Institutional Insights: Citi US Equity Trading Desk View

.jpeg)

Markets encounter another round of positioning risk.

Momentum, growth, and core holdings all experienced declines, while low-risk assets saw a significant rally of 3 standard deviations. We remain cautious, believing there will be better entry opportunities in the future, and currently the risk/reward ratio for buying the dip is unfavourable. QQQ continues to be the top choice for de-risking.

Markets ended a three-day period of calm with a near-identical repeat of recent risk-off sessions. The S&P 500 (SPX) dropped 1.1%, falling back below the 200-day moving average, erasing what had been a 5% rebound since the March 13 lows. The underlying details offered little improvement over the headline performance, as Momentum (-0.3%), Growth (-0.9%), and Low Risk (-1.9%) sectors reverted to their previous patterns of weakness.

Sector performance mirrored this trend, with Technology (-2.5%), Consumer Discretionary (-1.7%), and Communication Services (-2.0%) experiencing sharp declines. Meanwhile, defensive sectors such as Utilities, Consumer Staples, and Real Estate saw gains of 50 to 150 basis points. However, there was no significant flight to safety, as 10-year Treasury yields rose modestly by 3 basis points, and gold edged down by 0.1%. European stocks also sold off in tandem with U.S. markets, adding a new layer to the downturn.

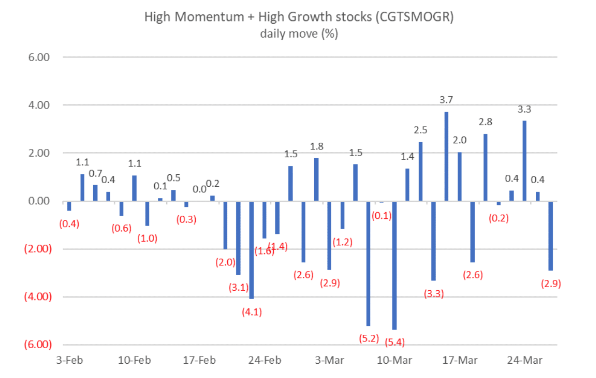

Today's market action serves as a clear example of why we continue to advise against buying the dip in equities at this stage. Core high-growth leaders faced renewed selling pressure, declining 2.9%, underscoring the risks still present in the current market environment.

Equity and credit implied volatility outpaced other assets during the recent move lower. The VIX rebounded sharply, closing at 18.3 (+6.9 points) after a 10-point decline since March 10. Similarly, the VVIX climbed back to 90 but has remained surprisingly below 100 for nine consecutive sessions.

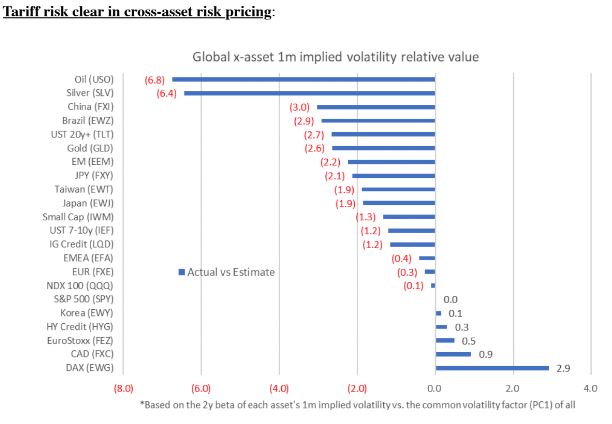

Cross-asset implied volatility showed mixed trends. Developed market (DM) equity 1-month implied volatility rose by nearly 2 points, driven by QQQ (positioning), and EWG and EWJ (tariffs). Meanwhile, HYG was a relative outperformer, increasing by 0.8 points and nearing the 6% level. However, implied volatility eased across emerging market (EM) equities, precious metals, and currency markets.

As a result, risk-asset implied volatility experienced the most notable shifts. Our relative value estimates highlight EWG, FXC, FEZ, and HYG as high on a global cross-asset basis. Conversely, implied volatility in commodities, EM equities, and US rates appears attractive on a relative basis.

What to do?

We remain cautious here. While the risk/reward positioning has improved significantly compared to two weeks ago, it is still not entirely "clean" given today’s price action. More importantly, markets do not decline solely based on positioning. The underlying triggers for this sell-off remain intact: concerns surrounding the US consumer and the unpredictability of tariff-related news continue to dominate. Additionally, earnings season and looming congressional budget and tax negotiations add further uncertainty.

Taking all factors into account, we believe better entry points are likely ahead, and the current risk/reward scenario for buying the dip remains unfavorable.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!