GBPUSD Heavily Sold - BOE On Watch Tomorrow

USD Rallying Hurts Pound

GBPUSD is down sharply today as Trump-driven USD strength, dovish BOE expectations and a drop in the UK construction PMI weigh on sentiment. The AP has called the results of the US presidential elections this morning with Trump securing 277 of the 270 popular votes needed to gain victory. With the Republicans having taken the Senate and on course to take the House also, the prospect of a Red Sweep is fuelling a surge in Trump trades. USD is gaining firmly in response to the news with the Dolar buoyed by the prospect of a return to Trump’s protectionist trade policies and growth-focused economic policy, pushing USD higher across the board today.

BOE Up Next

Along with the rally in USD, GBP is also being weighed on ahead of tomorrow’s BOE meeting which is widely expected to see the bank cut rates by a further .25% while signalling that further cuts are likely. Indeed, in the wake of the US elections results, the BOE might have cause to sound more dovish given that the UK NIESR published a report today signalling that a Trump presidency would have severe repercussions on UK growth. A stark drop in the UK construction PMI today has added to bearish pressure with the index dropping back into contractionary territory last month. Near-term, risks appear skewed to the downside in GBPUSD given the near-term outlook for continued USD strength.

Technical Views

GBPUSD

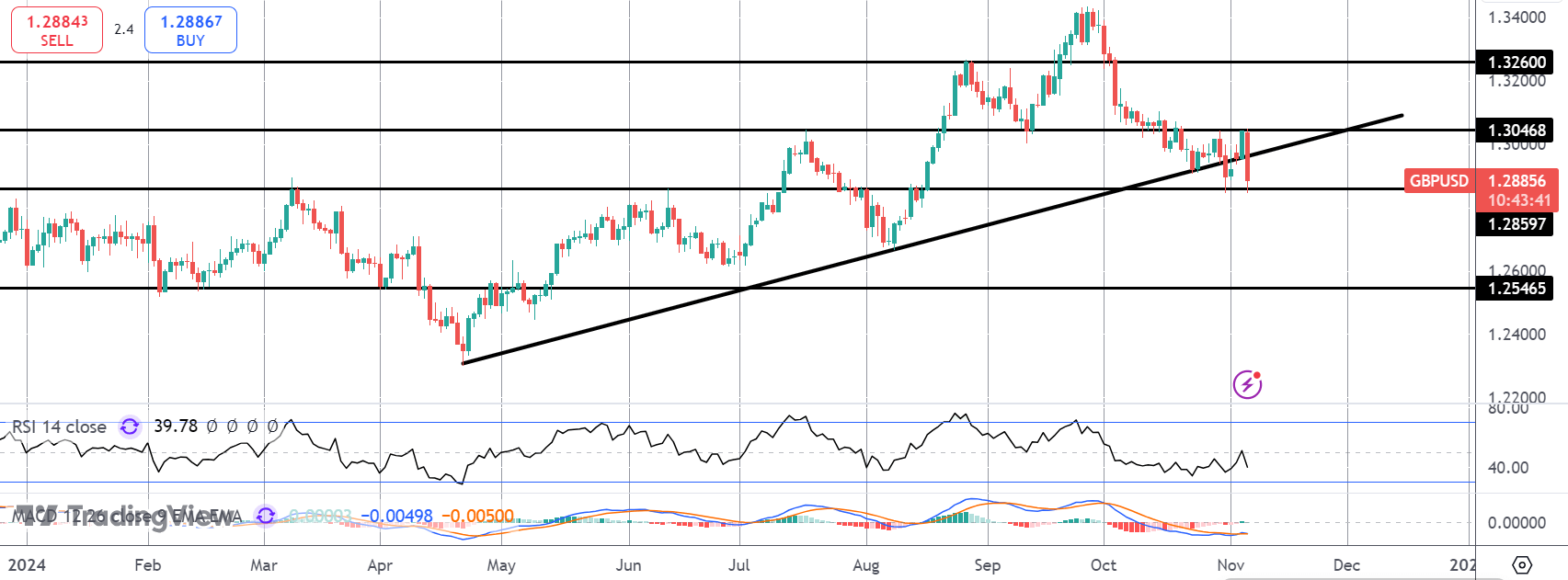

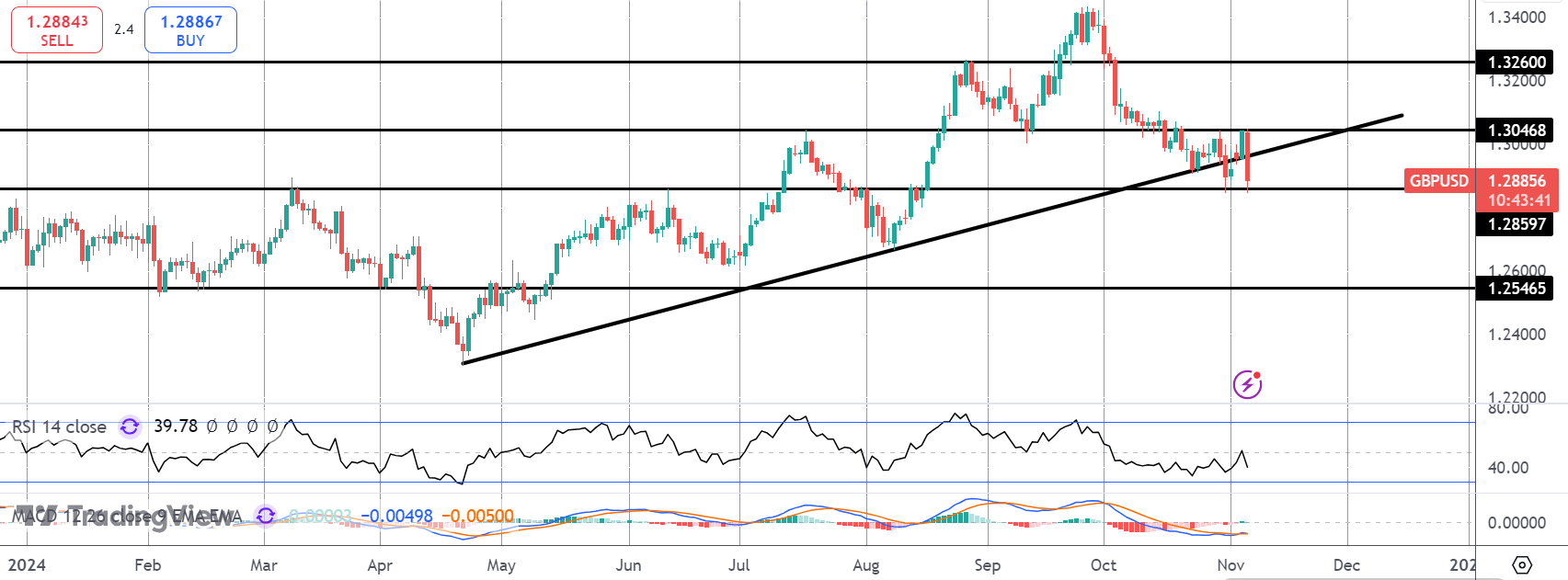

The sell off in GBPUSD has seen the market breaking back below the bull trend line from YTD lows. Price is now testing support at the 1.2859 level once again. If we break lower here, the path is open for a test of much deeper support at the 1.2546 level. Bulls need to get back above 1.3046 near-term to alleviate bearish pressure.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.