Daily Market Outlook, June 13, 2022

Daily Market Outlook, June 13, 2022

Overnight Headlines

- US Recession Expected For Next Year, Economists Forecast

- China Alarm US In Private Warnings To Avoid Taiwan Strait

- China Walking Back Loosening Just Weeks After Reopening

- Rate Hike Hopes Raise Worries Amid Debt-Laden Eurozone

- BoE Forecasted To Hike Interest Rates To New 13-Year High

- UK Faces Stagnation And Recession Risk, CBI Officials Warn

- Tory MPs Attack Over Plans To Rip Up N Ireland Brexit Deal

- Macron Majority Threatened After Parliament First-Round Vote

- Yen Hits Key 135 Level Amid BoJ's Increasingly Isolated Plans

- Bitcoin Sinks To 18-Month Low As US Inflation Impact Spreads

- SEC Regulator Investigating Goldman Sachs Over ESG Fund

- DHL Warns Supply Chain Won’t Recover To Pre-Covid Days

The Day Ahead

- Equity markets across the Asia-Pacific region have started the week noticeably lower, reflecting a broad deterioration in risk sentiment. Markets remain challenged by the prospect of aggressive policy tightening, particularly by the US Federal Reserve, which risk driving a material slowdown in economic growth. Market sentiment has also been knocked by the re-emergence of Covid outbreaks in Beijing and Shanghai leading to some targeted curbs being imposed, with concerns rising that widespread restrictions could be put in place.

- The release of UK April GDP figures this morning showed the economy contract for a second-consecutive month. Declines were registered across all three broad sectors, industrial production, construction and services, which means that the Bank of England’s forecast of a 0.1% rise in GDP in Q2 overall, now looks ambitious.

- Over the remainder of the week, the focus will be on several central bank policy updates with potentially the most significant for markets being those by the Bank of England and the US Federal Reserve. The Fed seems set to add to the recent spate of aggressive tightening moves by central banks. In contrast, while financial markets expect the Bank of England to deliver another 25bp rate rise, its message and also the Bank of Japan and Swiss National Bank, may continue to be more cautious stressing the need to balance inflation concerns against downside growth risks.

- Later today, ECB officials Simkus, Holzmann and Guindos are due to speak. Last Thursday, the European Central Bank confirmed that it will probably raise interest rates by 25bp on 21 July. In addition, it indicated that rates could be hiked by a further 50bp in September with further rises expected to follow. Those announcements continued the recent trend of central banks surprising markets with more aggressive than expected tightening moves. While markets have largely priced in 75bp of policy rate increases over the next two meetings, comments from these officials will be closely watched for signs over how widely the ECB’s broad message is shared across the council members.

- Elsewhere there is a dearth of economic data with no releases due in the UK, US or Europe. Early tomorrow the Office for National Statistics (ONS) will release the latest UK labour market report, primarily covering the three months to April. Expect the latest read to show that the market remains tight with a solid 220k rise in employment and a drop in the unemployment rate to 3.6%. Headline wage growth is also forecast to rise further above the 7% (3m/year) mark.

FX Options Expiring 10am New York Cut

- EUR/USD: 1.0475 (237M), 1.0550 (250M), 1.0575 (359M)

- GBP/USD: 1.2500 (224M). AUD/USD: 0.7150 (462M)

- USD/CAD: 1.2850 (200M)

- EUR/JPY: 140.00 (632M), 143.00 (1.69BLN)

