Market Spotlight: Goldman Earnings in Focus Today

Goldman To Follow JPM & Citi?

Shares in US banking giant Goldman Sachs are trading higher ahead of the open today as traders brace for the group’s Q4 earnings. A slew of strong earnings from leading financials on Friday has helped stoke sentiment ahead of the release. In terms of the numbers, Wall Street is looking for EPS of $5.56 on revenues of $10.75 billion. Goldman has been on a strong run recently with three consecutive quarters of topping analyst expectations. Given the current backdrop, a strong result today should propel GS shares back up towards the November 2022 highs around $388.

However, as we saw with JPM and Citi last week, alongside the headline figures, traders will also be looking at the breakdown of the group’s business sectors. With both banks recording a heavy drop in investment banking revenues, investors are bracing for a similar story from Goldman today. The market will also be keen to head CEO Solomon’s outlook and how he views downside risks not just to the bank but the US economy as a whole, particularly in light of Goldman laying off more than 3000 employees just last week.

Technical Views

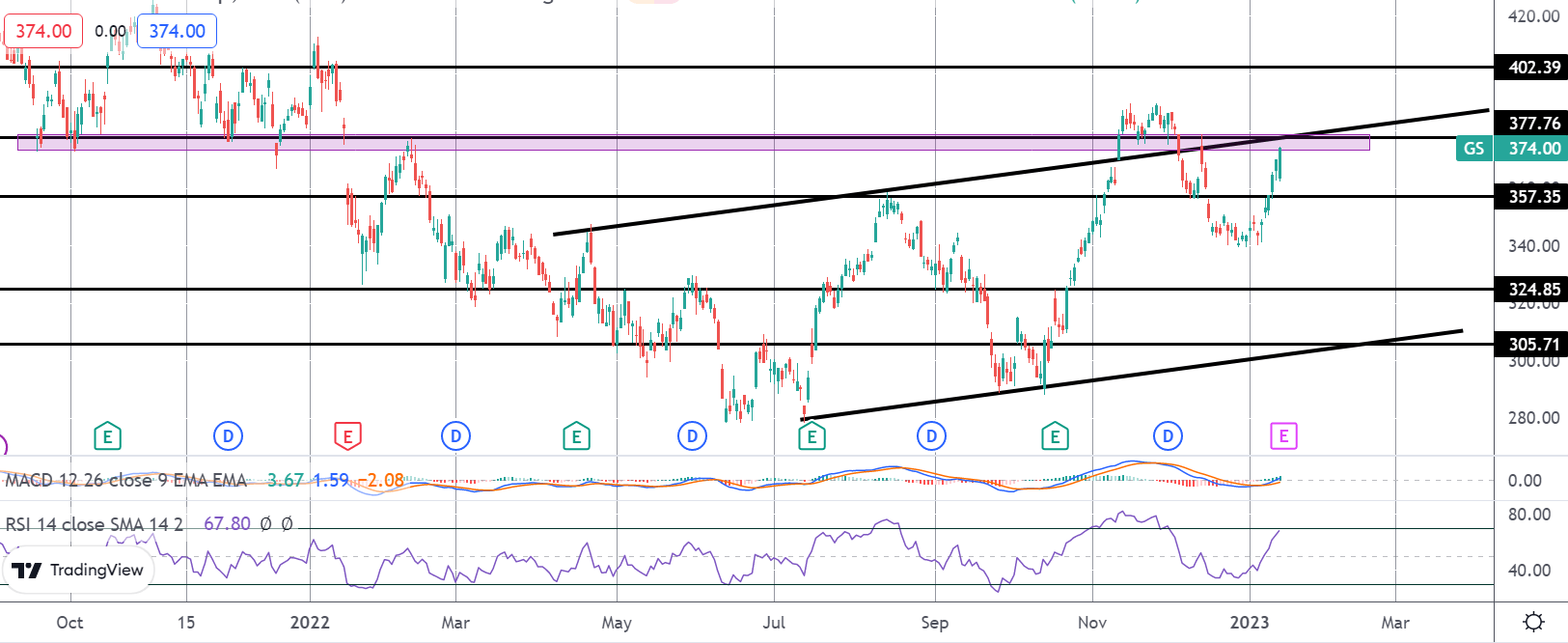

GS

The rally in GS shares has seen the stock climbing back above the 357.35 level. Price is now testing the area of resistance around the bull channel top and the 377.76 structural level. This is a key resistance zone for GS and a break above here will open the way for a further run towards 402.39 next, in line with bullish momentum studies readings.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.