Nasdaq At Record Highs on Trump & Fed

Stock Rally Continues

The Nasdaq is trading at fresh, all-time highs today on the back of the latest Fed rate-cut yesterday. Following Trump’s election success and news of a Republican clean sweep in Congress, traders were weary of a potential shift in tone from the Fed. Much has been made of the projected impact a Trump presidency will have on the US economy. The consensus view is that Trump’s protectionist trade policies and growth-focused domestic economic policies will spur an uptick in US inflation and stronger US economic activity near-term. However, there was no sense yesterday that the Fed has altered its view and traders are now pricing in a higher likelihood of a further .25% cut in December.

USD Retreating Post-FOMC

With the US Dollar currently receding from its post-election highs and market focus turning back to the macro picture in the US, stocks look to have more room to run higher. Market pricing for a December cut is currently sitting around 75%, meaning that incoming US data will still be highly impactful as we move through the month. Labour market readings and inflation-linked data will be the main focus with any further weakness likely to see that pricing creeping higher, further supporting stocks. One further element to watch will be any rhetoric from Trump, particularly on social media, regarding policy plans and staff appointments which could also impact USD and stocks.

Technical Views

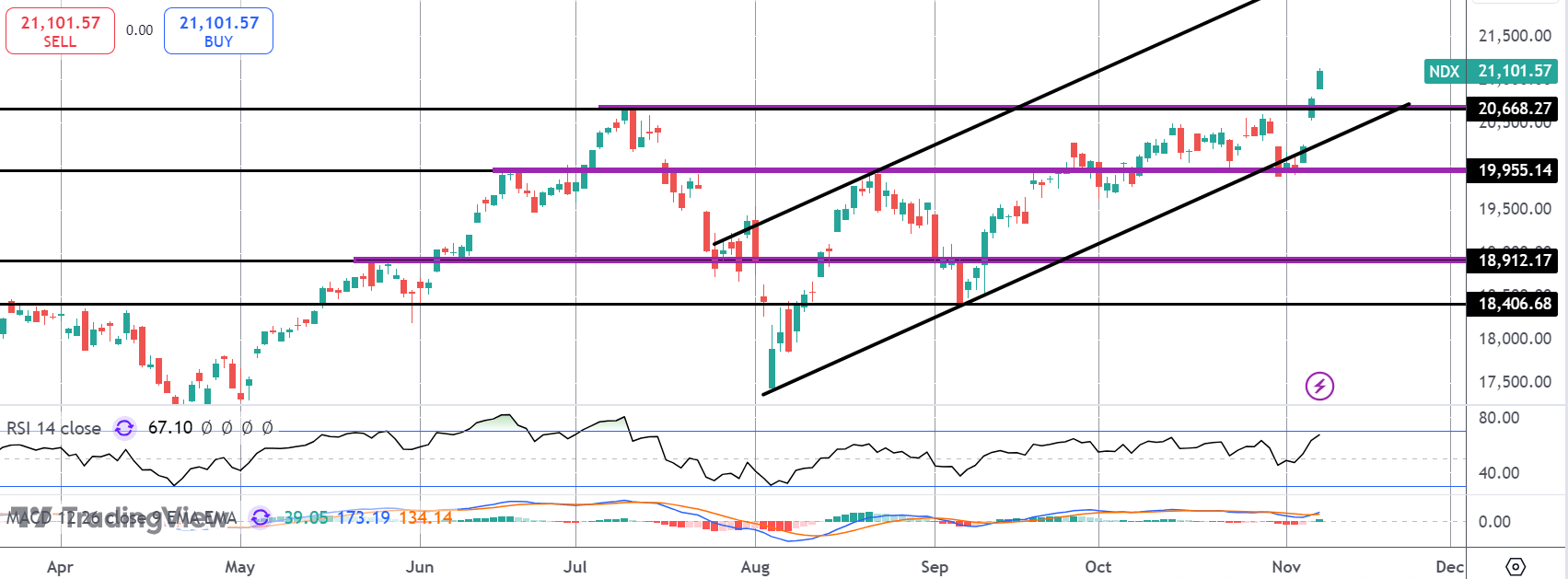

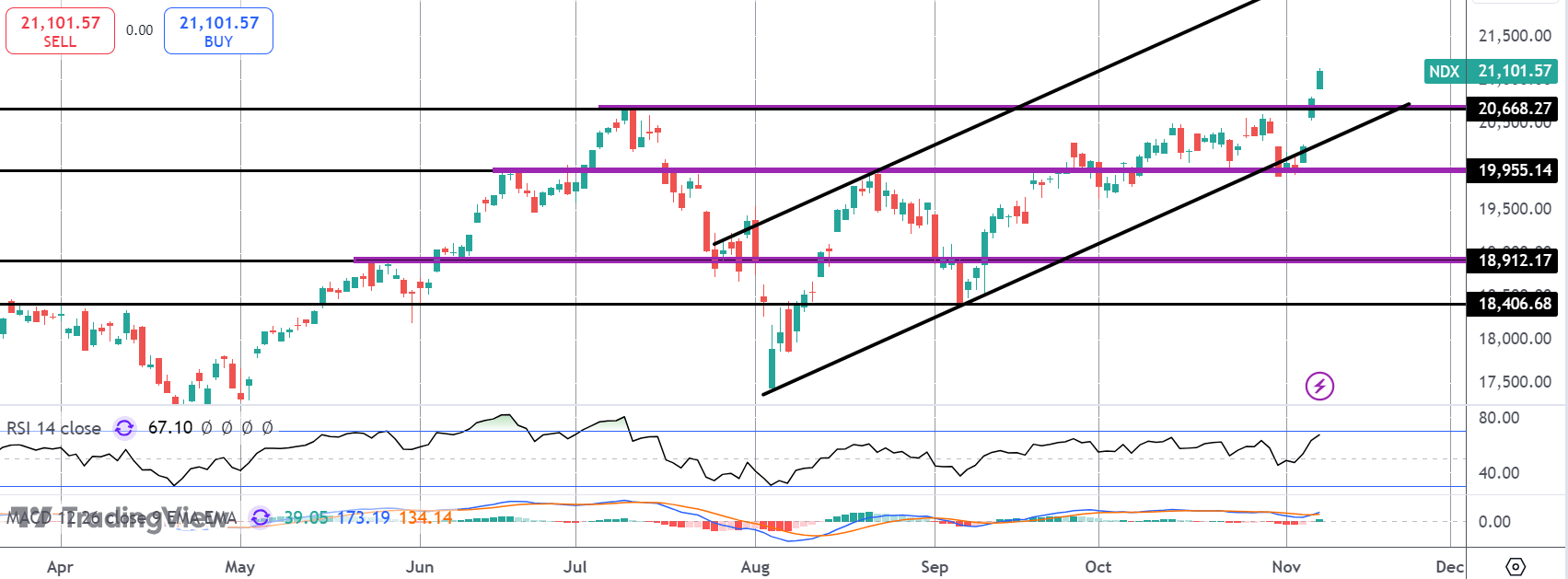

Nasdaq

The rally in the Nasdaq has seen the market breaking out above the 20,668 level to new highs. Supported by the bull channel and bullish momentum studies readings, focus remains on further upside while we hold above 19,955, which is the key pivot to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.