Market Spotlight: Nat Gas Threatening to Break Lower

Gas Prices Testing Key Support

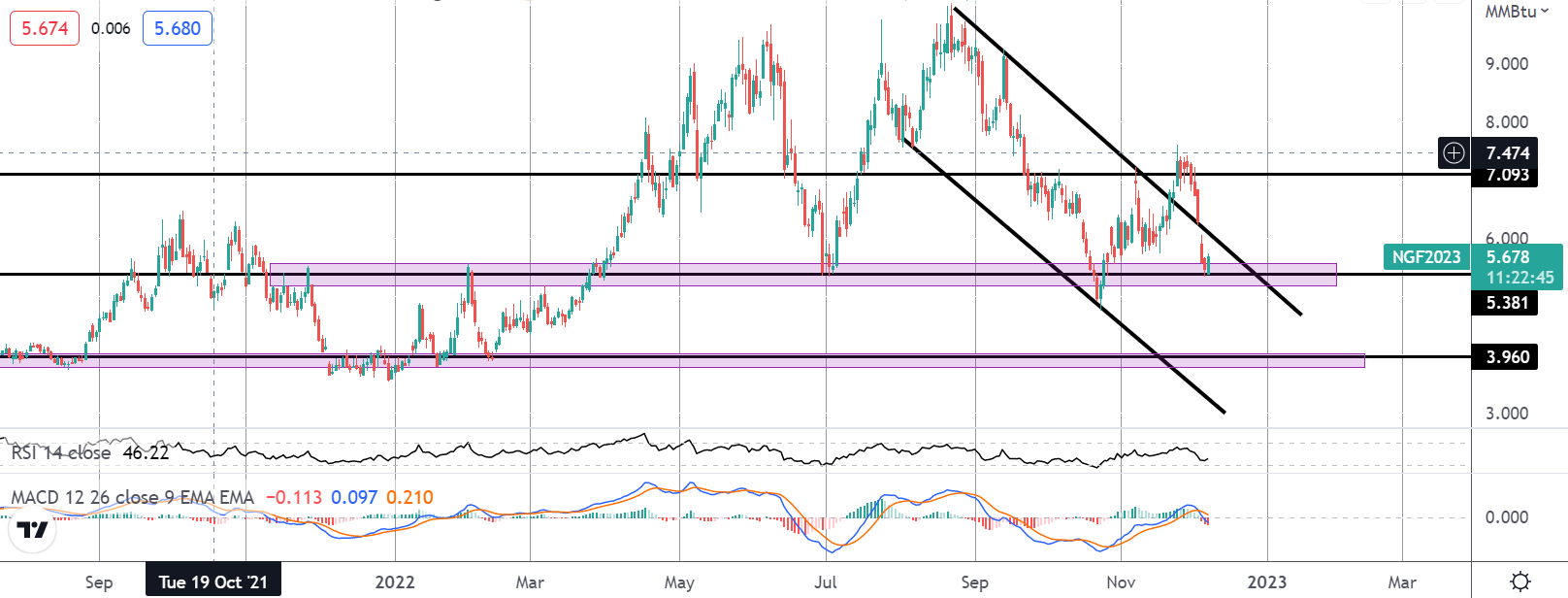

Natural Gas prices are once again testing the key support level around 5.38. This area marked the lows of the first significant down move in June, as well as the subsequent retest in late October. Prices are now testing the level once again with risks of a downside break growing.

Factors Weighing on Nat Gas Prices

Milder temperatures in Europe over Autumn meant that European storage facilities, which had been stocked to record levels in anticipation of a difficult winter, were able to retain higher levels for longer. Additionally, Europe and other consumers such as the UK, have been making great strides towards replacing Russian energy supply. Decreasing the reliance on Russian energy means that these consumers are less impacted by disruptions to supply, reducing the likelihood of the sort of panic buying we saw earlier in the year as Russia invaded Ukraine.

