Daily Market Outlook, September 2, 2022

Daily Market Outlook, September 2, 2022

Overnight Headlines

- Global Bond Index Fall To Bear Market On Powell Pushback

- US NFP Has Potential To Push Fed Toward Third Jumbo Hike

- UK Is Already In The Middle Of A Recession, BCC Forecasts

- Fed’s Bostic: ‘Work To Do’ With Inflation Long Way From 2%

- US Calls Iran’s Response To Nuclear Talks ‘Not Constructive’

- China To Avoid Flood-Like Stimulus And Keeps Prices Stable

- Japan Repeat Warning On Volatility As Yen Hits 24-Year Low

- ECB Still Seen Playing Catch-Up As Rate-Hike Path Steepen

- Europe Considers Price Limits To Decrease Electricity Prices

- Brussels Warn Frontrunner Liz Truss On Triggering Article 16

- Christmas Hiring Push Job Vacancies In Britain To New High

- Apple Workers In Oklahoma City Petition To Unionise Store

The Day Ahead

- Investor risk sentiment remains soft ahead of today’s key US labour market data. Further increases in US Treasury yields and the dollar were attributed to a solid ISM manufacturing report yesterday and Fed officials maintaining their hawkish messaging. Oil prices, meanwhile, moved higher after the US said that Iran’s response to revive the nuclear accord was ‘not constructive’.

- Today’s focus is the US August labour market report due at 13:30 BST as markets assess the Fed’s next policy move in just over two weeks’ time. Expect another healthy rise in employment, but by a smaller margin of 285k compared with the surprisingly strong 528k gain in July. The unemployment rate is expected to remain unchanged at 3.5%. Look for annual earnings growth to edge up to 5.3% from 5.2% in July. The US ADP report released earlier this week, a closely watched precursor to today’s official report, was weaker than expected, showing private sector payrolls up by 132k. However, it remains to be seen just how closely the ADP data based on new methodology tracks today’s official data. The weekly jobless claims data, meanwhile, fell to a two-month low. Overall, despite GDP falling in the first half of the year, the US labour market is expected to remain solid, supportive of another significant rise in interest rates.

- The only notable Eurozone release today is producer price inflation data. Factory-gate prices are forecast to remain elevated above 35% in the year-on-year comparison. Focus is squarely on the ECB policy announcement next week. With another upside surprise in Eurozone headline CPI inflation to 9.1% in August, there is rising speculation that policymakers may opt for a 75bp hike. It looks like it will be a close call between a 50bp or a 75bp rate rise.

- There are no major UK data releases today. Sterling market focus will shift to next week’s key events, which include BoE Governor Bailey and other MPC members testifying to Parliament. The BoE delivers its policy update in the week after next with markets fully priced for a 50bp rate increase. The new leader of the Conservative Party is also expected to be announced on Monday (probably around lunchtime). Markets are keenly awaiting any further details on potential additional policy support for households and businesses.

FX Options Expiring 10am New York Cut

- EUR/USD: 0.9850 (645M), 0.9875 (340M), 0.9900 (1.8BLN), 0.9925 (352M), 0.9950 (610M), 0.9975-80 (446M), 1.0000-05 (1.94BLN), 1.0020-25 (1.44BLN), 1.0050 (1.01BLN)

- USD/JPY: 138.00 (1.34BLN), 138.25-30 (380M), 138.65 (323M), 139.00 (250M), 139.25 (200M), 139.50 (300M), 140.00 (560M), 140.50 (260M)

- EUR/JPY: 139.57 (953M)

- GBP/USD: 1.1475 (252M), 1.1600 (560M), 1.1750 (291M)

- EUR/GBP: 0.8550 (250M)

- AUD/USD: 0.6795-00 (786M)

- USD/CAD: 1.3150 (310M), 1.3200-10 (341M)

