Daily Market Outlook, October 29, 2020

Daily Market Outlook, October 29, 2020

Apart from China, most Asian equity markets are down this morning following big declines in Europe and the US. Concerns about Covid-19 cases are dominating, with sharp rises reported in much of Europe and the US. Both Germany and France announced new lockdowns yesterday lasting until at least the end of November. Reports suggest that in England, Nottingham will be subject to new higher level ‘tier 4’ restrictions. More positively, some media organisations are reporting that a German Covid-19 vaccine, backed by Pfizer, may be available before Christmas.

US Q3 GDP data is likely to confirm an initial strong rebound in economic growth following the summer easing in lockdown restrictions. Look for a 29% annualised rise (and some forecasters expect even bigger gains). However, as GDP fell by 5% in Q1 and 31.4% in Q2, the level of activity will still be significantly below that at the end of 2019. Moreover, the data will probably be seen by markets as providing few clues as to what happens next given concerns that the pace of the rebound is now slowing significantly in the US and elsewhere. Consequently, even a stronger-than-expected data may prompt only a very limited response from markets. Tomorrow’s Q3 GDP releases for the Eurozone, which are also likely to show a sharp initial upturn and may also have little impact on markets that are more focused on timelier indications as to what happens next.

Today’s October readings for business and consumer confidence from the European Commission tick that box and are likely to show confidence slipping as Covid-19 cases rise. Meanwhile, ahead of tomorrow’s October Eurozone CPI data, updates from Germany and Spain are expected to show annual consumer price inflation still in negative territory.

Ahead of today’s policy update, the European Central Bank is under growing pressure to consider further stimulus. That probably does not mean that they will act today, although some action is a possibility, but they may pave the way for new measures to be announced at their next meeting in December. Expect them to signal that with comments pointing to increasing downside risks to the economic outlook. Further easing is most likely to mean more asset purchases, in particular, an increase of around €500bn in its Pandemic Emergency Purchase Programme.

In the UK, the Bank of England’s September money data is likely to provide further evidence of the near-term boost to housing activity from the temporary reduction in stamp duty. Meanwhile early Friday, the October Lloyds Business Barometer will provide a timely update on business sentiment.

Citi FX Quant: Prelim FX hedge rebalancing month-end - As of asset index closing values of 28 October, the estimate for this month-end’s FX hedge rebalancing needs has flipped to a moderate USD buy from a sell-signal published in the preliminary estimate earlier this week. The signal change is largely driven by a sharp fall in equity indices which are down month-to-date in both the United States and Europe. Foreign investors’ needs to reduce hedges on US equities is the main driver of the estimated USD buying need. However, with the FTSE Russell US Government Bond Index under-performing other major markets this month, fixed income investors’ hedge rebalancing needs are also estimated to be USD positive. Although European equity markets are down more than the US this month, the signal is a USD buy across all crosses. This is because our model assumes more foreign ownership of US equities and higher hedge ratios in Europe. The average signal strength is -0.6 standard deviations across all G10 currencies. The signal to sell AUDUSD is on the margin stronger because of out-performance of Australian assets.

Today’s Options Expiries for 10AM New York Cut

- EURUSD: 1.1700 (734M), 1.1715-25 (1.5BLN), 1.1750-55 (1.3BLN), 1.1765-70 (770M), 1.1800 (372M)

- GBPUSD: 1.2800 (485M), 1.2990-1.3000 (324M)

- USDJPY: 103.20-25 (1.6BLN), 103.60 (1BLN), 104.00 (1.8BLN), 104.40-50 (700M), 104.75 (523M), 105.15 (600M), 105.25 (1.3BLN)

- AUDUSD: 0.7065 (212M), 0.7100 (307M), 0.7120-30 (380M)

