Daily Market Outlook, July 12, 2022

Daily Market Outlook, July 12, 2022

Overnight Headlines

- Asian Markets Trade At Two Year Lows On Growth Fears

- Euro On The Edge Of Parity With The Dollar Driven By Energy Prices

- Japan Shouldn’t Intervene Over Yen Now, Former FX Chief Warns

- Japan's June Wholesale Prices Rise For 16th Consecutive Month

- Australian Business Mood Sours In June Even As Activity Holds Up

- Australia’s Biggest Pension Fund Braces For A Prolonged Slowdown

- Fed’s George Warns Raising Rates Too Fast Risks ‘Oversteering’

- Bostic Confident US Economy Can Handle Another Jumbo Rate Hike

- ECB Should Model New Bond Scheme On Old One, Nagel Says

- Sunak To Stand Firm On Taxes Until He Has ‘Gripped Inflation’

- BoE Gov Bailey: UK Inflation Still Likely To Fall Sharply Next Year

- UK Retail Sales Fall As Inflation Hits Consumers - Industry Bodies

- US Dollar-Japanese Yen Slips On Fresh Round Of Verbal Intervention

- Global Bonds Rebound As Growth Fears Overwhelm Inflation Nerves

- Oil Extends Drop As Concerns Over Economic Slowdown Grip Market

- US Believes OPEC Has More Capacity To Raise Crude Production

- IEA Exec Dir Fatih Birol: World Has Not Seen Worst Of Energy Crisis

- JPMorgan’s Kolanovic Hedges Risk-On Wager, Cuts Corporate Debt

The Day Ahead

- Asian equity markets are down this morning as fears of a sharp slowdown in growth come to the fore again. Crude oil prices are also down, although still above last week’s lows, reflecting reports that the US government thinks that OPEC has room to expand production. Reports suggest that Chancellor of the Exchequer Zahawi will outline new measures next week making it easier for companies to raise funds in the UK. The rules for the Conservative leader election have been set out. Nominations close today with each candidate requiring at least 20 supporting Conservative MPs. These will be whittled down to two, with party members then choosing the winner to be unveiled on 5th September.

- Today’s German ZEW survey will provide one of the first indications of economic trends in the Eurozone during July. Of particular interest will be anything it reveals about the impact on confidence from the European Central Bank’s likely interest rate rises in the second half of 2022. The survey may also show some impact from the latest rises in gas prices, although some of last week’s increases may have been too recent to be recorded. Expect today’s report to see a fall in both current conditions and future expectations.

- This week’s key economic releases for the US are the June CPI (Wed) and retail sales (Fri). Both could have a significant impact on Federal Reserve’s decision about how much to raise interest rates. In contrast, today’s June NFIB small business survey will be seen as less significant but it may supply some useful insights. Already released components showed ongoing problems in filling job vacancies, while wage pressures remain intense.

- The Reserve Bank of New Zealand is expected to be the latest central bank to raise interest rates. Its update due very early tomorrow is forecast to confirm a third consecutive rate hike of 50 basis points taking rates to 2.50%, 225bp above last year’s lows. Ahead of that, today’s speech from Bank of England Governor Bailey will be watched for clues on the BoE’s next rate move. However, recent experience suggests that he is unlikely to pre-commit.

- May UK GDP data due early Wednesday is forecast to show the first rise in output in three months. However, that is likely to be due primarily to a statistical distortion rather than to an underlying rebound in activity. The Office for National Statistics does not normally seasonally adjust for one-off events such as the Jubilee. Therefore, the move of the usual late May holiday into June is likely to have boosted output growth and we think that could lead to a rise in May GDP of 0.5%. However, that will be more than offset in June by a negative effect due to the two extra holidays.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0175-85 (521M), 1.0195-05 (466M)

- 1.0260-70 (1.19BLN)

- USD/JPY: 135.00 (565M), 135.55-65 (1.19BLN)

- 137.60-65 (1.34BLN), 138.00 (355M)

- EUR/JPY: 137.50 (640M). USD/CHF: 0.9725 (230M)

- 0.9900 (201M)

- GBP/USD: 1.1830-35 (355M)

- USD/CAD: 1.3000-05 (423M), 1.3020 (202M), 1.3120 (240M)