Technical & Trade Views

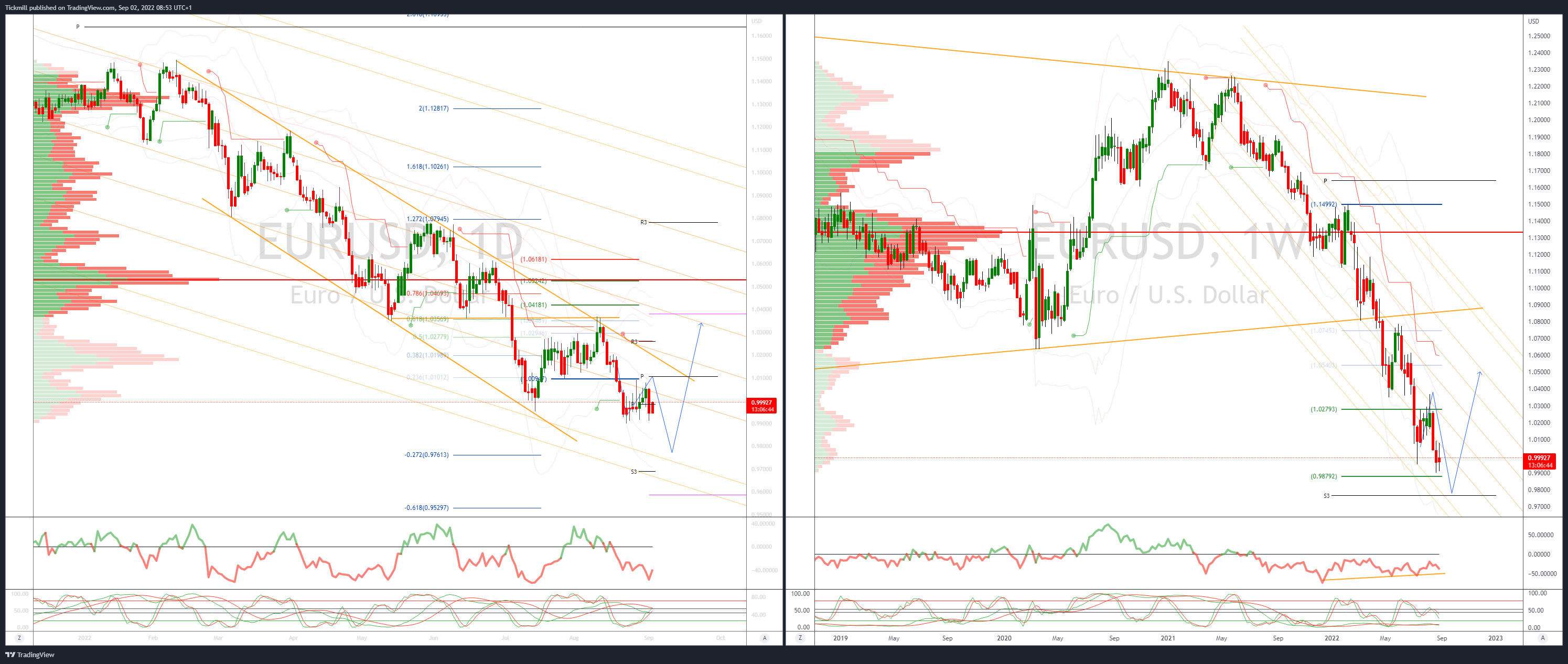

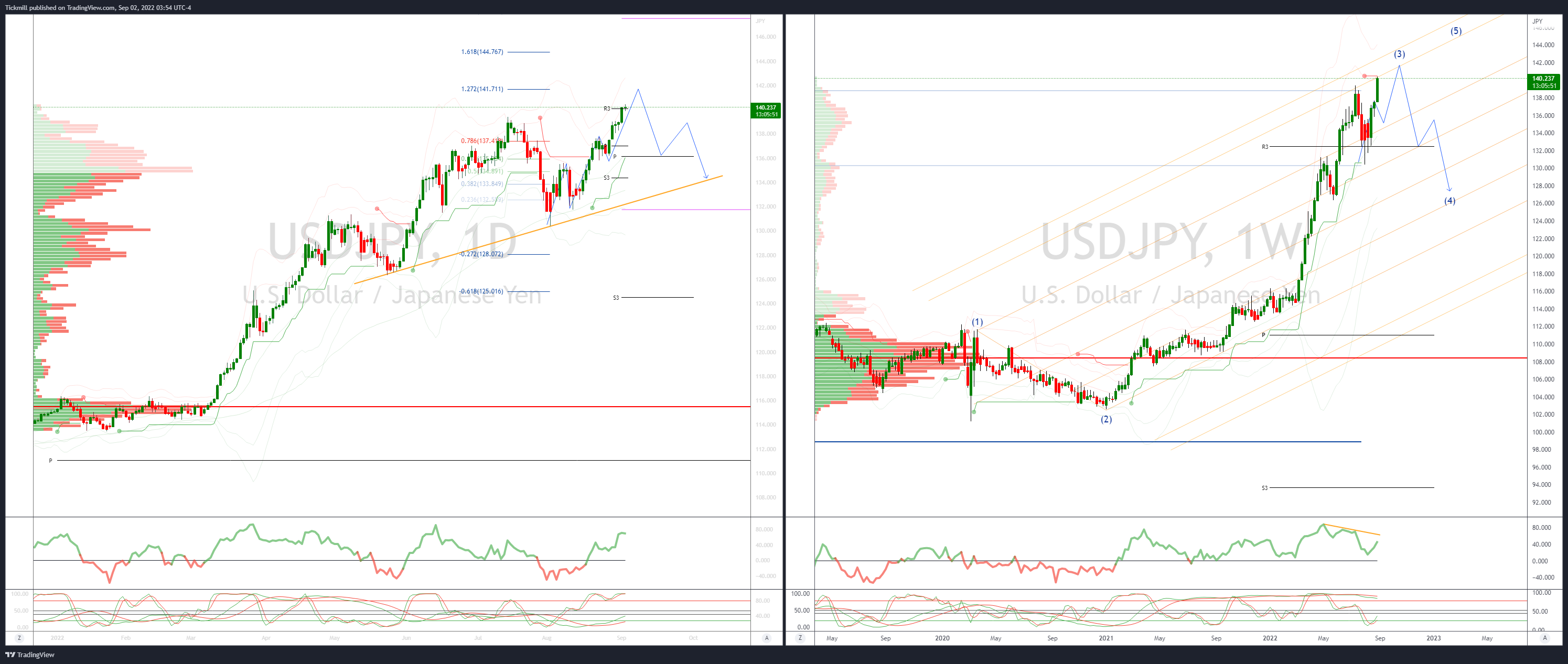

EURUSD Bias: Bearish below 1.0250

- 0.9900 proves resilient, but remains vulnerable

- Steady early after closing down 1.05%, leading the U.S. dollar higher

- Firm U.S. data, contrast with EZ recession risk

- Range likely ahead of often volatile U.S. payrolls

- 20 day VWAP bands track lower - bearish trending signals return

- 0.9900 August base proved resilient on a fourth test - pivotal support

- Close above 1.0089 falling 21 day moving average would be positive

