points, although weekly gains averaged 4.36%, thanks to optimism about the economic recovery following promising data from Pfizer’s COVID-19 vaccine trials.

Broader Topix Index fell 1.33% to 1.703.22 points.

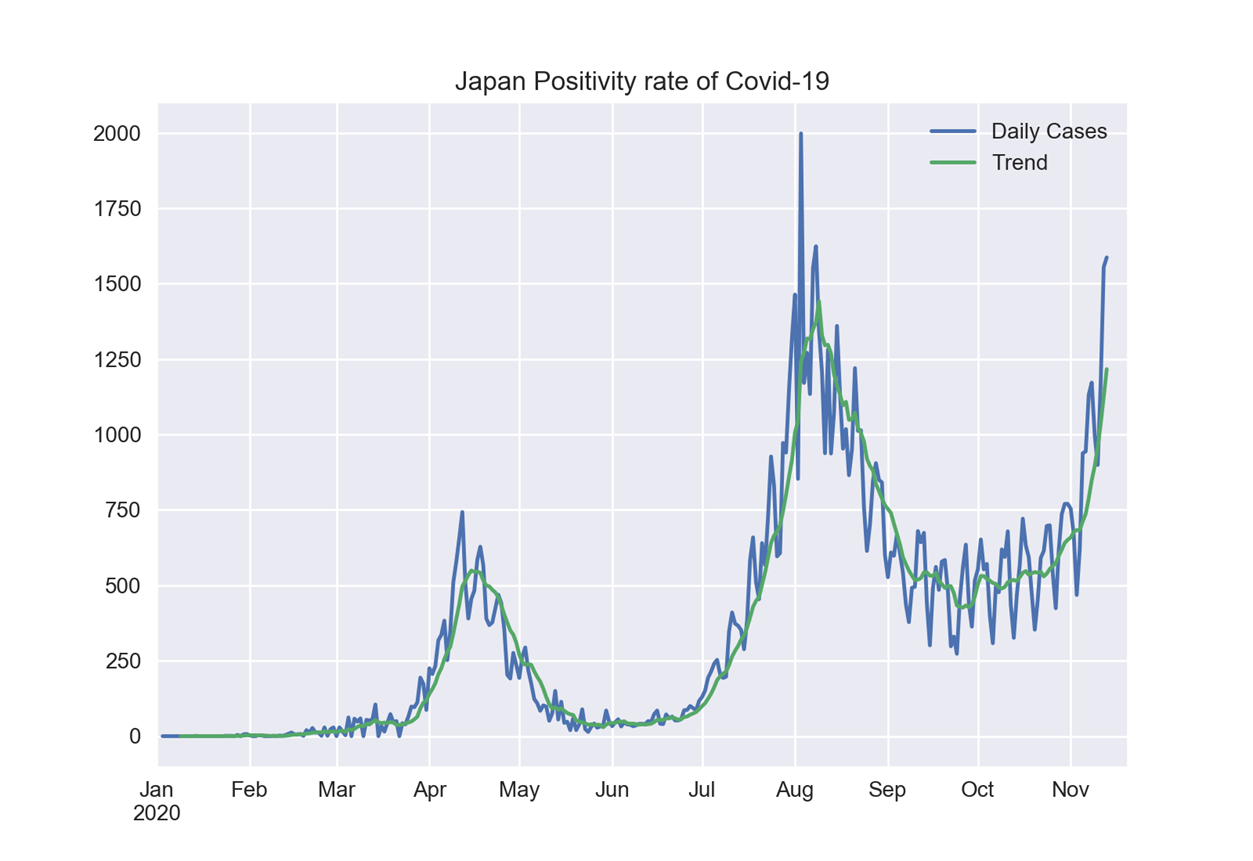

Japan reported on Thursday a record 1,634 new cases of the virus, according to Japanese broadcaster NHK. Japan cases are on the rise, suggesting that Japan may be experiencing a second wave of the epidemic:

Airline shares fell nearly 3.6% as investors feared that another spike in the virus could force government to reinstate travel curbs. At the same time, investors increased demand for stocks, which benefited from stay-at-home trend: shares of Nintendo and Sony Corp rose by 1.08% and 1.81%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.