Technical & Trade Views

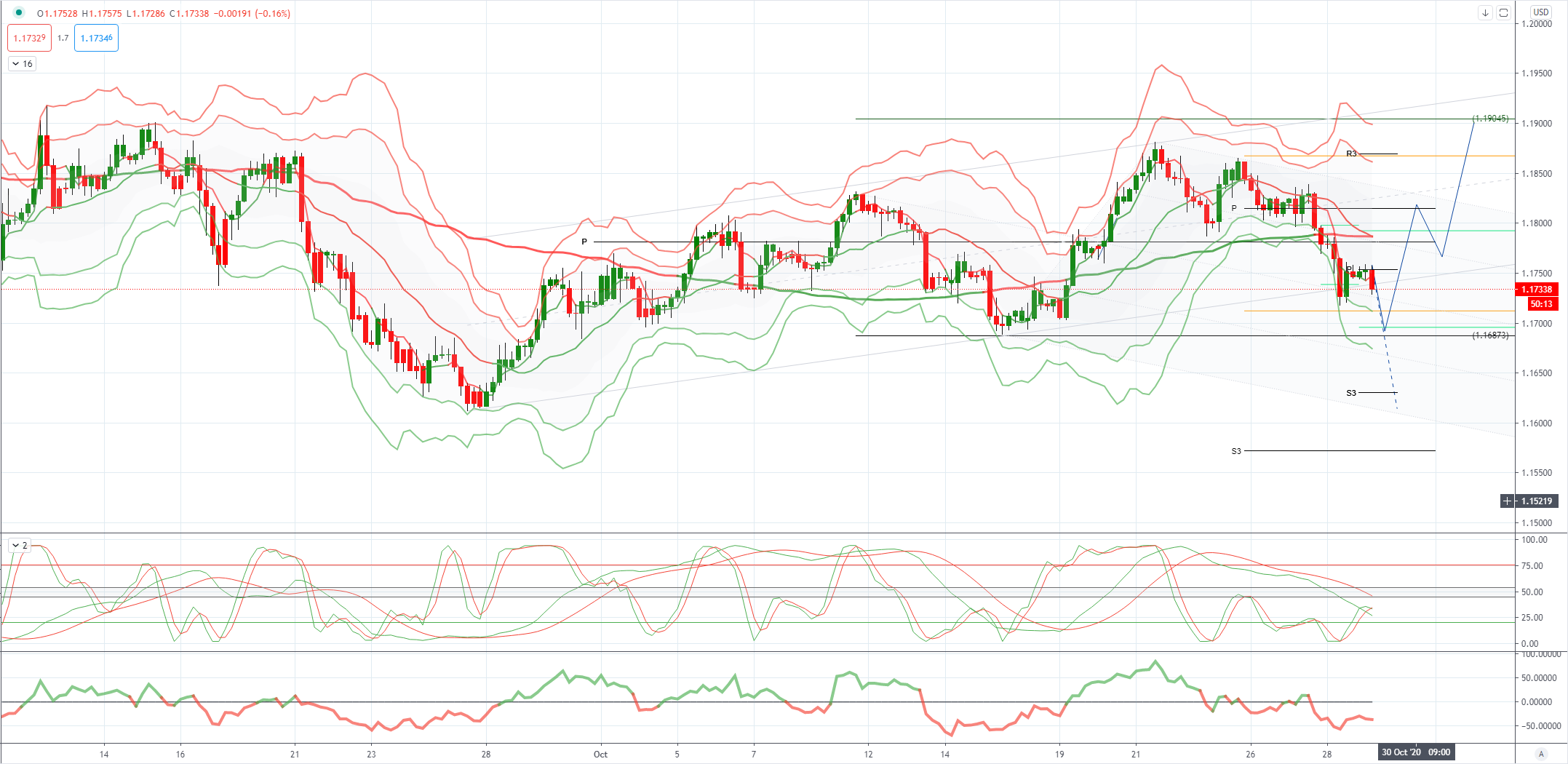

EURUSD Bias: Bullish above 1.1687 targeting 1.19

EURUSD From a technical and trading perspective, as 1.1687 supports look for a test of the primary equality objective at 1.19, expect profit taking pull back on first test. UPDATE a failure to hold 1.1687 lows opens quick move to test 1.1610

Flow reports suggest topside offers increasing the closer the market gets to the 1.1900 level with strong offers into the area however, a break through the 1.1920 level will likely see the market gunning for the 1.2000 for the highs of the year however, option plays are likely to see good defences of the levels for the moment and any push through could be brief before dropping back again and any push for the top would have to have good timing. Downside bids on a strong through the 1.1720 level and weak stops hanging around the 1.1680 level if the market could reach the move with limited bids then through to the 1.1620 area.