- 0.9900 1.8 BLN, 0.9950 589 mln, 1.0000/05 1.936 BLN Friday's close strikes

- Weekly projected range support sited at 9830/50

- 20 Day VWAP bearish, 5 Day bearish

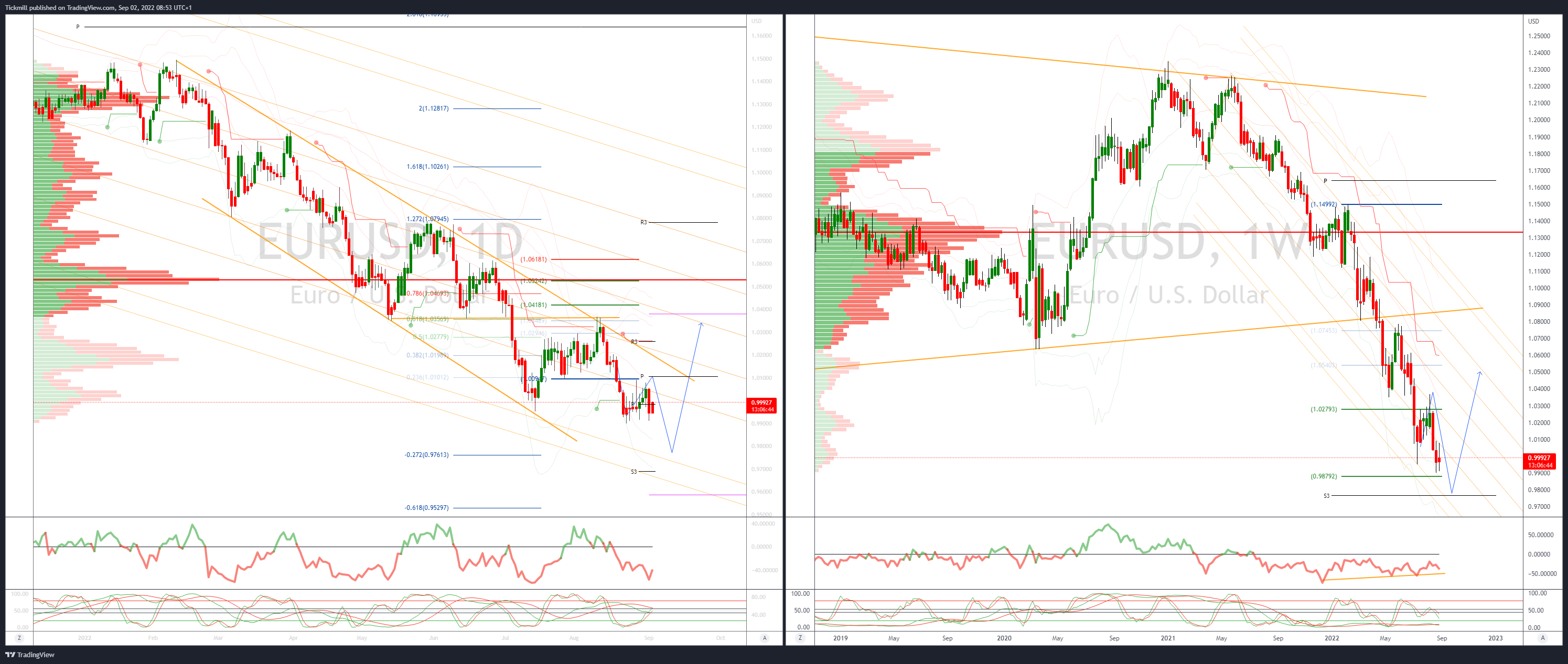

GBPUSD Bias: Bearish below 1.2050

- Heavy, as negative issues mount for the new PM

- Steady after closing -0.7% amid broad based UST led, U.S. dollar strength

- Cheaper BoE credit needed to finance climate friendly projects

- September UK rail workers to strike over pay, jobs, conditions