Technical & Trade Views

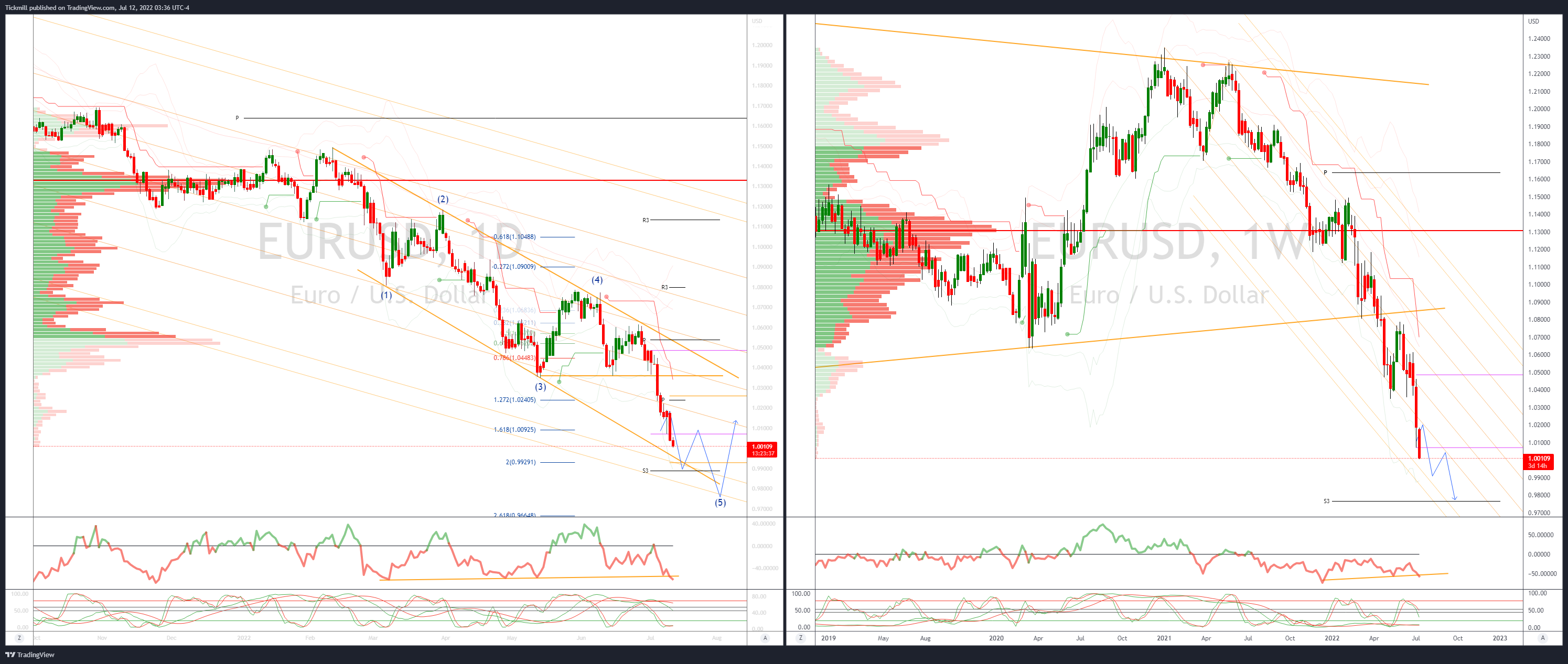

EURUSD Bias: Bearish below 1.05

- Remains offered just above parity

- Energy price and supply concerns seen as principle driver

- Upside capped by US Yields on increasing Fed rate hike bets

- ECB/FED policy divergence remains in focus, CPI Wed’s next catalyst

- Bids eyed below parity .9950 offers sitting above 1.0050

- 20 Day VWAP is bearish, 5 Day bearish

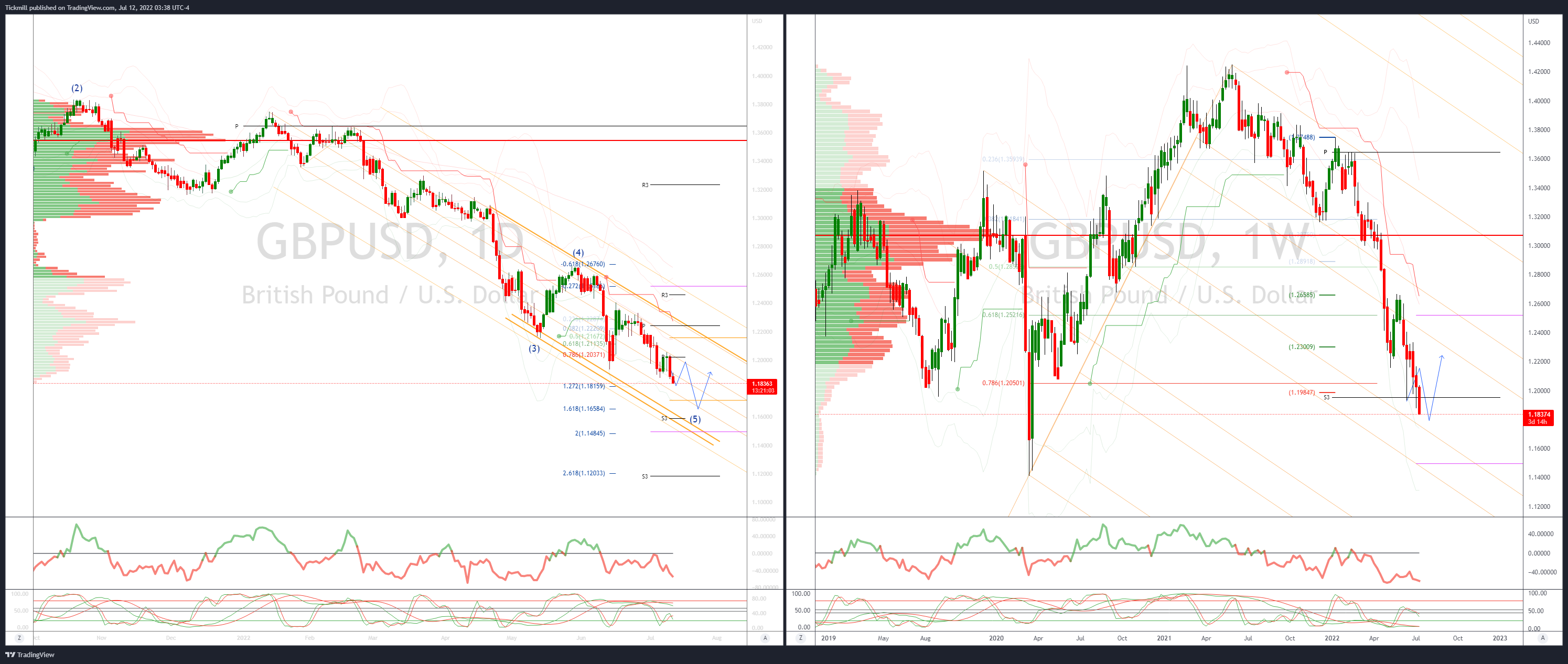