Technical & Trade Views

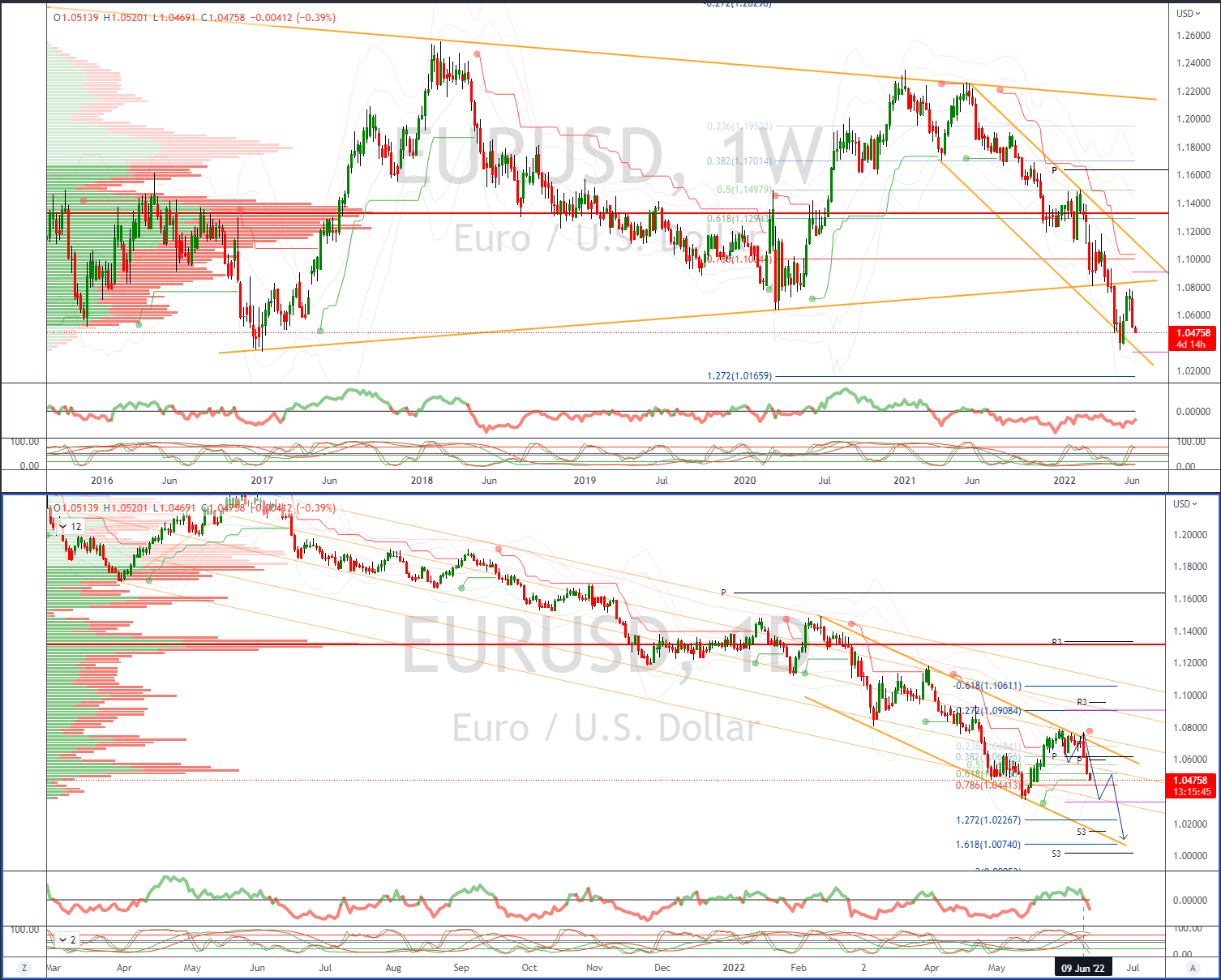

EURUSD Bias: Bearish below 1.07 Bullish above

- EUR/USD's big two day slump broke and closed under the 1.0516 Fibo on Friday

- 1.0516 Fibo is a 61.8% retrace of the 1.0349 to 1.0787 May (EBS) rise

- That is increasing the scope for a much bigger slide well under 1.0452 Fibo

- 1.0452 Fibo is a 76.4% retrace of the same gain

- Fourteen-day momentum also turned negative on Friday

- FX traders have a negligible bet on dollar rising

- This is the case at the start of a major tightening in U.S. policy

- Currently traders are long of just 12.5 billion dollars (incl EM bets)

