Monday Market Recap: Geopolitical Tensions Recede, Gold Prices Retreat, and the Dollar Shows Resilience

Safe-haven assets and the currency rushed to price in the risks of a serious escalation of the conflict in the Middle East before the weekend, but by Monday, it became clear that although tension persists, the conflict remains predominantly local. Third countries that could potentially exacerbate the situation, such as Iran, are limited to warnings, albeit rather alarming ones. As a result, we witnessed a retreat in the price of gold by approximately 1%, from $1930 to $1913 per troy ounce, even though prices surged by more than 3% on Friday. For the same reason, bullish momentum has somewhat waned in the dollar. On Monday, the US dollar index moderately declined, primarily due to a 'relief rally' in the European currency.

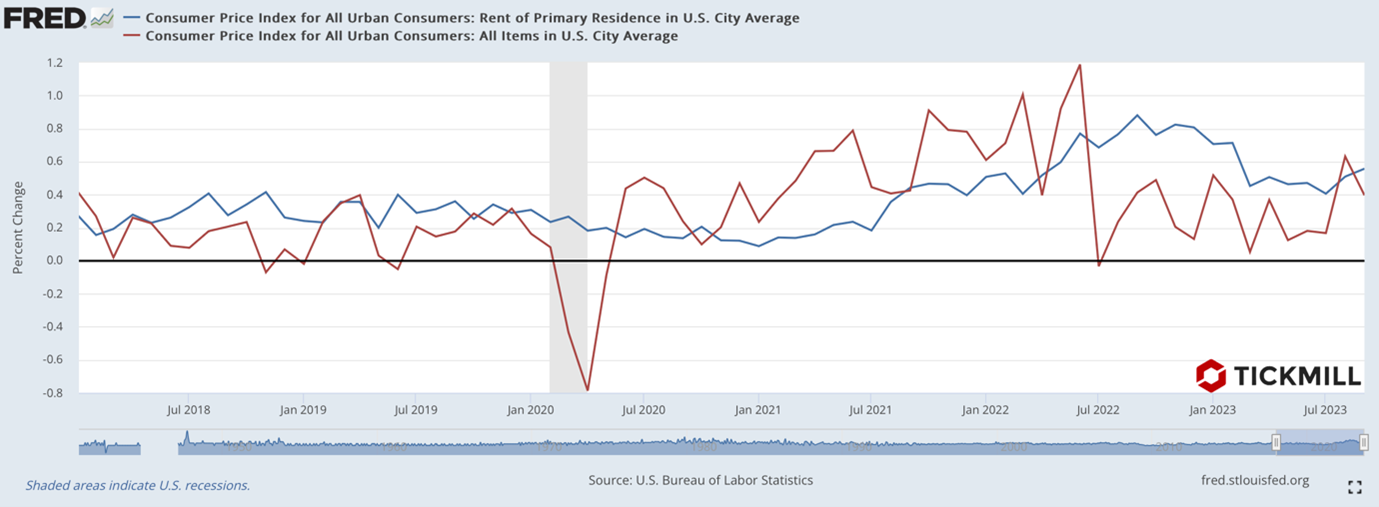

Yields on Treasury bonds moved upward, adding approximately 3-5 basis points on Monday. This once again indicates that although investors may temporarily return to defensive assets, such as Treasuries, in the case of a general risk aversion (for example, in the event of heightened geopolitical tension), the overarching theme remains the trajectory of inflation and the Federal Reserve's response to incoming data, as well as any excessive, speculative bond market movements. The inflation report from last week, as previously discussed, featured rather unpleasant aspects for the central bank, particularly an acceleration in monthly non-manufacturing sector inflation and rental rates. The service sector is more labor-intensive, and nominal wages within it are considered less sticky, so if inflation accelerates within this sector, markets generally anticipate wage growth and subsequent increases in demand due to rising incomes as a short-term macroeconomic consequence. Regarding rental prices, they exhibit inertia due to the long-term nature of contracts. Comparing the overall CPI and the rent price index, it can be observed that the latter exhibits greater 'trendiness,' being less volatile and reacting with a delay to shocks or changes in the economy:

This is why the markets were genuinely concerned last week, as inflation in the service sector accelerated from 0.4% in August to 0.6% in September, and the increase in rental rates went from 0.3% to 0.6%. The overall CPI and even the core CPI could not encompass these aspects, but they cannot be ignored.

This week, we await the report on U.S. retail sales, which may surprise on the downside, as preliminary data on credit card spending by American households suggests a slowdown in growth. On Thursday, the Federal Reserve's 'Beige Book' report is due, and Federal Reserve Chairman Jerome Powell will speak. While the market does not expect strong data on the U.S. economy, as it does not anticipate hawkish statements from Powell, other, more substantial risks for the U.S. dollar, particularly the weakening of currency opponents, are likely to dominate sentiment. In particular, rising oil prices worsen the trade balances of countries that import energy resources and set the stage for accelerating inflation, which is probably the primary driver of weakness for the Euro, British Pound, and Japanese Yen at the moment.

Looking at the technical chart of EUR/USD, it can be noted that the price once again rebounded from the upper boundary of the trend channel (as discussed earlier) in the vicinity of 1.064 and retested the round level of 1.05, significantly increasing the risks of a true breakthrough and a move of the pair into the 1.04 area and below:

If the rebound on Monday sees further development, the area near 1.06 is likely to attract additional sellers.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.