Independence From Russian Energy

News this week that the US will double its natural gas exports to the UK, alongside news that UK exports to the EU are set to hit six-year highs, have helped calm investor uncertainty. Additionally, with EU leaders still working towards agreeing a price cap on Russian energy, prices look set to fall further if such a cap can be agreed. So far, a EUR 220 level per barrel has been touted as the key option, though there is still some disagreement with some countries pushing back against the cap. With independence from Russian energy looking increasingly achievable, gas prices look vulnerable to further losses near-term as the market continues to correct from the post-invasion highs seen earlier in the year.

Technical Views

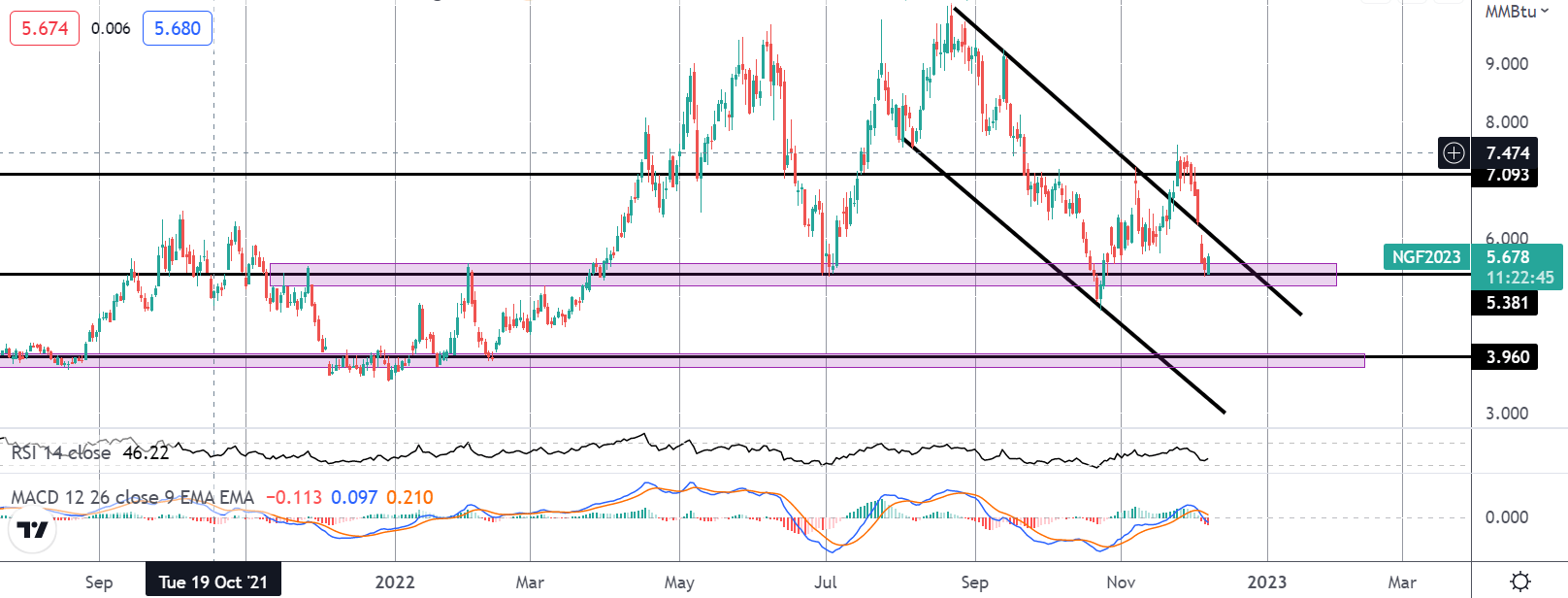

Natural Gas

Nat Gas prices are currently sitting back on the 5.381 level support. While this area holds, a further rotation higher back towards the 7.093 level is still viable. This would be in line with the bullish divergence we’re seeing into the level. However, should price slip back below here, focus shifts to a deeper move towards 3.960 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.