Surprise Rate Cut From Fed - More To Come?

Fed Cuts Rates by 0.5%

In a worrying display of serious the threat of COVID-19 is to the global economy, the US Federal Reserve took the historic step yesterday of announcing an unscheduled rate cut. The Fed announced a surprise .50% rate cut, the first-time rates have been cut outside of the FOMC since December 2008, in efforts to help support the economy during the downside threat from COVID-19.

On Friday, Fed chairman Powell released an unscheduled statement highlighting the Fed’s willingness to act as the threat from COVID-19 continues to grow. On the back of that statement, market pricing for a March rate cut soared. However, the decision to cut ahead of the March meeting reflects the severity of the risks posed by COVID-19.

In the statement issued alongside the announcement, The Fed said “The coronavirus poses evolving risks to economic activity. In light of these risks and in support of achieving its maximum employment and price stability goals, the Federal Open Market Committee decided today to lower the target range for the federal funds rate.”

Speaking later on Tuesday at a press conference, Fed Chairman Jerome Powell told reporters ““The magnitude and persistence of the overall effect on the U.S. economy remain highly uncertain and the situation remains a fluid one. Against this background, the committee judged that the risks to the U.S. outlook have changed materially. In response, we have eased the stance of monetary policy to provide some more support to the economy.”

Markets had been recovering earlier in the week amidst hopes of fresh stimulus from central banks. However, despite some initial upside in equities in response to the cut, asset markets began trading lower again later on Tuesday. The nature of the cut has raised serious questions about just how bad the downside impact of COVID-19 will be. With the RBA and the Fed having both cut rates this week, there is now a heightened expectation that the BOC will follow suit when it meets later today. The BOJ and BOE are also widely expected to announce fresh easing, as is the ECB, as the WHO announces that the global death toll from the virus is 3.4% higher than initially thought, and still rising.

Will Fed Cut Further?

The big question now is whether the Fed will cut again when it meets in the middle of March. Rates pricing for the US is now suggesting a move all the way down to zero by the end of the year. With the spread of the virus still intensifying, the Fed is hoping to help buffer against downside economic shocks if the situation deteriorates further. However, most banks and economists seems to agree that the current environment will also require fiscal support to help lift sentiment given the gravity of the situations.

Trump Calls For More Easing

Meanwhile, President Trump is putting the emphasis solely on the Fed for now, calling for further rate cuts. Taking to his favourite medium of Twitter, the POTUS wrote : “The Federal Reserve is cutting but must further ease and, most importantly, come into line with other countries/competitors. We are not playing on a level field. Not fair to USA. It is finally time for the Federal Reserve to LEAD. More easing and cutting!”. Trump also continued his pattern of personally attacking the Fed chair, saying: “Jerome Powell led Federal Reserve has called it wrong from day one. Sad!”

