Crude Slips As Geopolitical Tensions Fade

Trade War Risks Fade

Crude prices are softening a little today on the back of easing tensions around the US/Greenland story and subsequent trade war risks with Europe. Following a fiery speech in Davos yesterday, Trump scrapped his tariff threat against eight European countries saying that talks had established the framework of a future deal on Greenland. While details are lacking so far, markets have generally responded well to the news today with equities rallying. Commodities have been softer however, owing in part to a stronger Dollar. For crude, the decline in political tensions and a reduced risk of any sort of military action is seeing softer prices for now. Any incoming headlines around US/Greenland will remain highly important for crude and any breakdown in talks or a return to hostile rhetoric from Trump should see prices spiking higher again.

EIA Inventories Due

Looking ahead today, focus will turn back to supply/demand drivers with the latest EIA inventories data due. The market is looking for a fresh drawdown of 1 million barrels today, a sharp contrast from the 3.4-million-barrel surplus seen last week. If confirmed, this should help underpin crude prices. Traders will also be watching the latest US data with weekly jobless claims, final GDP and core PCE all due. Any USD volatility should also influence crude price action today.

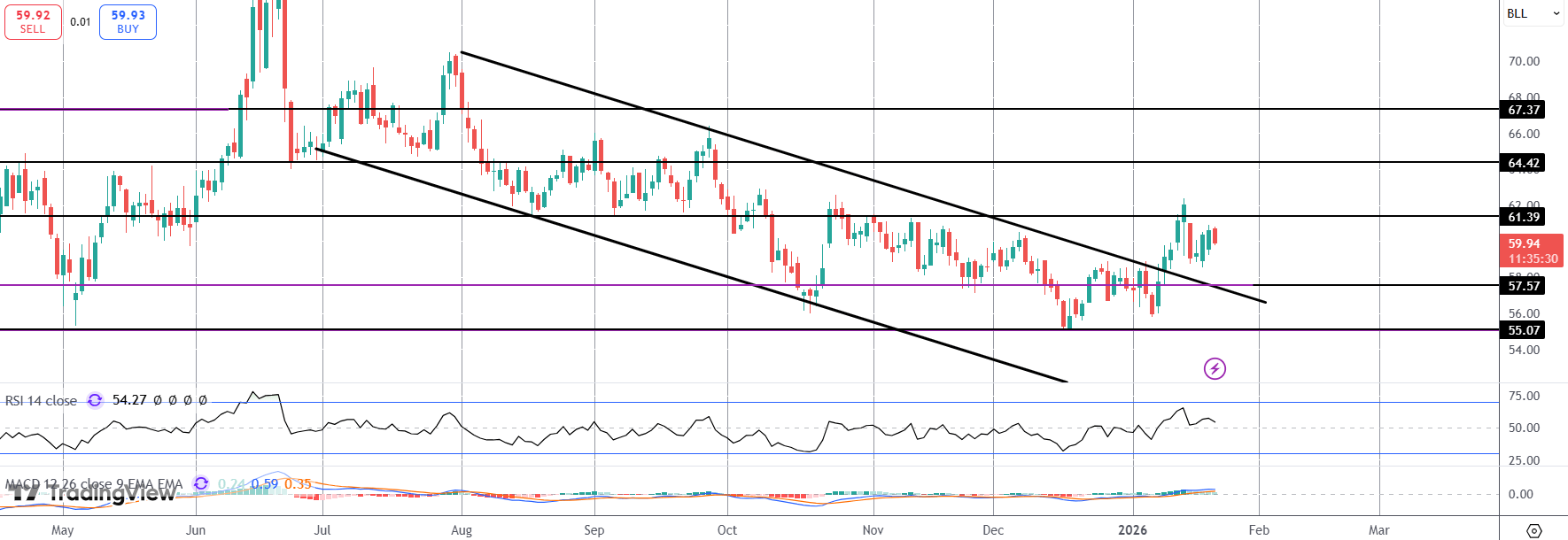

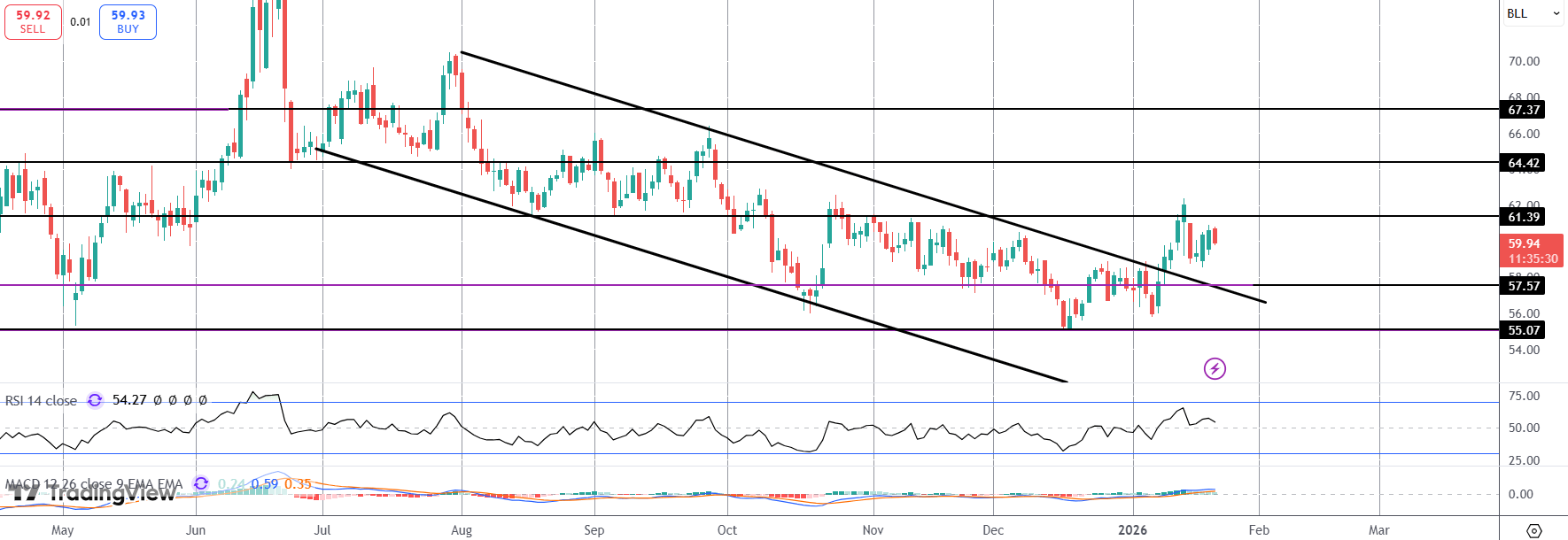

Technical Views

Crude

For now, crude prices remain caught between the broken bear channel highs and the 61.39-level resistance. With the channel break still active, focus is on an eventual push higher with 64.41 the next target for bulls. Downside, 55 is the key support to watch if we break back inside the channel.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.