HSBC Shares Spike Pre-Market On Big Earnings Beat

Solid Q1 Earnings Beat

HSBC shares are trading firmly higher ahead of the open today after the bank released a bumper set of Q1 earnings. Amidst the return of concerns for the US banking sector on the back of the forced closure of First Republic Bank over the weekend, the results have been welcomed by markets. On the headline numbers, HSBC reported Q1 EPS of $2.60, more than double the $1.25 the market was looking for. Additionally, revenues were seen higher at $20.171 billion, vs $16.34 billion expected.

SVB Profits

Notably, the bank said that the purchase of Silicon Valley Bank’s UK business had added $1.5 billion in profits over the quarter. The bank’s results were a solid increase on its performance over the prior quarter (revenues $15.4 billion, EPS 2.46) and marked an even bigger jump when compared with the same quarter a year prior (revenues $12.549 billion, EPS $0.70).

On the back of such strong performance, the bank announced a $2 billion share buyback program, along with a quarterly dividend of $0.10. The bank cited a widespread uptick in net interest income as a result of higher rates as the main upside driver. Looking ahead, the London headquartered bank remained confident of further strong performance to come.

Technical Views

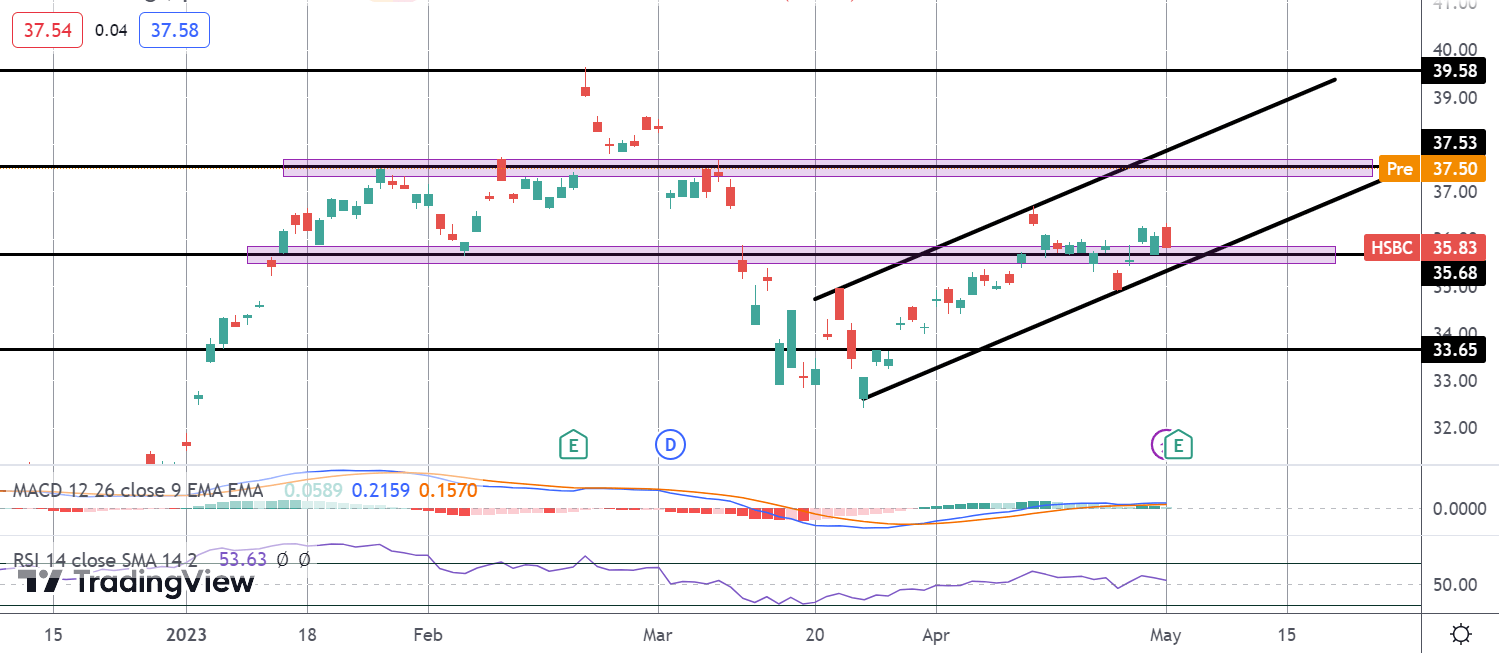

HSBC

The rally off the YTD lows has seen HSBC shares framed by a neat bull channel. Price has recently broken above the 35.68 level and, pre-market, is now trading above the 37.53 level also. With momentum studies bullish, the focus is on a continued push higher while price holds above this level putting focus on 39.58 as the next upside target.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.