The IndeX Files 24-05-2022

Risk Sentiment Weakens on Hawkish Central Bank Expectations

A softer start for global equities benchmarks following initial strength yesterday. Equities traders seem to be caught between the upside impact of the current US Dollar correction and the broader concerns regarding a coming global downturn. The uptick in central bank hawkishness this week (ECB and BOE) has put the focus back on growth concerns with traders worried over the prospect of a late 2022 recession fuelled by tighter monetary conditions and elevated inflation. Indeed, it was for this reason that we heard from Fed member Esther George yesterday who actually deviated from recent Fed hawkishness. George suggested the Fed might opt to pause its tightening program following a further 1% lift by July. While George’s view certainly looks to be an outlier among current Fed projections it will be interesting to see if we hear any other Fed members joining this camp in the three weeks up to the next FOMC.

Data wise, the main focus today is on a slew of PMI readings due across the eurozone (including individual French and German results), the UK and the US. Given current downturn concerns, weakness in these readings will no doubt add to softer risk sentiment today likely sending equities further lower. We’ll also hear from Fed’s Tenreyro and Powell later along with ECB’s Lagarde.

Technical Views

DAX

The DAX continues to hold between support at the 13672.31 level and resistance at the 14170.79 level this week. The breakout above the bear channel has yet to follow through and with both MACD and RSI softening, risks of a further move lower are building. Below current support, 13067.45 is the next level to watch. To the topside, a breakout would put the focus on 14791.27 next.

S&P 500

The recent decline in the S&P has been framed by a neat and narrow bear channel, formed within the larger bear channel. Price is currently testing the larger bear channel low and is potentially carving out an interim double bottom suggesting potential for a reversal higher towards 4062.25 and 4153.50. To the downside, 3845.25 remains key support to watch.

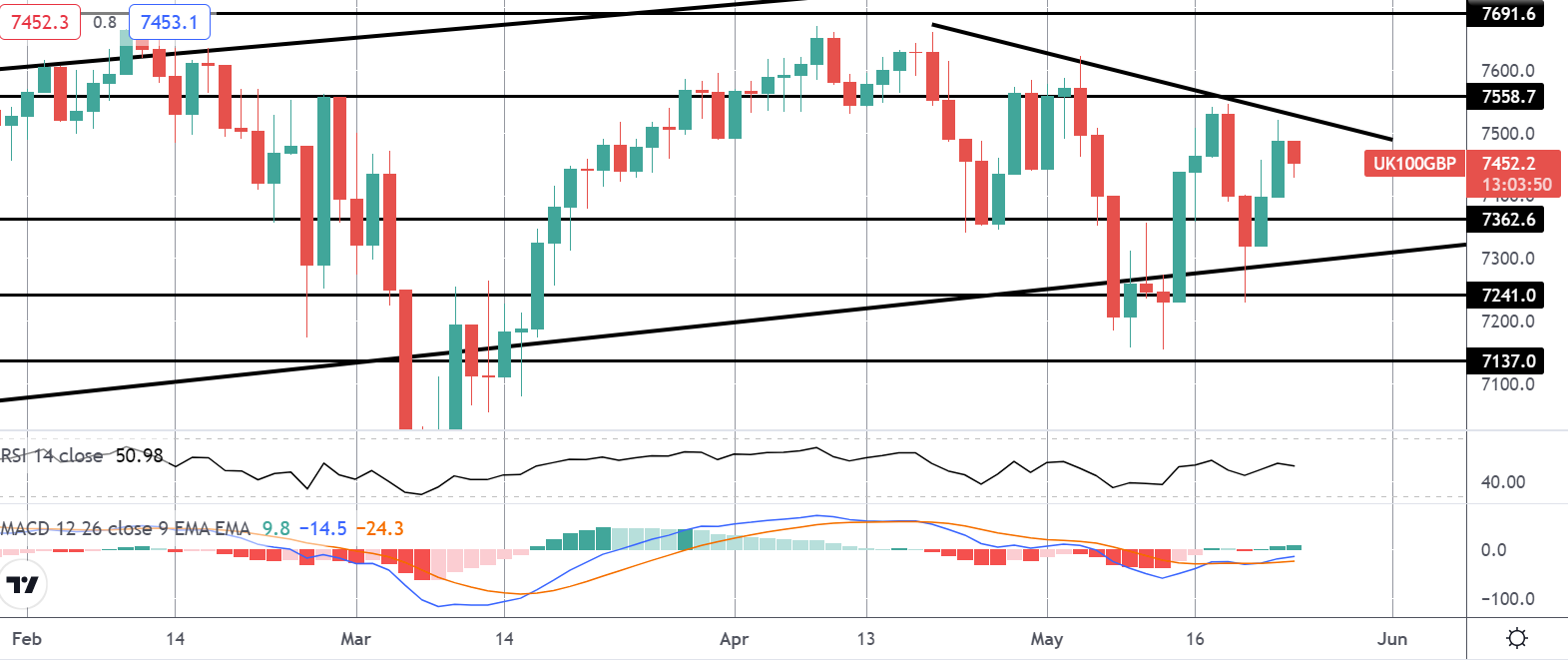

FTSE

While still within the middle of the larger bull channel, we are starting to see a triangle pattern form in the FTSE. Given the broader bull trend, the focus is on an upside break with 7558.7 the key barrier for bulls to break. Above there, 7691.6 is the next level to watch.

NIKKEI

The NIKKEI continues to hold around the middle of the larger falling wedge pattern which has framed price action this year. Currently, price is hovering around the 26932.1 mark. With both MACD and RSI bullish, the focus is on an upside break of the 27422.9 level with price currently carving out an inverse head and shoulder pattern against that neckline zone.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.