GBPUSD Bias: Bearish below 1.2150

- GBP under continued pressure in a weak Asian trade

- Energy price inflation, recession fears and political unknowns weigh on GBP

- Wednesday sees 1.15Bln options at 1.2035

- Bears breach YTD lows en-route to a test of 1.18

- Offers seen at 1.20 Bids 1.1720

- 20 Day VWAP is bearish, 5 Day bearish

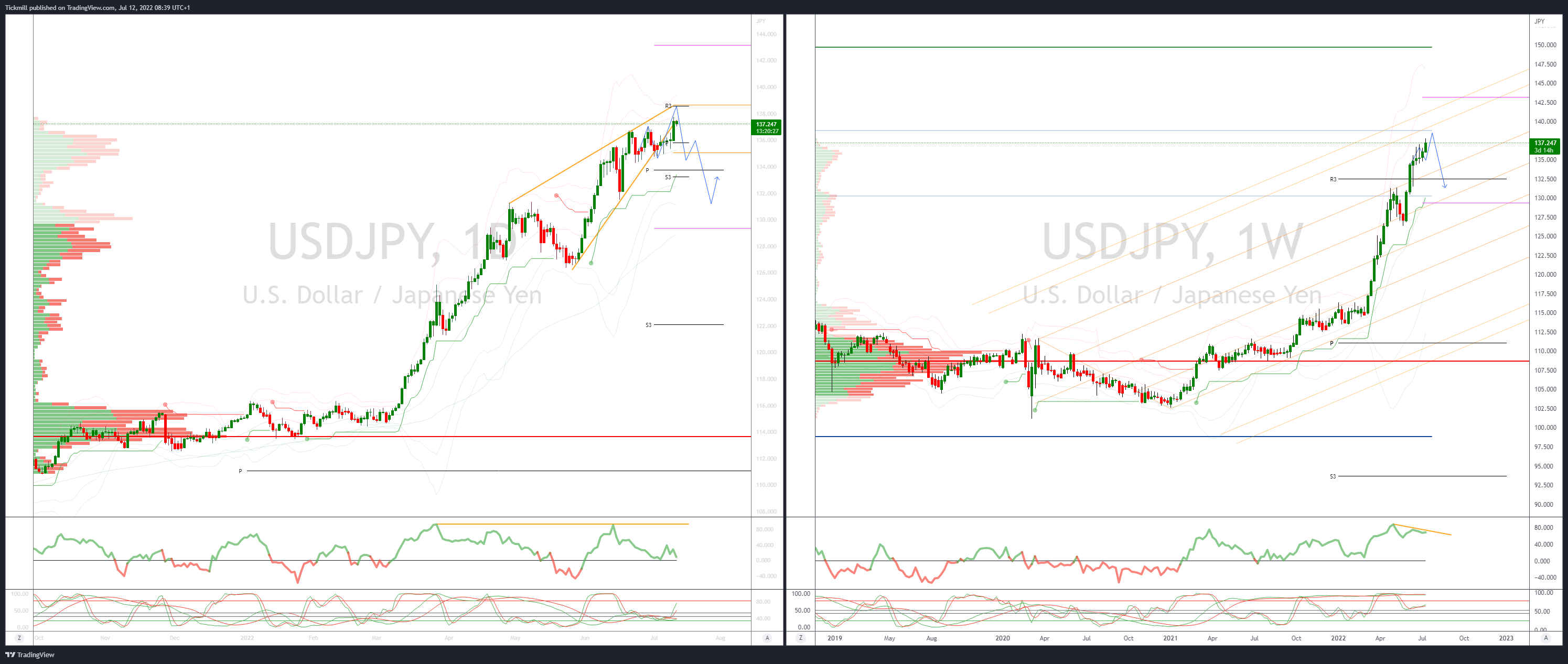

USDJPY Bias: Bullish above 134

- USDJPY trades at a 22 year high in the Asian session but off best levels