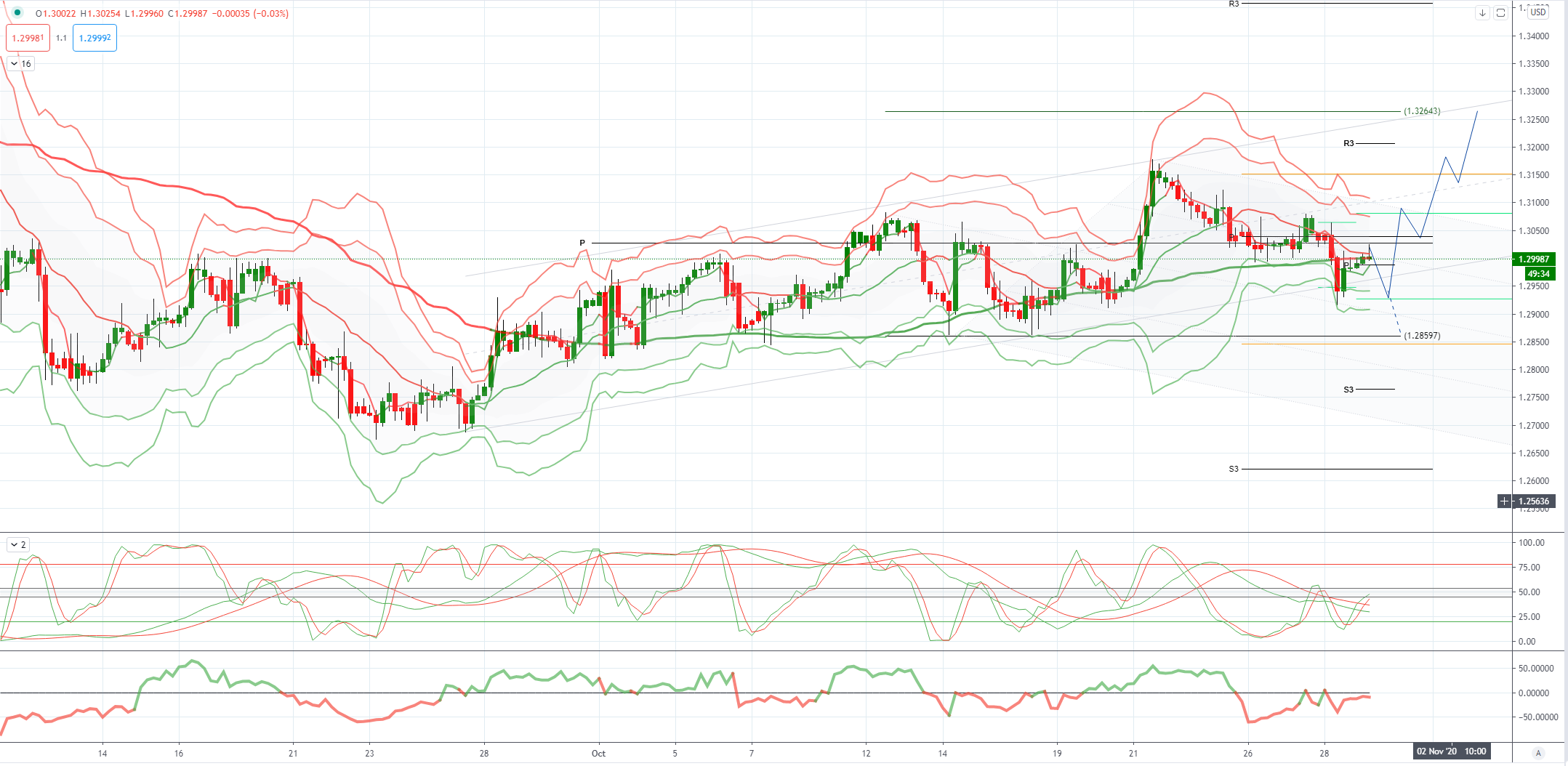

GBPUSD Bias: Bullish above 1.2861 targeting 1.3266

GBPUSD From a technical and trading perspective, while 1.2950 attracts sufficient bids look for a test of primary equality objective at 1.3264

Flow reports suggest downside bids light through to the 1.2900 area where stronger bids remain, with weak stops likely through the level and opening the downside only to the 1.2850 where stronger bids are likely to move through and the support growing for the moment at each sentimental level. Topside offers light through to the 1.3100 level before limited offers move in, only once the market tests towards the 1.3200 level do the offers increase with strong stops suspected through the level.