Technical View

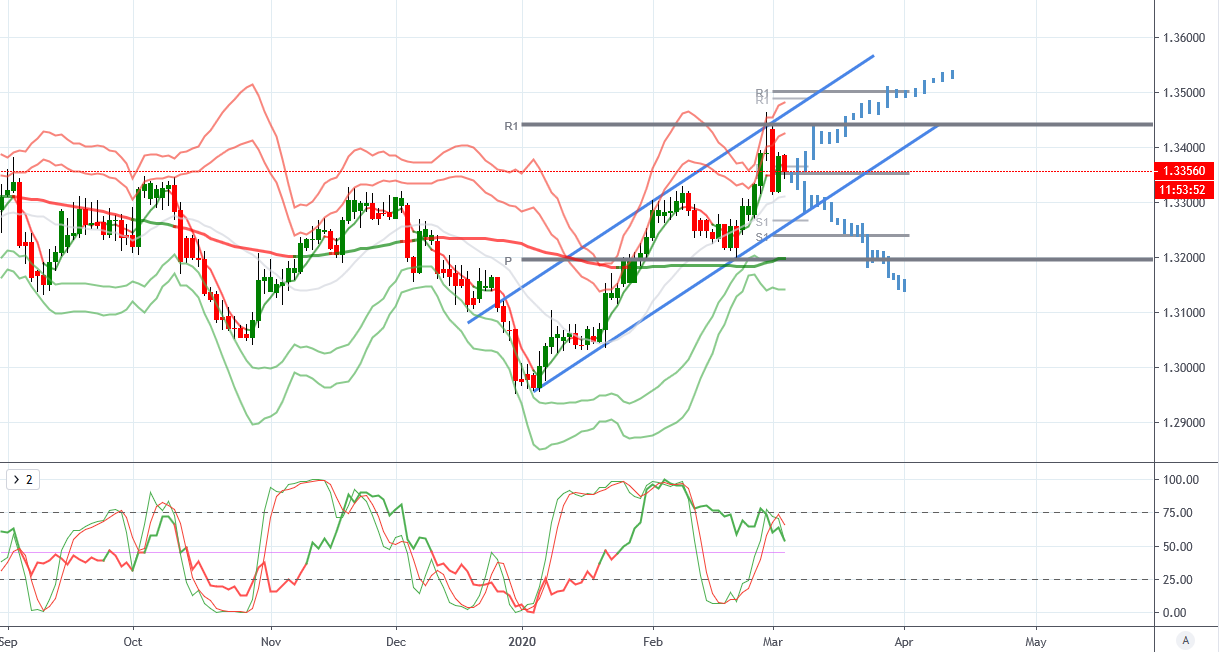

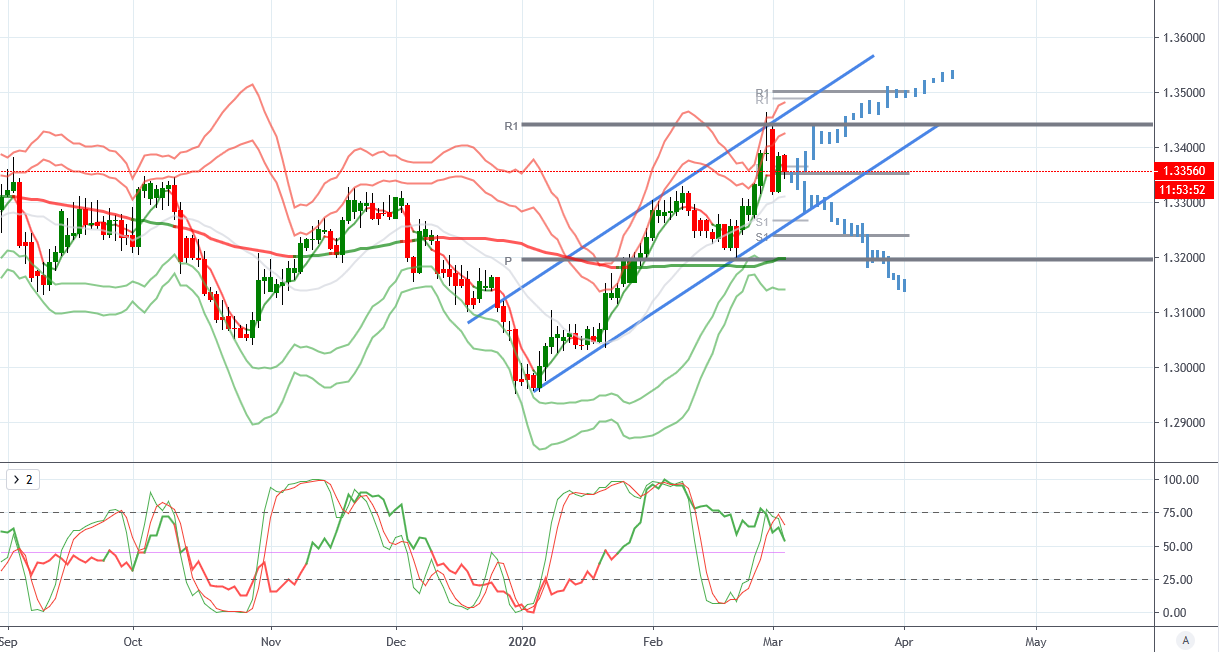

USDCAD (Bullish above 1.3350)

From a technical viewpoint. USDCAD has begun to correct lower from the yearly R1 at 1.3441, having also tested the top of the bullish channel. Despite initially breaking down below the monthly pivot at 1.3350, price is now sitting back atop the level. While above here, we could see a continuation higher, supported by bullish VWAP, targeting a move back up through current highs. Below the monthly pivot, however, and the bull channel low will be the next support to watch ahead of main support at the yearly pivot (1.3193).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!