- Market watching for the outcome of US, Japanese trade discussion

- JPY FinMIn jawboning having limited impact

- Tuesday sees 1.1Bln 137.60 option expiries

- Japanese importer bids seen just below 137

- Traders see range expansion 135/140

- US10Y trade back below 3%

- Offers seen at 138.60

- 20 Day VWAP is bullish, 5 Day bullish

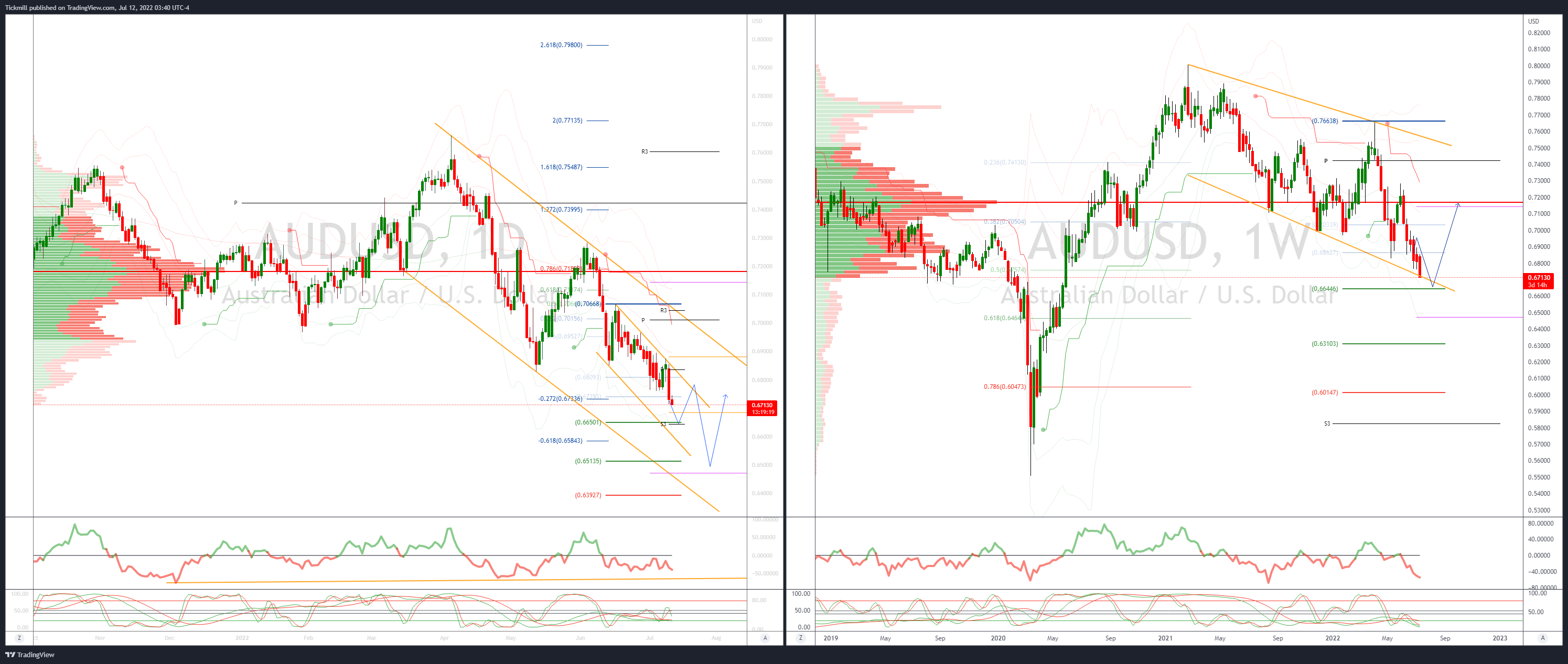

AUDUSD Bias: Bearish below .7050

- AUD continuing to be weighed by souring risk sentiment

- AUD consumer sentiment weakens on rising inflation concerns