- Cost of living crisis, strikes in many sectors - new PM must make an impact

- Bearish trending setup targets 1.1413 March 2020 base longer-term

- Close above 1.1702 needed to undermine downside bias

- 1.1473 lower 20 day VWAP band initial support - 1.1613 resistance

- 20 Day VWAP is bearish, 5 Day bearish

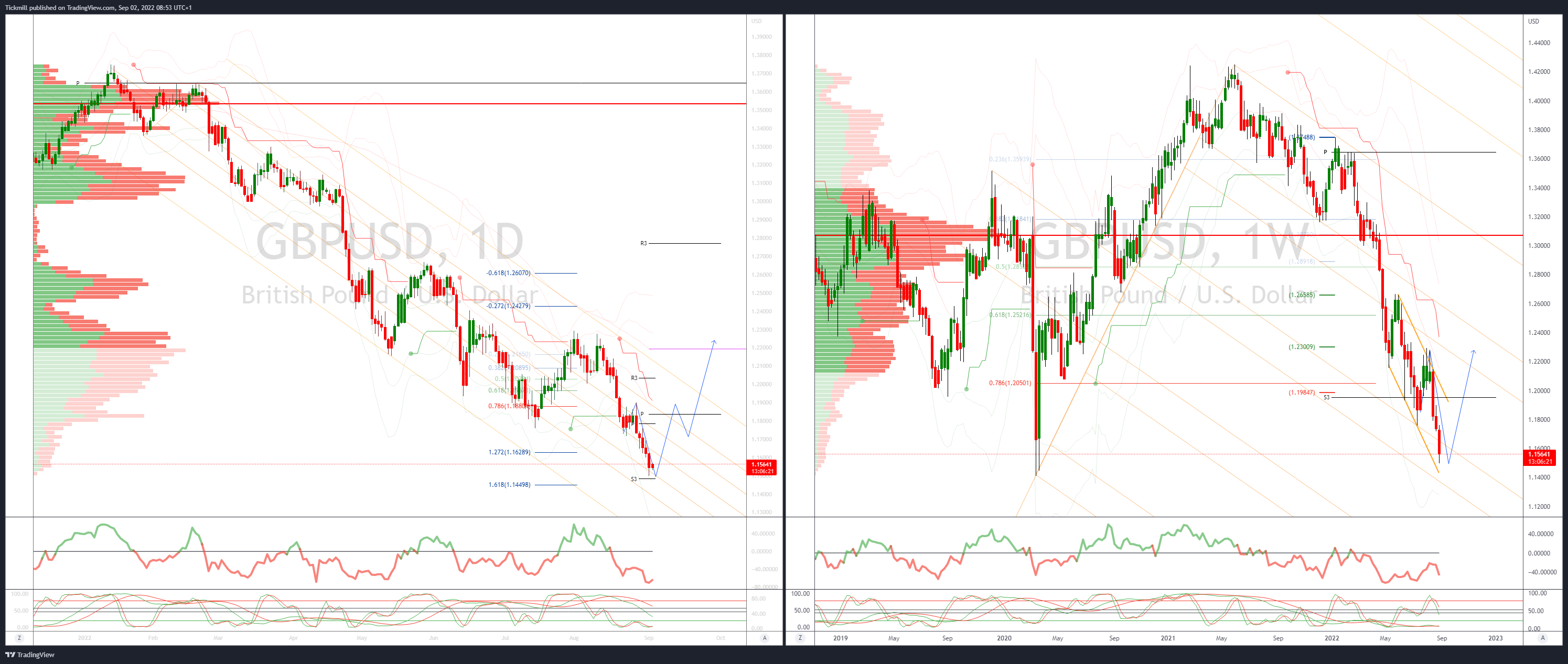

USDJPY Bias: Bullish above 133.40

- USD/JPY up another leg with US yields, through 140

- USD/JPY up another leg on higher US rates overnight, to 140.22 in NY

- Still bid in Asia, 140.05-27 EBS so far, consolidating gains

