Inflation Surprise for the ECB

EURUSD slipped by almost half a percent during Asian trading on Wednesday:

As mentioned in the previous article, it might be wise to hold off on shorting the dollar.

Other majors are also losing ground, except for the Japanese yen, which is holding up quite well. The moderate decline in USDJPY coincided with a correction in the stock markets, which could be the first sign of risk-off sentiment as Japanese investors are known to be active players in foreign bond and equity markets.

The US economy is expanding, accompanied by rising interest rates. However, borrowing costs will eventually become burdensome. The Federal Reserve is curbing demand in the economy and intends to continue doing so - how else would it tame inflation? -, which will inevitably dampen revenue and dividend growth forecasts for companies. Without revenue and dividend growth, holding stocks loses appeal. The question is when the market perception of the Fed "overdoes it." Recently, the Fed played catch-up (expectations of economic expansion outpaced expectations of policy tightening), but the gap is gradually closing. A bear market will emerge when the market perception expects a tightening that will soon derail expansion.

In the context of the growing fragility of the market, the following chart is also interesting: the ratio of FAANG stocks (the major big tech companies) to SPX, which serves as an indicator of concentration risk in the US stock market. It has rapidly risen since the beginning of 2023 and is now near a key resistance level:

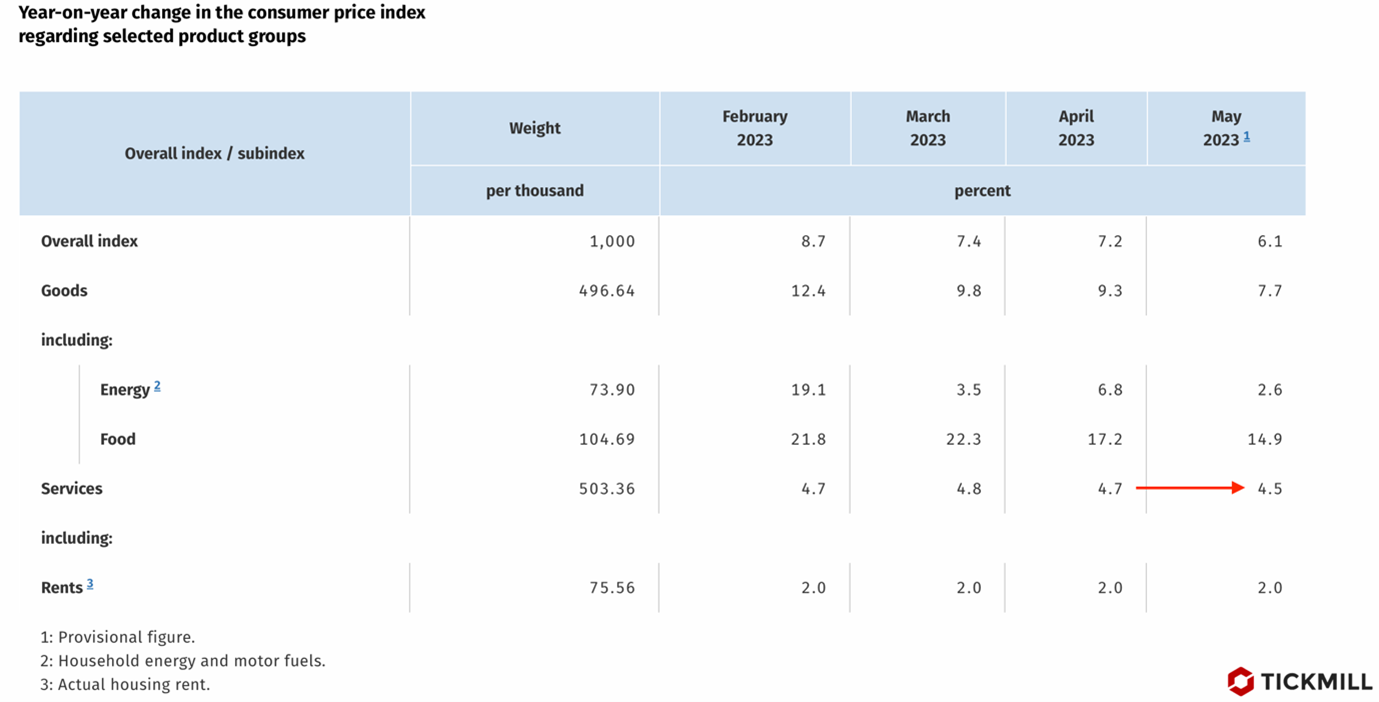

In the Eurozone, inflation appears to be taking a step back. In France, price growth slowed from 5.9% to 5.1% in May, while in Germany, it dropped from 7.2% to 6.1%. The decline was expected, but not to this extent. In the German services sector, inflation slowed by 0.2% to 4.5%:

In a scenario where ECB officials are concerned about the "second-round" inflation through the wage-demand feedback loop, inflation behavior in the services sector is one of the best indicators of how effectively rate hikes are working. Both Fed and ECB officials have mentioned this multiple times. Therefore, the ECB will have to slow down, at least in its communication. The market has already started reassessing the odds, and a 50 basis point hike is now highly questionable. In this situation, the dollar is unquestionably favored over the euro, leading to a sharp decline today.

The decline in EURUSD since the beginning of May has been characterized by very weak attempts to resist it. Today's inflation data create unfavorable informational asymmetry for the euro: key data for the EU has been released, and it is negative for the euro, while releases for the US are scheduled on Thursday (ADP) and Friday (NFP), with expectations leaning toward hawkish surprises. These two observations increase the likelihood of downward breakout moves, and meaningful support for the pair, in my view, may only emerge around 1.0550-1.06.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.