Institutional Insights: Goldman Sachs NFP Scenario Analysis 07/03/25

.jpeg)

Goldman Sachs: NFP PREVIEW

FICC and Equities

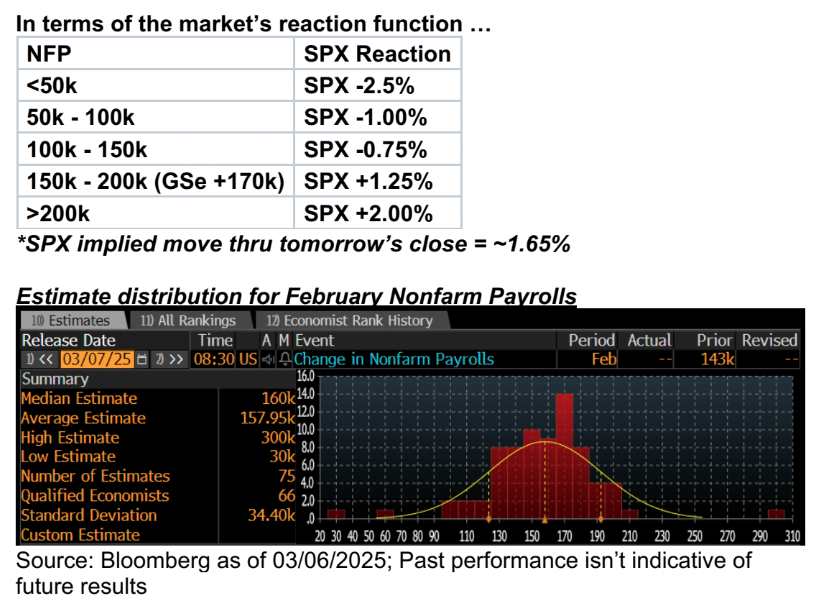

From GS Research: We project nonfarm payrolls increased by 170k in February, slightly exceeding the consensus estimate of +160k but falling short of the three-month average of +237k.

- We anticipate the unemployment rate remained stable at 4.0% (rounded), aligning with consensus expectations, while the labor force participation rate likely held steady at 62.6%.

- Average hourly earnings are estimated to have risen by 0.3% month-over-month, reflecting diminishing wage pressures alongside favorable calendar effects. This would elevate the year-over-year growth rate to 4.2%.

We believe the NFP print is crucial in determining the future direction of equities. From our standpoint, there are three potential ways to gain confidence in reversing the rotations observed so far.

First, investor positioning could become so "washed out" that buying U.S. equities becomes appealing, even without a strong macroeconomic rationale. Our Sentiment Indicator has dropped significantly, from +2.8 standard deviations in late November to -0.4 as of last Friday. However, despite this sharp decline, the indicator remains above the "trough" levels typically seen during past equity market corrections, which are usually around -1.5 to -2 standard deviations. This suggests that positioning has not yet reached a sufficiently depressed level to justify a tactical upside without a clear catalyst.

It’s important to note that this reading reflects data as of last Friday, and we’ll receive the latest update tomorrow after the market close. Positioning might have declined further since then. However, based on current data, this condition has not yet been fully met. In the absence of this positioning condition, we believe equities will require a distinct catalyst to drive further gains.

Policy relief is an option but lacks strong conviction, and today’s tariff reversal may add uncertainty. Growth remains the key driver for equities, with NFP as the first major test. US equity markets have partially repriced growth optimism, making risk/reward less extreme than weeks ago. Cyclicals vs. Defensives now reflect GDP growth slightly below 2.5%, aligning with baseline forecasts but above the 2024 summer trough and 2023 weak growth levels. Signs of labor market weakness could trigger another downturn in equities and cyclical stocks.

Heading into NFP, the equity market remains fragile, down nearly 7% from the highs, with an inverted vol curve, VIX spot above 25, and the front 5 VIX futures above 21. Both realized and implied volatility have surged, with short-dated straddles pricing the most volatility since August 5th last year. The 1-day straddle for NFP is currently higher than election night’s. This reflects market growth fears and a different technical setup. Dealers are short gamma across the board, limiting the usual buy-the-dip or sell-the-rip dynamics. The desk view is straightforward: good news is good, bad news is bad. A strong jobs number could ease some concerns, though tariff headlines will persist. With vol elevated, the desk prefers spreads; for a reversion play, the SPY 14Mar 585/600 call spread is offered at 3.55.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!