- USD bid on combo of strong US mfg/labour data, hawkish Fed, downbeat EZ

- Japan-US rate differentials widening again on diverging CB expectations

- Some caution still ahead of key US jobs report tonight, NFP +300k eyed

- Japanese exporter offers to trail up, larger, importer bids on dips

- Option expiries in area - 140.00 $530 mln today, $3 bln+ at 140.00 next wk

- 20 Day VWAP is bullish, 5 Day bullish

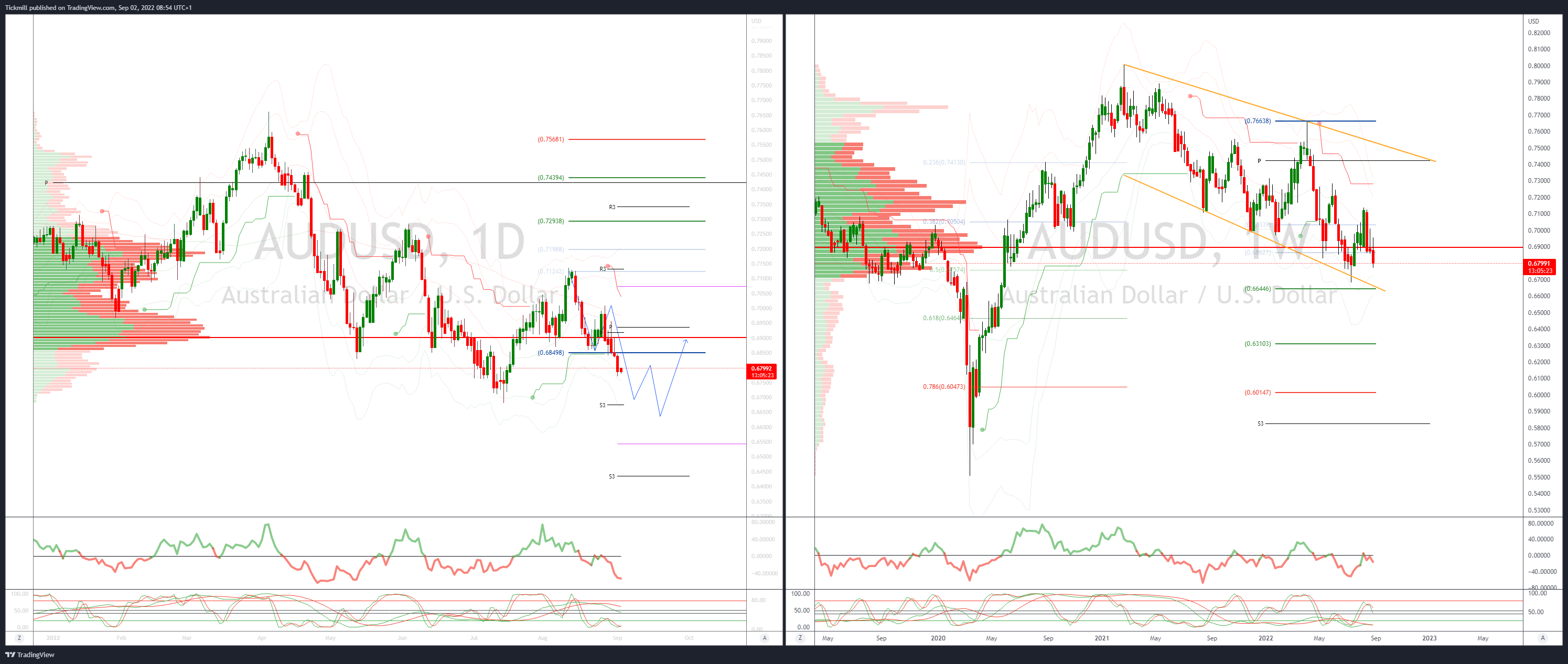

AUDUSD Bias: Bearish below .71

- Bargain hunting, but charts suggest 0.6682 vulnerable

