Dissecting the Markets: EUR/USD Under Pressure as Weak German Inflation Data Fuels ECB Rate Cut Speculation

The EUR/USD pair is under pressure in Thursday's New-York session, slipping below the 1.055 level as German inflation data for November came in weaker than anticipated. The report showed that consumer prices rose 2.4% YoY, falling short of the 2.6% forecast. On a monthly basis, the HICP contracted by 0.7%, a steeper decline than the expected 0.5%.

This subdued inflation data has fueled speculation that the ECB may opt for a larger-than-typical interest rate cut of 50 basis points in its upcoming decision. Earlier this week, ECB board member Isabel Schnabel's remarks in a Bloomberg interview, while less dovish than expected, had momentarily tempered expectations for aggressive easing. However, the latest inflation figures may reignite bets on significant rate cuts.

Adding to the Euro's challenges is the political uncertainty in France, where budget negotiations remain gridlocked. Prime Minister Michael Barnier cautioned that financial markets could face significant turmoil if the French parliament fails to pass the critical budget bill, raising concerns about potential government instability.

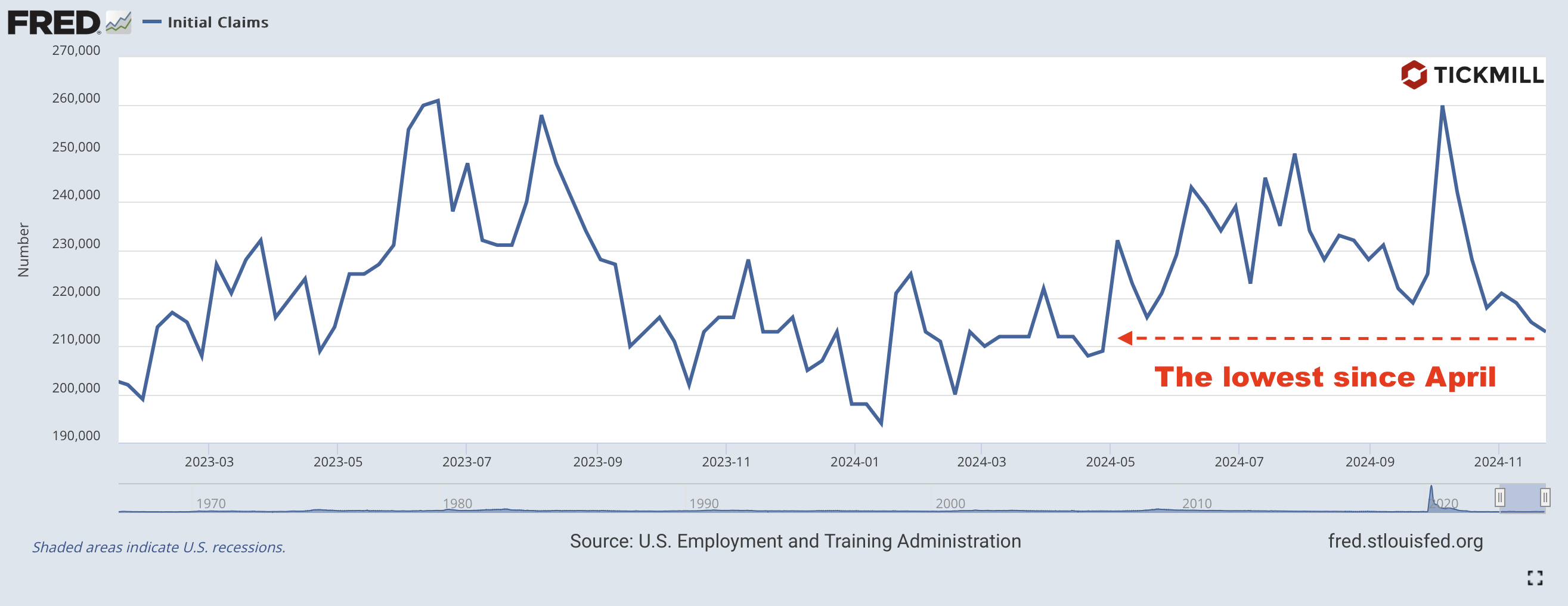

Interest rate derivatives experienced a slight adjustment in expectations for a December Fed policy easing following the release of durable goods orders, revised GDP data, and unemployment claims. The most significant report, durable goods orders, fell short of expectations, with core orders increasing by only 0.1% in October compared to the 0.2% forecast. Third-quarter GDP met estimates, growing at 2.8% year-over-year, while initial unemployment claims dropped to a fresh weekly low of 213K, beating the 215K projection:

As the chart above shows, there has been a sustained decline in unemployment claims, with the latest figure marking the lowest level since April. This suggests continued labor market resilience, potentially exerting wage pressures that could pose a challenge to the Fed's easing plans.