- At beginning of last Fed tightening cycle in 2015 they owned 48 billion

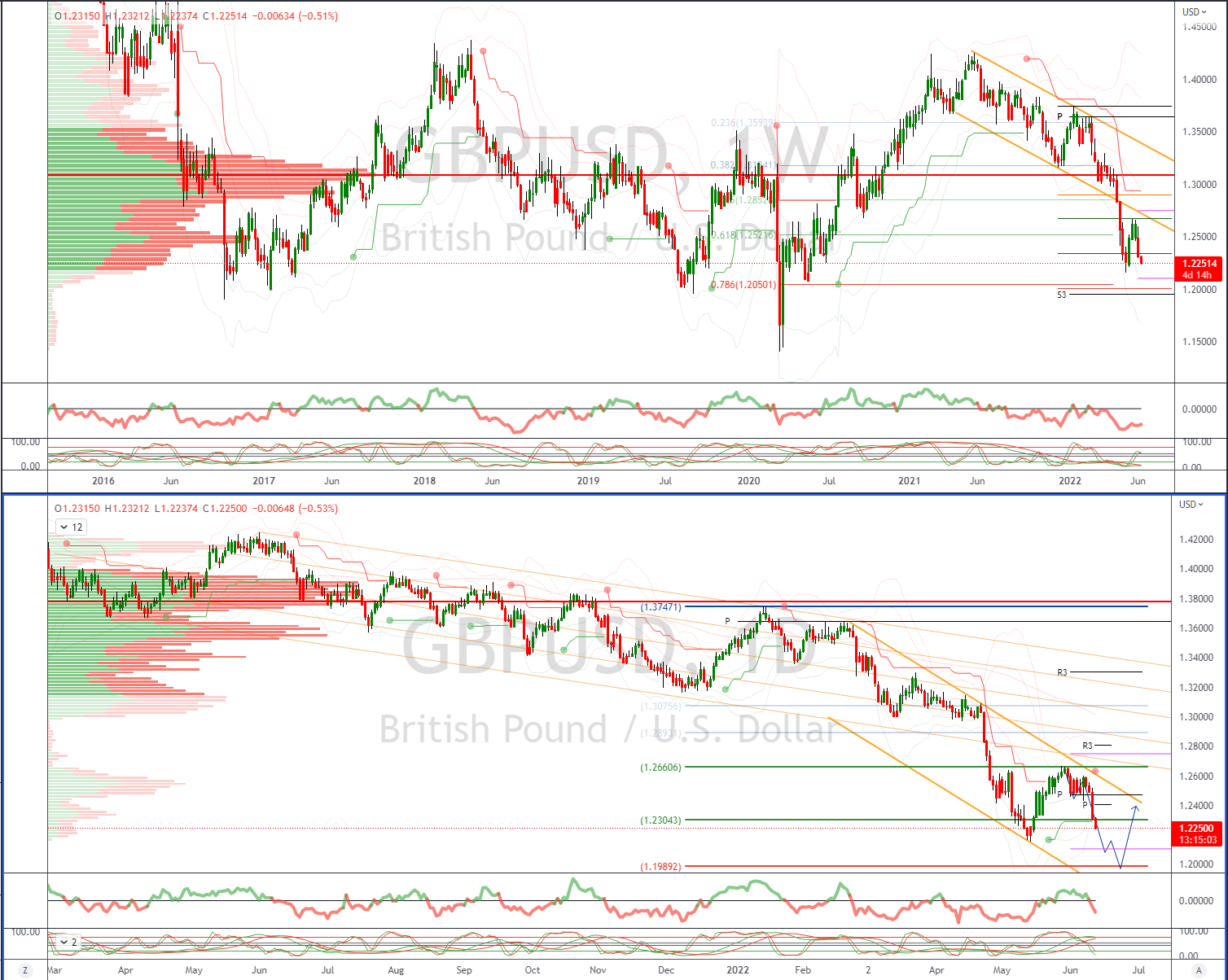

GBPUSD Bias: Bearish below 1.26 Bullish above.

