Dovish Fed Shift Sends Bearish USD Signals

FOMC Minutes Show Growing Rate Cut Support

Last night’s FOMC minutes delivered on the dovish side as expected. The minute showed that several members were in favour of a cut last month while the ‘vast majority’ agreed on cutting rates in September as appropriate. Additionally, where inflation had previously been the main focus point for discussions, this time around, concerns were focused on the employment side of the Fed’s dual mandate. This was particularly noteworthy given that data earlier in the day showed that Q1 payrolls had been revised lower by 818k, reflecting greater weakness in the jobs market than previously thought.

Dovish Fed Pricing Shift

Market pricing for September is now showing a 67% - 33% split for a rate cut of .25% or .5% respectively. This pricing has grown increasingly dovish over the last week or so, informed by weaker inflation and jobs market data. Beyond September, at least one further .25% cut is priced in this year. However, if data continues to track current trajectory, this could well move to include a 3rd rate cut this year.

Powell in Focus Next

The focus now turns to Fed’s Powell who speaks at Jackson Hole tomorrow. On the back of recent jobs and inflation data undershooting forecasts, and with the FOMC minutes showing a clear dovish shift at the Fed, traders are now widely expecting Powell to cement these dovish expectations, creating room for a fresh move higher across risk markets while exposing USD to fresh downside.

Technical Views

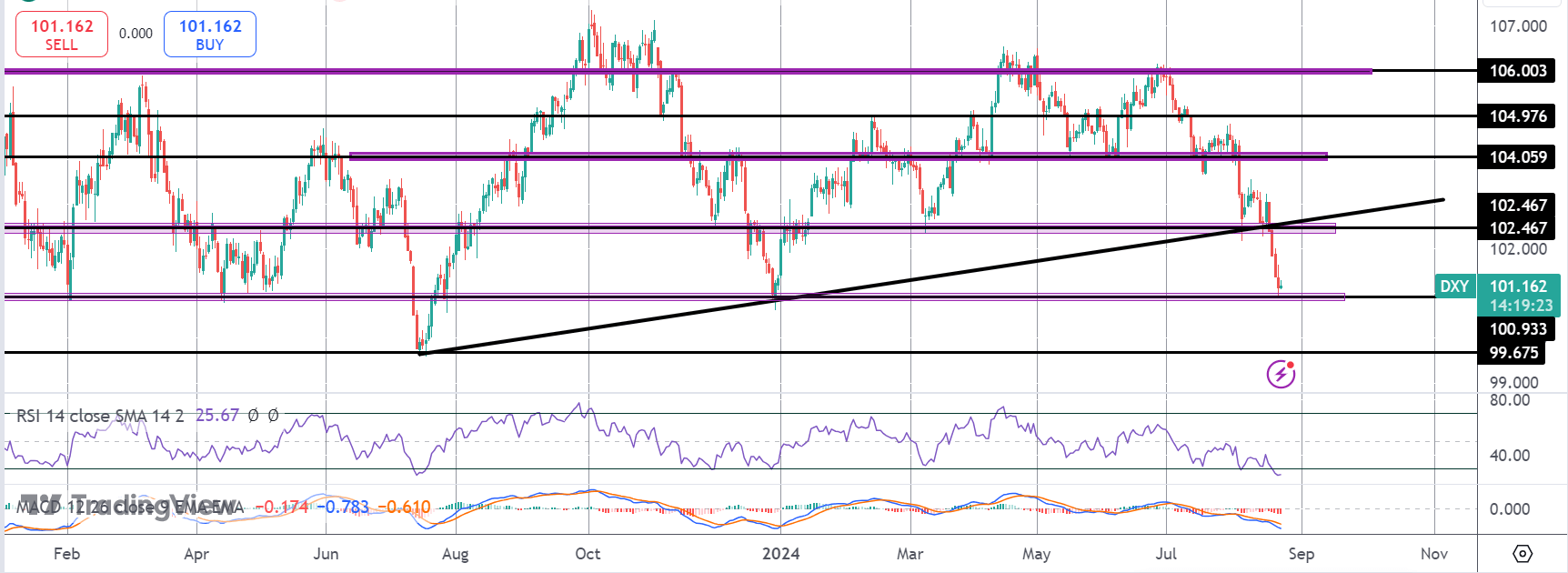

DXY

The Dollar Index is now testing support at the 100.93 level. With the index down sharply from the July highs around the 106.00 level, some consolidation and recovery cannot be ruled out. However, while price holds below the 102.46 level and the broken bull trend line, focus is on a further push lower with 99.67 the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.