Market Spotlight: Reality Check For Meta Platforms?

Meta Earnings In Focus

Along with the FOMC today we also have big news in US earnings with Meta Platforms reporting its Q4 results today. With the iconic tech stock having suffered a brutal decline in value last year, amidst the worst year for tech stocks since 2008, traders are keen to see how the company fared in Q4. Wall Street is looking for EPS of $2.25 on revenues of $31.55 billion. If seen, this would mark a firm uptick from the prior quarter’s results and put an end to two consecutive quarters of earnings declines. The company recently cut 13% of its workforce at the tail end of last year and traders will be looking to see how this has impacted Meta’s margins.

Reality Labs Spending In Focus

The big focus for traders today, however, will likely be on Meta’s Reality Labs spending. The group has been pumping money into VR & AI, holding huge $4 billion losses as of last quarter. Investors were unsettled by this with Meta shares dropping sharply in response. If this figure is seen to have grown over Q4, this will likely weigh on trader sentiment towards the stock, particularly in light of the recent layoffs, sending Meta lower near-term. However, if Meta is seen to have scaled back spending in this area then this might help restore sentiment, lifting the stock near-term.

Technical Views

Meta

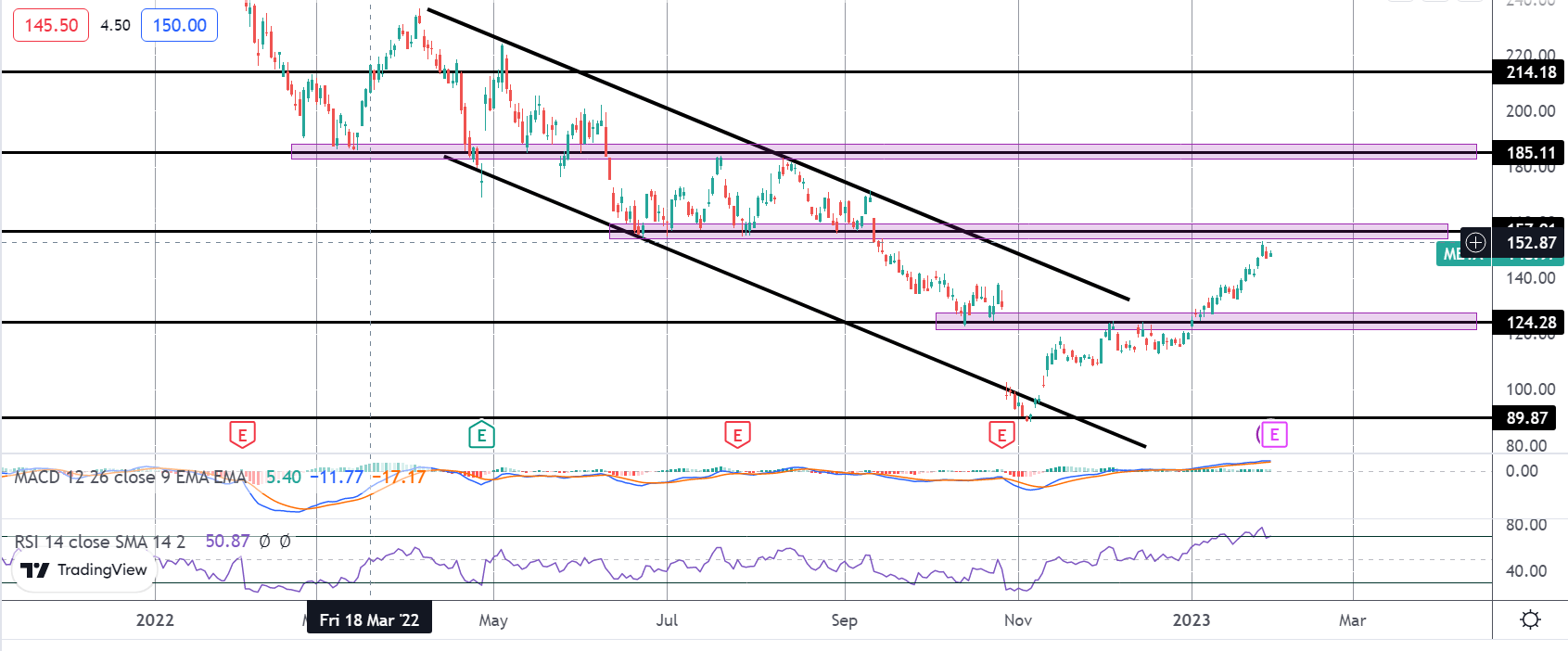

The rally off the 2022 lows has seen the stock breaking out of the recent bear channel as well as moving above the 124.28 level. Price is currently stalled into a test of the 157.01 level which remains the key barrier for bulls. A break above here will be firmly bullish, opening the way for a run up to 185.11 next. To the downside, 124.28 remains the key support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.