- GBP/USD falls to fresh four week low on negative UK April GDP

- Cable drops to 1.2255 on unexpectedly negative UK April GDP number

- Down 0.3% vs +0.1% f/c - 1.2255 lowest level since May 16

- 1.2264 was Asia low, as risk aversion hurt GBP and buoyed safe-haven USD

- Asian stocks slump; Nikkei down 3%. European/U.S. equity futures negative

- 1.2302 was Friday's low, after USD jumped on hot U.S. CPI data

- UK to unveil new N.Ireland trade rules today, risking EU clash

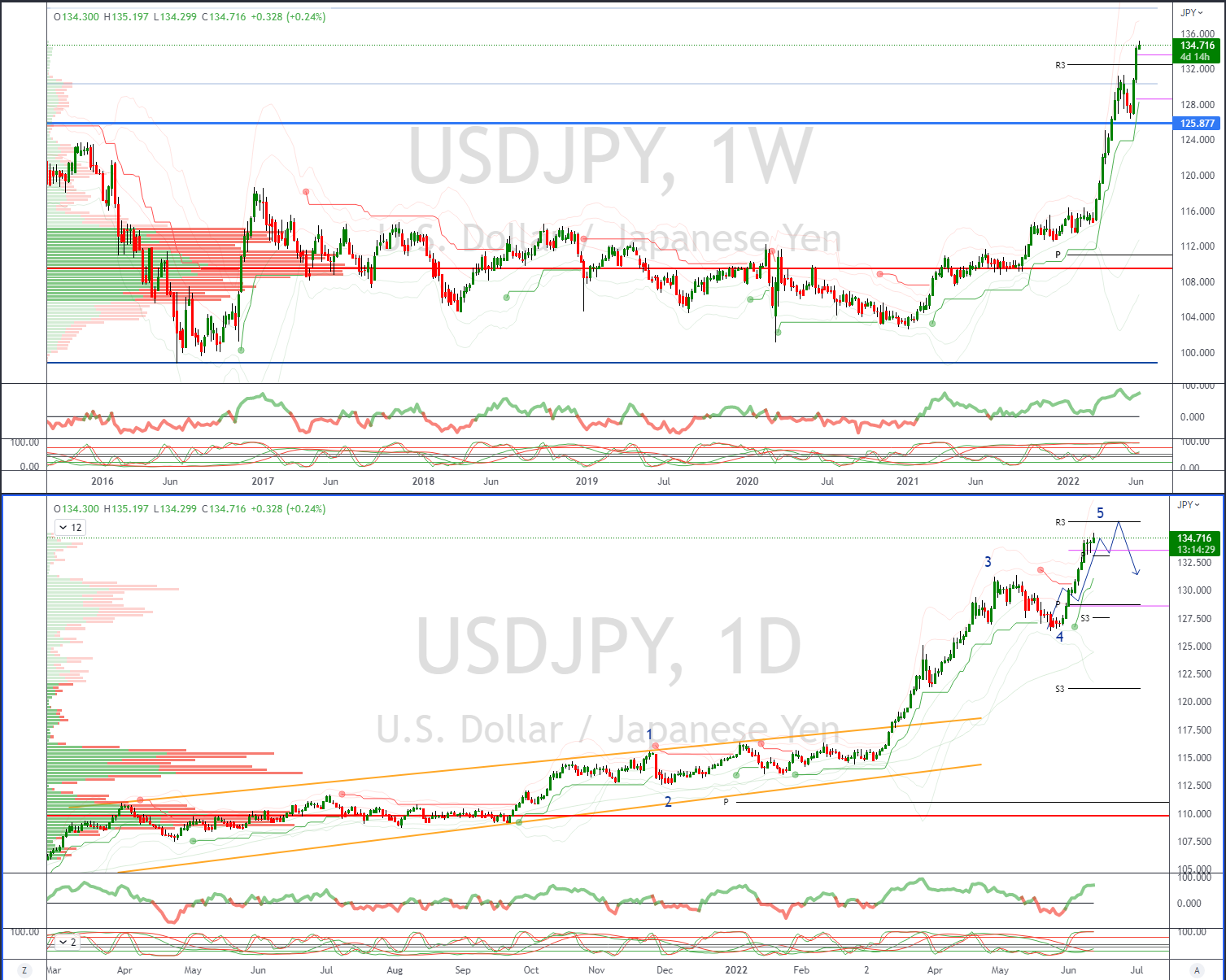

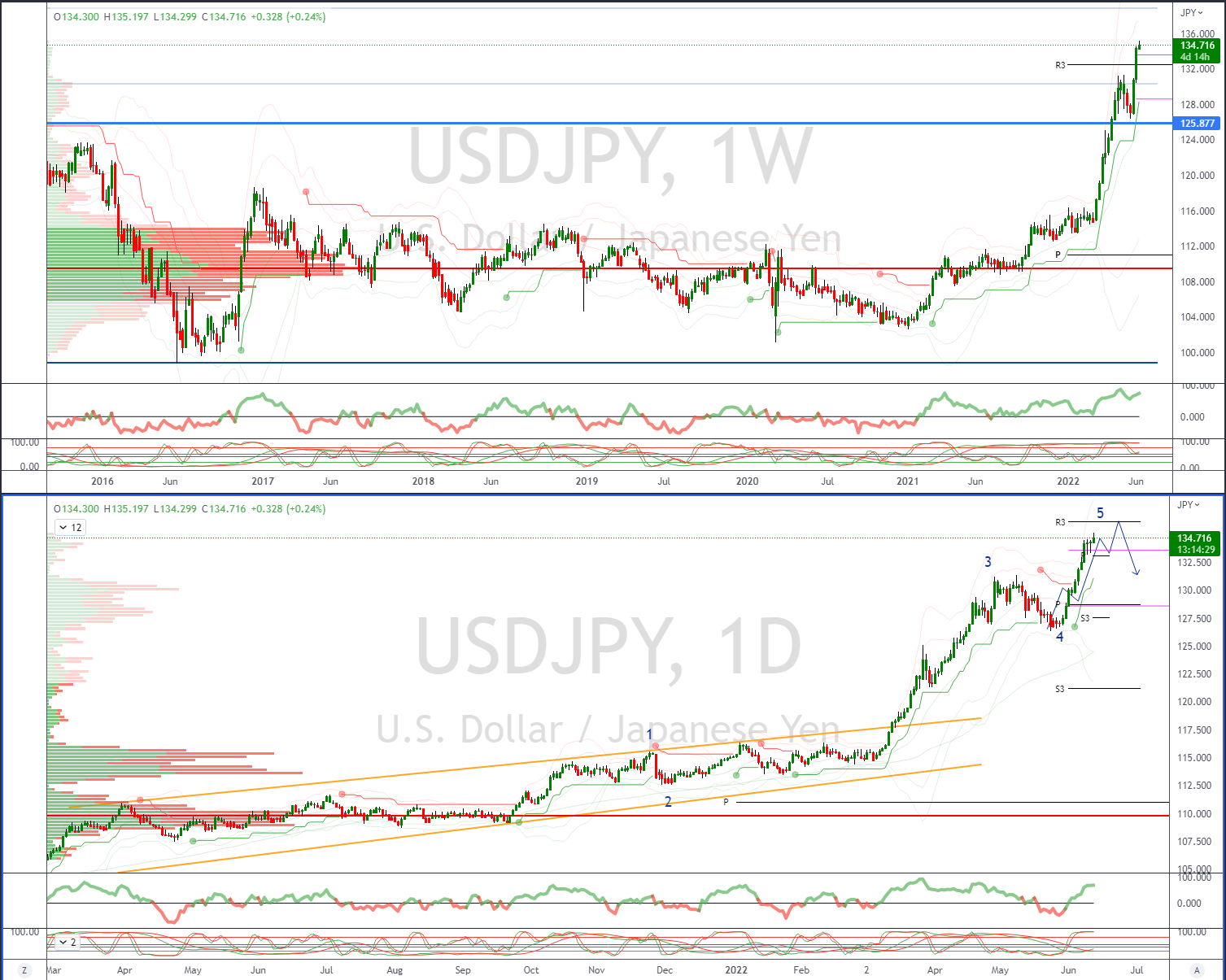

USDJPY Bias: Bullish above 127 Bearish below

- USD/JPY's bullish cycle has marginally breached the 2002 135.20 peak

- That has unmasked the October 1998 136.90 high

- 14-day momentum is positive, reinforcing the overall bullish market

- Market is stretched near-term, with traders looking to get long on dips

- Bids at the 133.25 level, which is ahead of last Thursday's 133.19 low