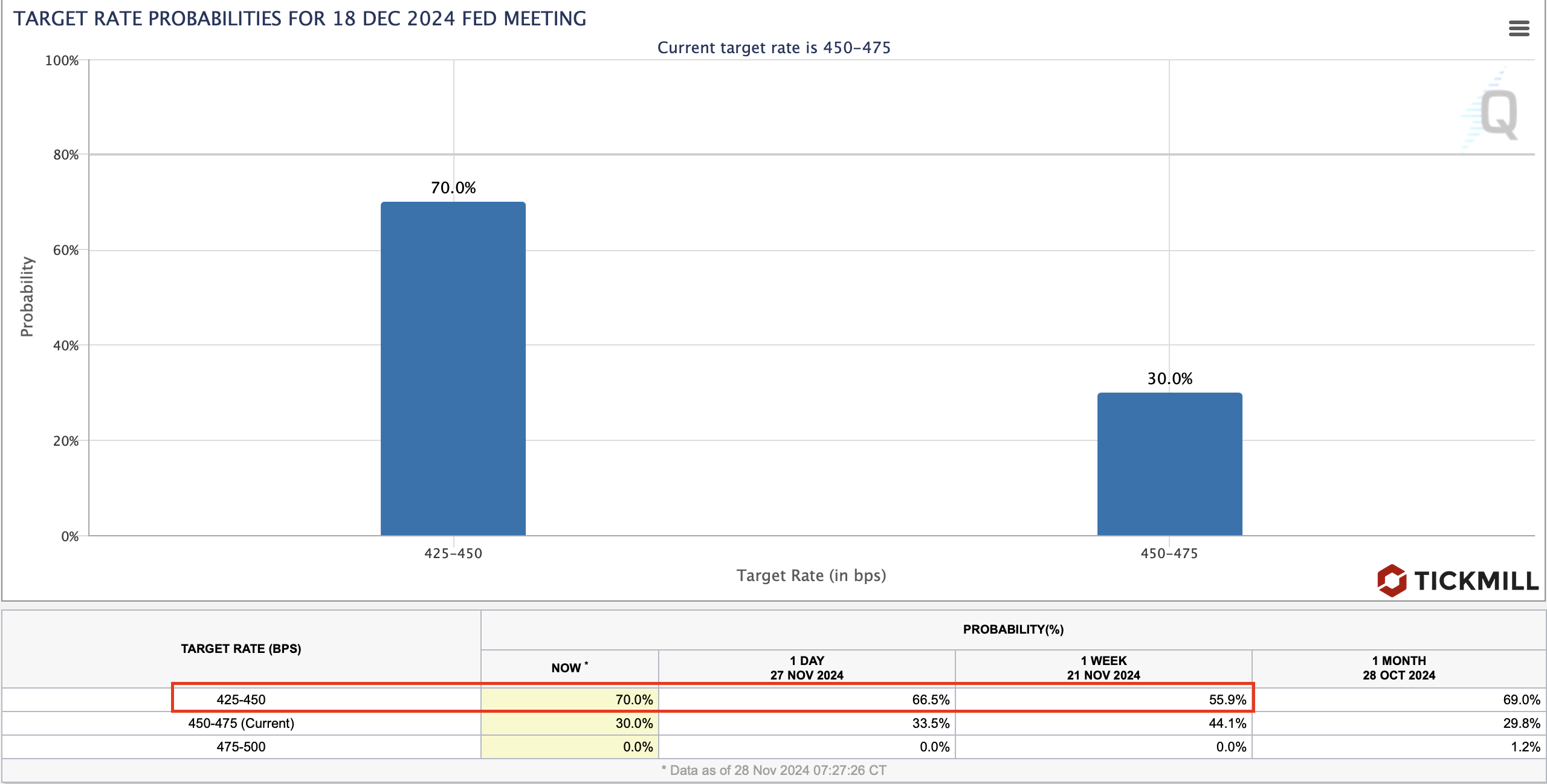

Despite these mixed signals, market confidence in a December rate cut has grown. The probability of a cut is now priced at 70%, up from 55.9% a week ago, supported in part by insights from the latest Fed Minutes, which bolstered expectations for a policy move next month:

Meanwhile, the US Dollar is showing modest strength against major currencies, with the US Dollar Index (DXY) recovering above 106.30 following a sharp sell-off the previous day. Market activity is expected to remain subdued for the rest of the week, given the Thanksgiving holiday and Black Friday.

Today’s rally in the Dollar can be partially attributed to a technical rebound off the 106 horizontal support level. However, the short-term technical outlook for the DXY suggests that bearish momentum may not yet be fully depleted. Any significant reversal, potentially sparking a fresh leg higher, is more likely to occur at lower levels.

As highlighted in our previous analysis, a plausible scenario involves a retest of the ascending trendline that has supported the Dollar's rise since early October. This would imply a further decline, potentially toward the 105.50 level, where the trendline's support could be tested. Only after this retest would the conditions align for a renewed upward trajectory:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.