The Crude Chronicles - Episode 162

Oil Traders Increase Longs

The latest CFTC COT institutional positioning data shows that oil traders increased their net long positions last week, taking the total upside position to 274k contracts from 254k contracts prior. With this increase, oil upside exposure is now at its highest level since the first week of July. Disappointingly for bulls, however, crude prices have fallen since that position increase made with price reversing sharply from the test of the 93.32 highs.

OPEC Cuts Demand Outlook

Oil prices have come under pressure recently from OPEC slashing its demand outlook for 2023. While previously, issues around tight market supply have been at the forefront of market focus, OPEC’s revised projections have turned the focus to demand instead for next year. The group cites huge global uncertainty, crippling inflation and supply side constraints as being the major headwinds for the demand outlook.

OPEC Ready to Act

Expanding on that message, the OPEC secretary general told reporters this week that OPEC stands ready to act as needed to support oil markets. The group this year announced fresh production cuts for the first time since the pandemic started in a bid to lift flagging oil prices. With oil prices having failed to deliver upside, there is now speculation that further such cuts might be actioned. The OPEC figure noted that the group is “aware, cautious and monitoring events worldwide.”

US Midterms Impact

The outcome of the US midterms also did little to help the oil outlook. The oil industry had been hoping for a landslide Republican win which would pave the way for lighter regulation and lower taxes. However, with the democrats retaining the vast majority of their seats and holding onto the Senate at least, the playing field is still very much even.

EIA Reports Huge Inventories Deficit

Indeed, good news from the Energy Information Administration wasn’t even able to help lift oil prices. The EIA reported a massive 5.4 million barrel drawdown last week, more than double the deficit forecast. However, while headline crude inventories fell, gasoline and distillate inventories both increased over the week, no doubt off setting the impact of the data.