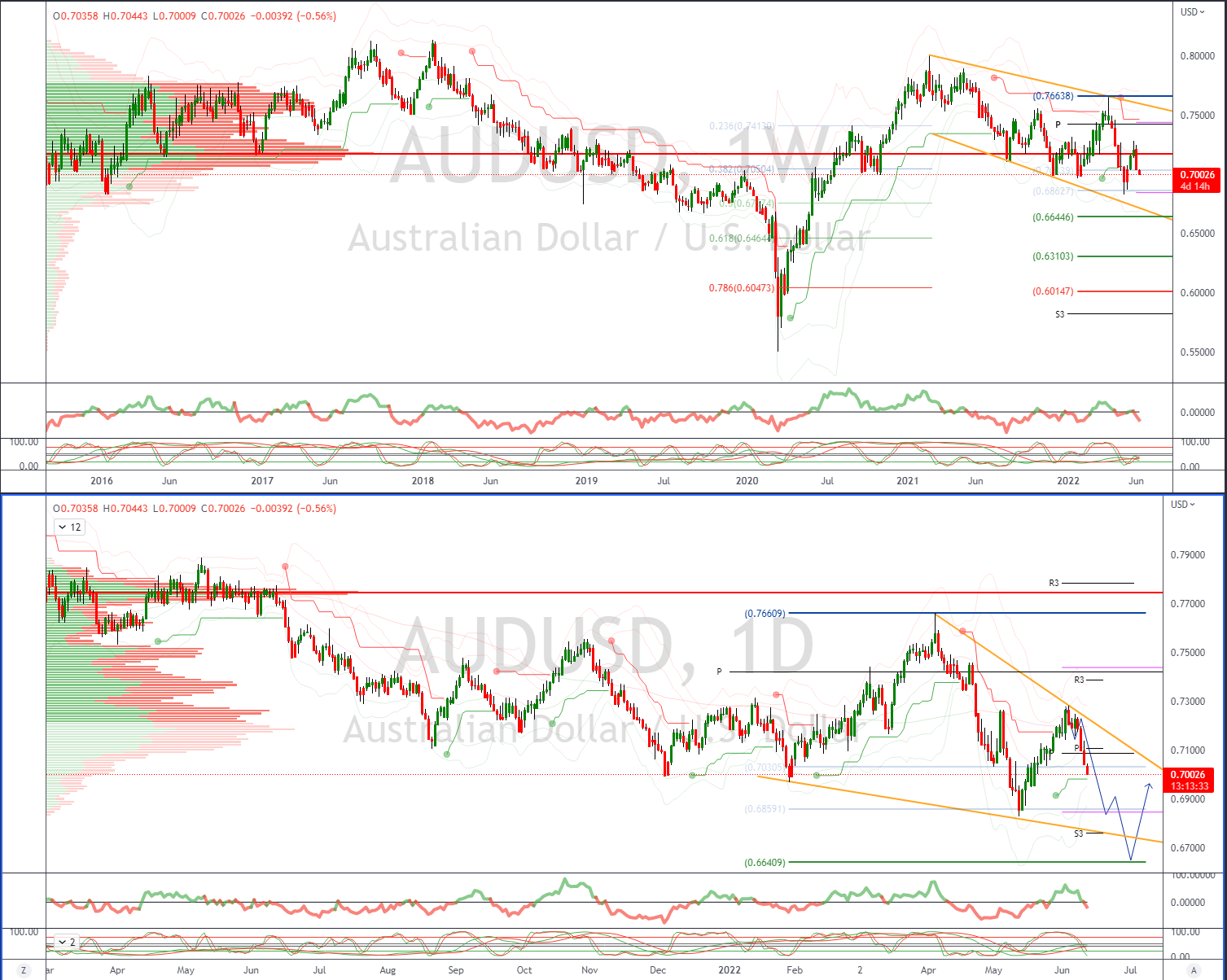

AUDUSD Bias: Bullish above .7200 Bearish below

- AUD/USD stabilizes near 0.7024, marks 4th straight drop

- Recovers from low of 0.7001 after blip up to 0.7072

- Bollinger downtrend channel confirmed on close below 0.7043

- Sea of red in Asia stocks following Friday's Wall St cue

- Investor anxiety heightened heading toward FOMC Wed

- Australia financial markets closed Monday

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!