Institutional Insights: Nomura - 'Growth Scare - Growth Shock'

.jpeg)

Nomura - 'Growth Scare - Growth Shock'

According to Nomura's flow guru McElligott, ISM data indicating "stagflation" has compounded ongoing concerns tied to the so-called "Growth Scare" narrative. This has been exacerbated by the latest escalation in the "Trump Tariff Tantrum." Meanwhile, the looming risk of a mid-March government shutdown remains unresolved, as the Senate has delayed reconciliation discussions until the end of the month—a timeline that offers little relief for those wary of further economic strain.

It’s worth noting my perspective that the Trump administration may be intentionally steering toward an "engineered recession." While this may sound alarming, the rationale seems to align with promoting a growth slowdown and disinflation, which could pave the way for Federal Reserve rate cuts and a weaker USD to support the administration’s broader economic vision. From a "Financial Conditions" standpoint, it’s plausible that a "negative wealth effect"—spanning equities and cryptocurrencies—might also serve this end. As such, I believe any notion of a "Trump Put" in equities is far from at-the-money (ATM) and remains significantly out-of-the-money (OTM). This has prompted clients to dynamically hedge and press short positions, with little Trump could say to reverse sentiment unless he completely abandons his current policy stance.

Despite some unwinding of March VIX call strikes yesterday and further monetization today of March 30-60 call spreads, we’ve seen new activity with a 50k buyer of VIX April 20 calls, keeping VVIX elevated. However, the current state of VIX options is not the epicenter of volatility concerns. In my view, a significant escalation would require either fresh, large-scale VIX call buying—unlikely given the unattractive entry point due to high implied and realized volatility—or a sharp equity market selloff of -3% or worse, which could trigger panic and systematic deleveraging.

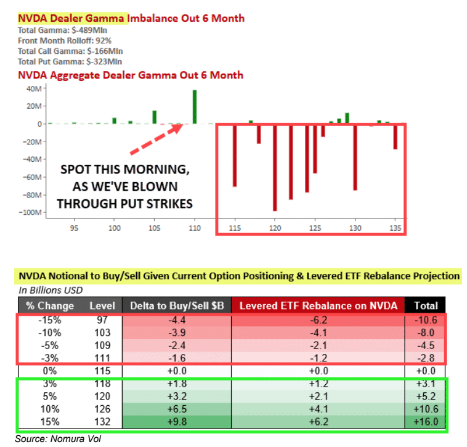

From the perspective of U.S. equities and "Real Negative Gamma," index options are entering increasingly precarious territory for dealers and market makers. The recent uptick in substantial downside put buying and steepening skew reflects mounting pressure. As spot prices continue to decline amid deleveraging and "net down" flows, dealers and market makers are being pushed into unfavorable positions, with mounting $Delta exposure further amplifying downward momentum.

The real driver of complexity right now is the ongoing deleveraging of longs or the "net down" process in what were once considered "high Sharpe" winners, particularly within Megacap Tech, AI, and the Mag7-8. These names are now facing significant pressure due to two key factors:

1) Long selling, which triggers a spiral effect into leveraged ETF rebalancing and end-of-day (EOD) sell flows. This is evident in our "Animal Spirits" basket, which tracks the largest single-name holdings in leveraged ETFs. As I've frequently pointed out, these ETFs have their assets under management (AUM) heavily concentrated in Megacap Tech, AI, and the Mag7-8. This segment has now dropped 22% from its December highs.

2) A surge in panic-driven demand for puts as a hedge against these same single-name Megacap stocks, which exacerbates the negative feedback loop and intensifies the sell-off.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!