- +0.2% on bargain hunting into Thursday's 0.85% fall - USD a touch softer

- No AUD data or scheduled RBA speeches, so risk appetite and the USD to lead

- Tight range likely ahead of the often volatile U.S. jobs data

- 20 day VWAPi bands expand, momentum studies slip - bearish trending setup

- Longer term target is a test of 0.6682, the July and 2022 base

- Close above 0.6910, 38.2% of the August-September fall would be positive

- 0.6771 New York low, and 0.6846 London high initial support and resistance

- 20 Day VWAP is bearish, 5 Day bearish

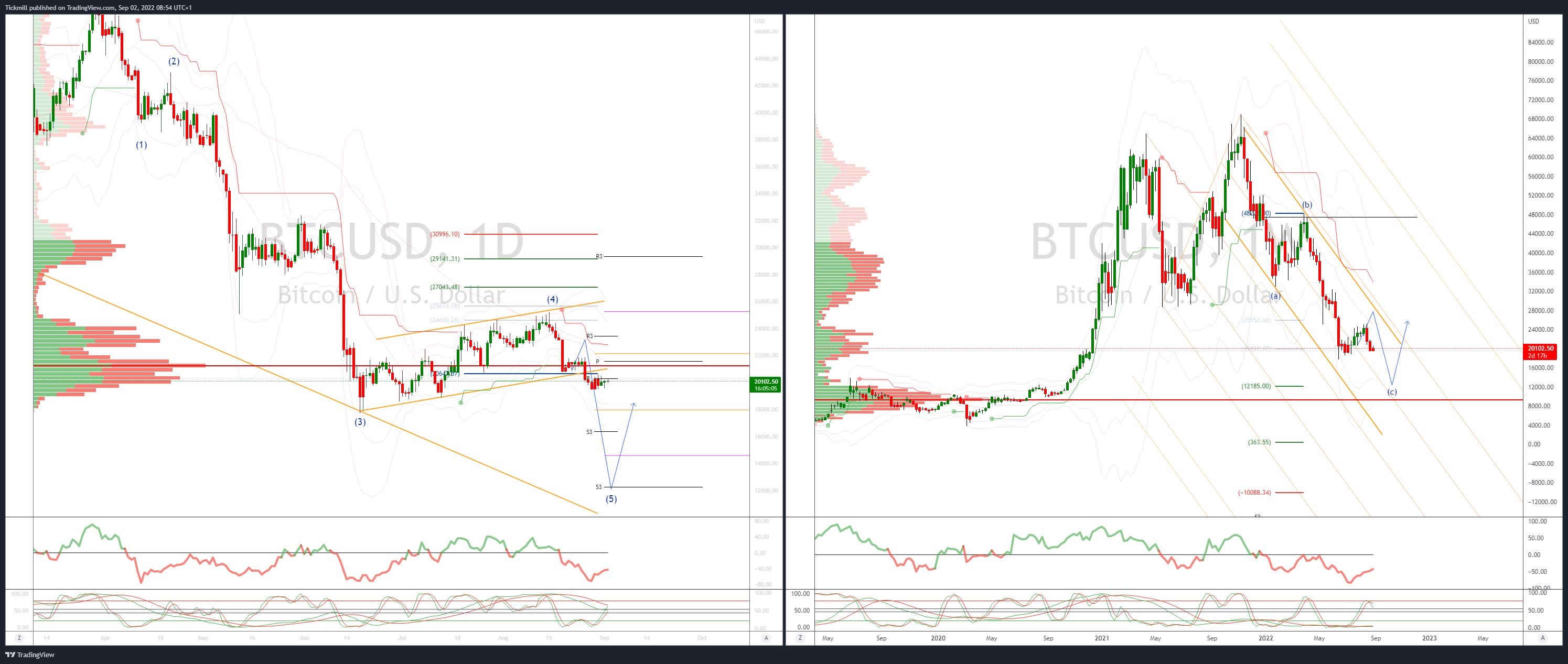

BTCUSD Bias: Bearish below 25.3K

- BTC rotates around 20K

- In a first in Oman, crypto currency to be used for payments

- crypto currency, pegged to the value of the Omani Rial, can be trialed for payments

- Regulatory roadmap for a progressive crypto industry in the UAE

- Collective Shift and ECOMI Partner to Bring Crypto Adoption to the Mainstream

- BTC supported by Jul 13 low 18.9k

- Aug 28's 22.2k may pull BTC higher

- 20 Day VWAP is bearish, 5 Day bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!