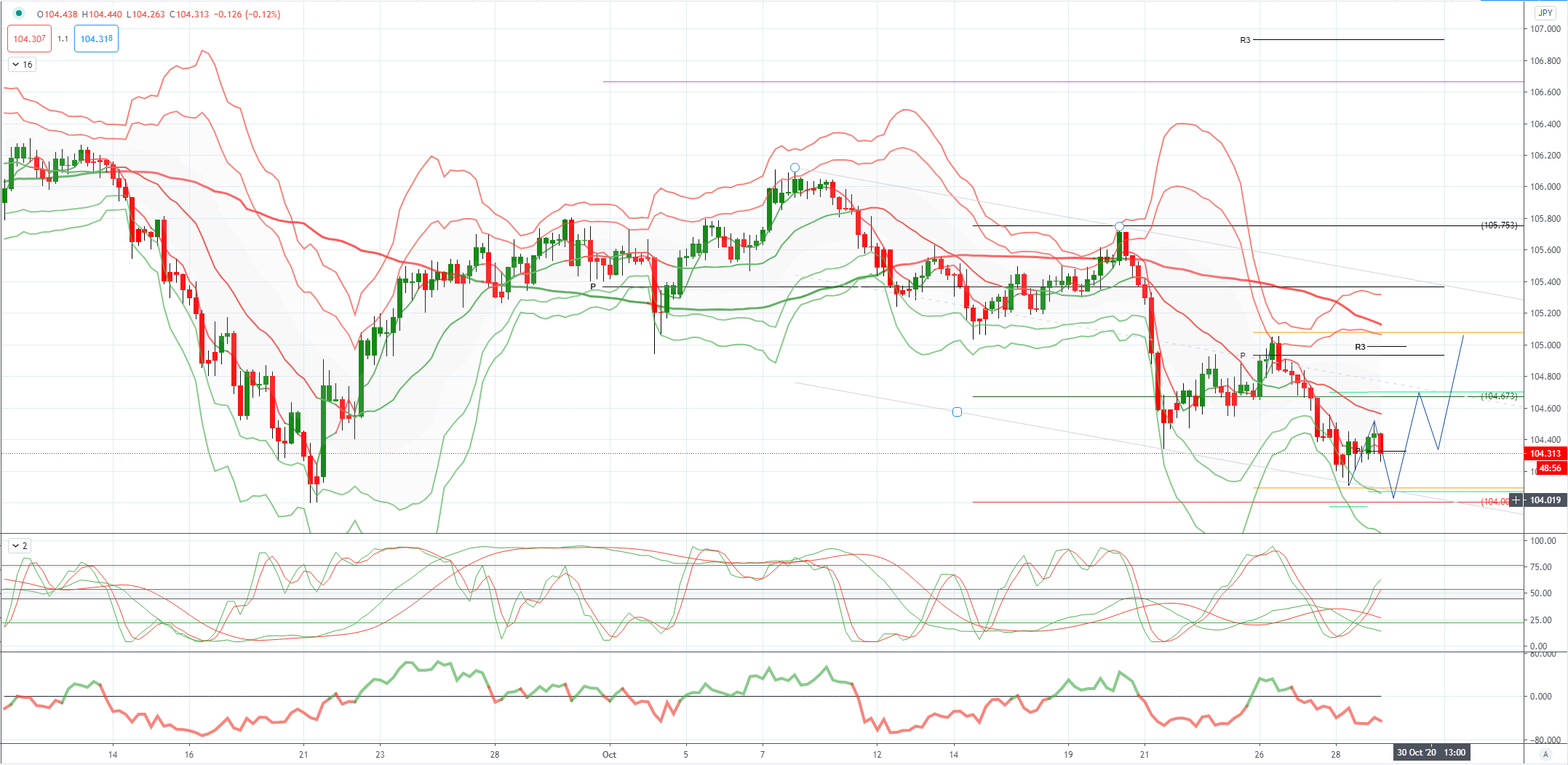

USDJPY Bias: Bearish below 104.30

USDJPY From a technical and trading perspective, as 104.30 supports look for a test of descending trendline resistance at 105.50 UPDATE breach of 104.30 opens a test of bids to 103.80

Flow reports suggest downside bids strengthen into the 104.20-00 level with possibly bottom pickers appearing below the figure level however weak stops through the 103.80 area could see a quick stab lower through to the 102.00 level before bids start to reappear. Topside offers light on a push through the 105.00 level with limited offers into the 105.80-106.20 area and the possibility of congestion then continuing through to the 106.40-80 area. And stronger offers thereafter

AUDUSD Bias: Bearish below .7243 targeting .6907

AUDUSD From a technical and trading perspective, as .7170 caps upside attempts look for decline to resume to expose bids and stops towards .6900

Flow reports suggest topside offers into the 0.7140-60 area unchanged before some light weakness appears however, 0.7180-0.7200 area sees stronger offers and 0.7220 level likely to see some congestion with stop losses through the level to open a quick move to stronger offers around the 0.7250 area. Downside bids light through to the 0.7060-40 area with stronger bids likely to appear on any move to test the 0.70000 areas, while there may be some weak stops on a move through the 0.6980 area the market is likely to see plenty of congestion into the 0.6950 area and increasing bids beyond.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 75% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!