Technical Views

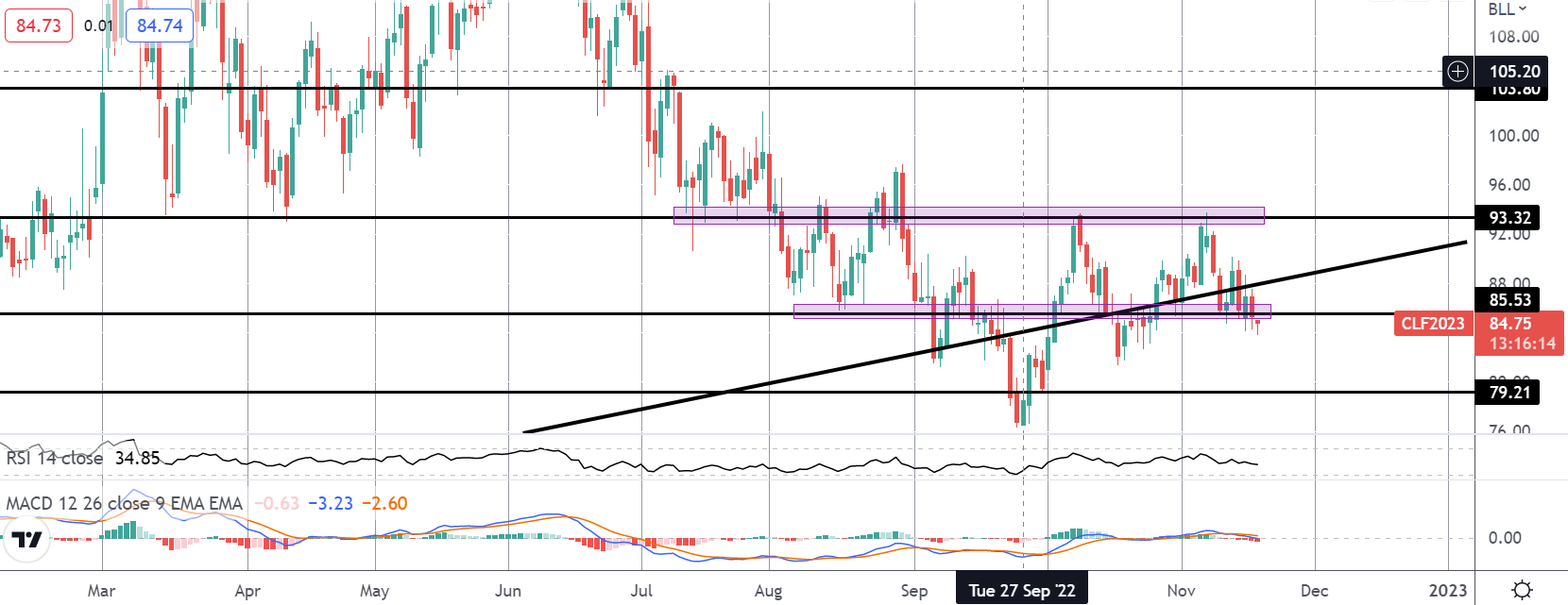

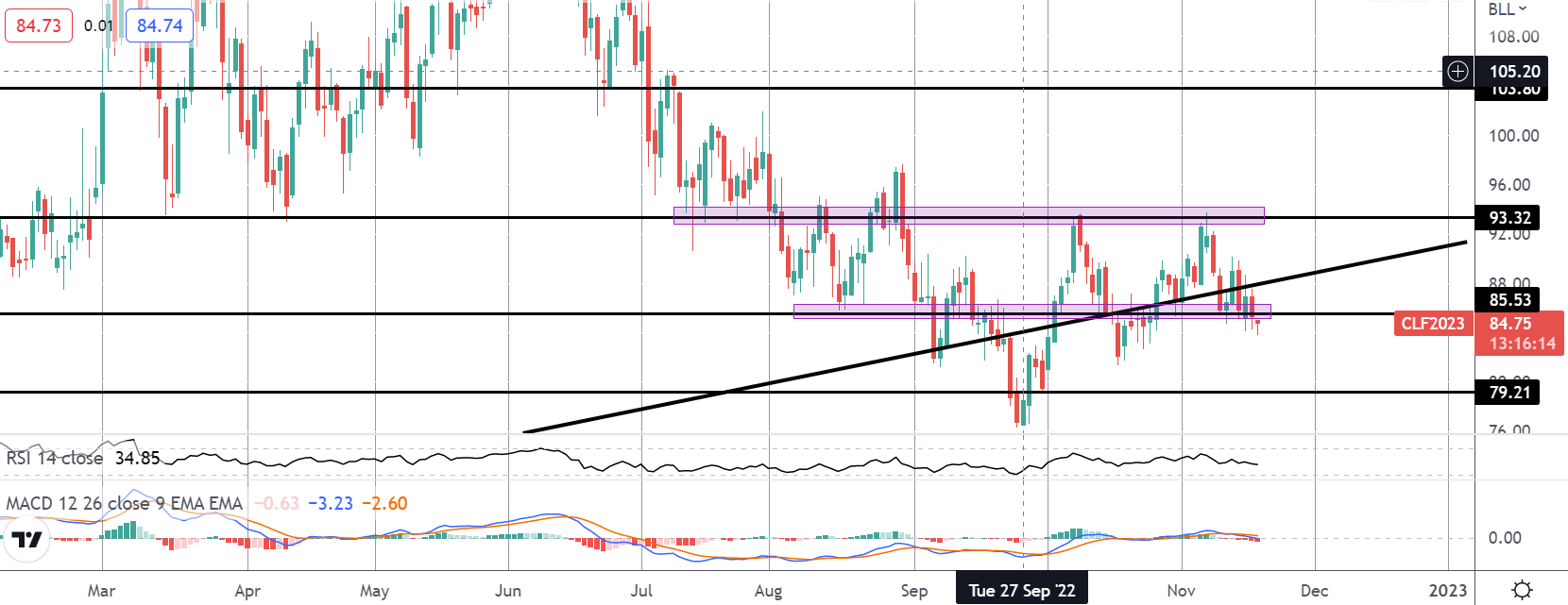

Crude Oil

The sell off from the 93.32 level has seen price reversing sharply lower with the market breaking back beneath the rising trend line and now testing below the 85.53 level. With momentum studies turning bearish here, while below this level the focus is on a move back down to YTD lows around 79.21 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.