- Fresh Covid concerns out of China, Shanghai finds new subvariant

- Commodities rolling over again iron ore trades down 3.5% overnight

- Offers seen at .6850’s with bids .6685

- 20 Day VWAP remains untested confirming downside

- 20 Day VWAP is bearish, 5 Day bearish

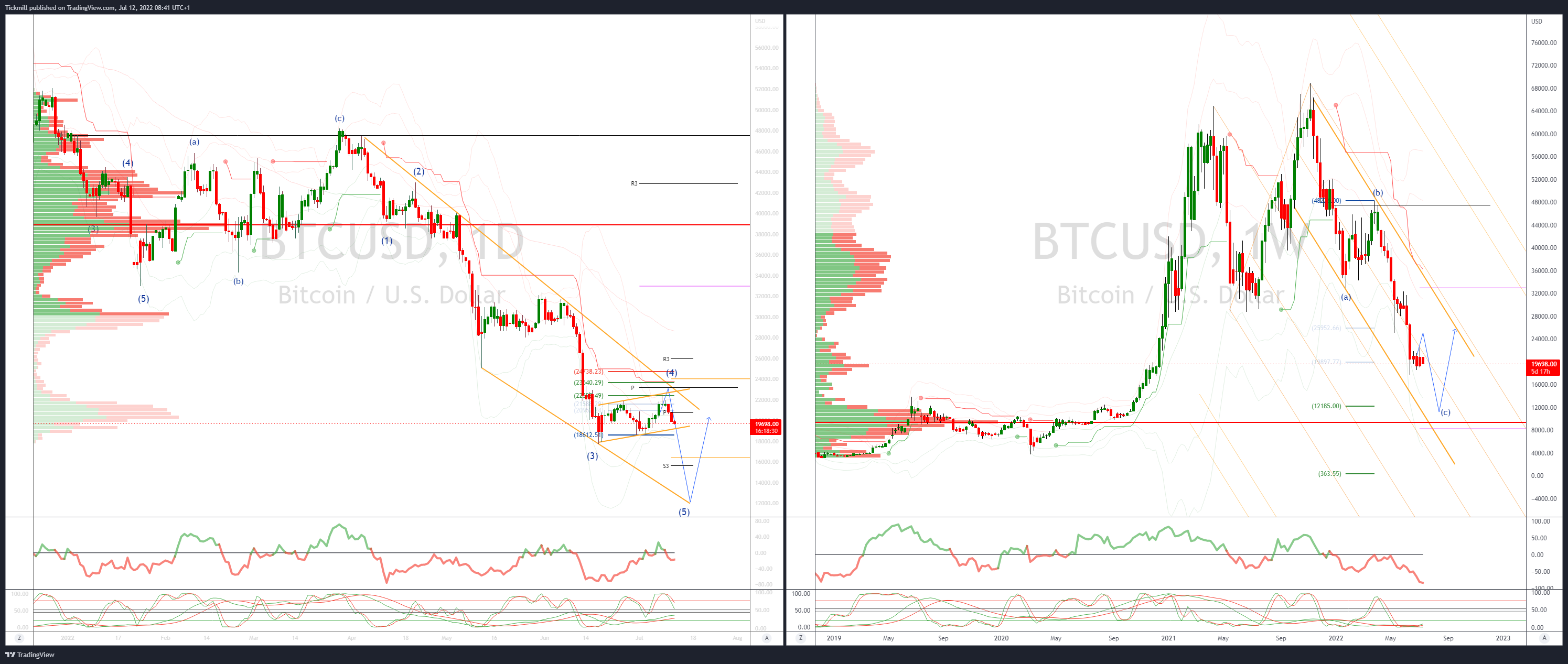

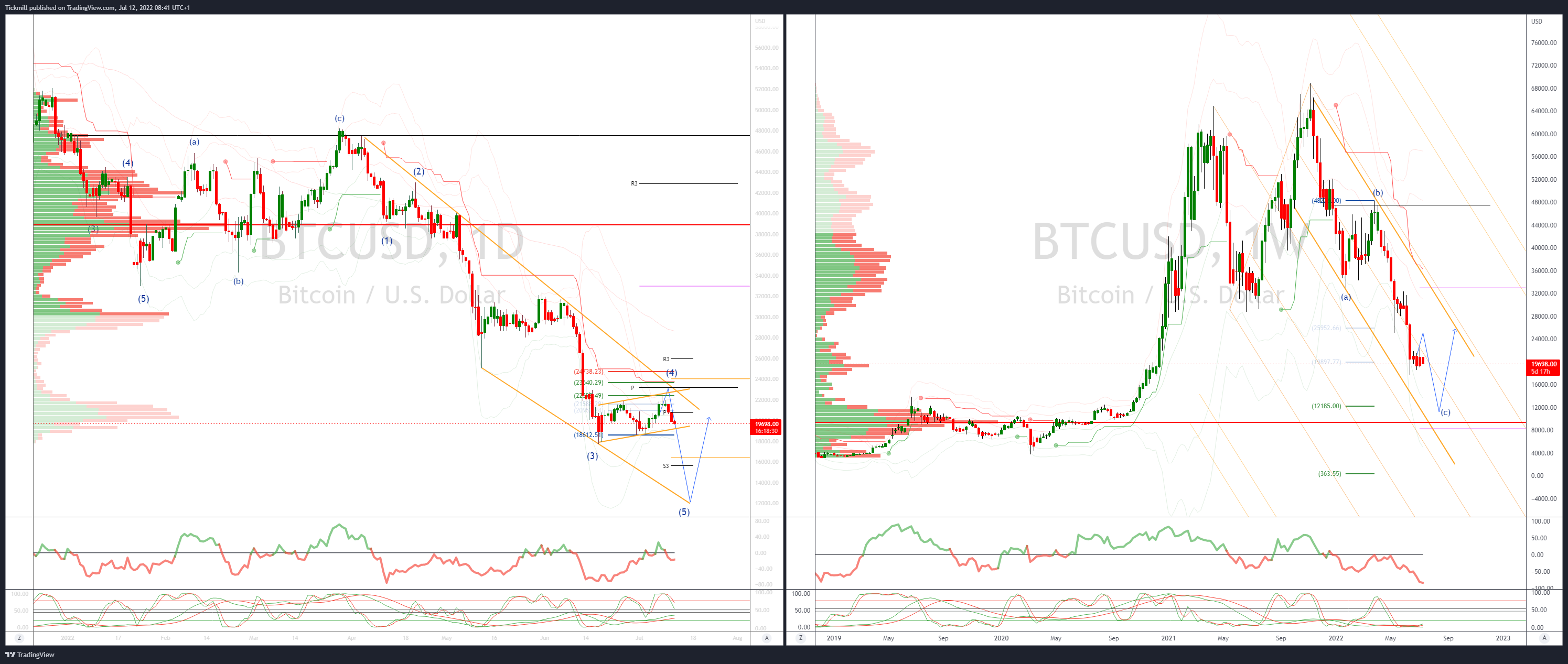

BTCUSD Bias: Bearish below 22k

- BTC continues to trade lower setting up a pivotal test of 19k

- 20 VWAP band contracting ready for next directional drive, currently pointing south

- Trend remains down within broader bearish channel

- Support seen at 19k then 18300 the base of the daily VWAP bands failure here opens a retest of lows

- Concerns regarding increasing Crypto scandals and scams leave BTC vulnerable

- Additional pressure seen from BTC miners liquidating positions on declining profitability

- 20 Day VWAP is bullish, 5 Day bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!