USDJPY Rallying Ahead of Bank of Japan Meeting

BOJ on Watch

USDJPY is on watch ahead of the weekend as traders ready for the January BOJ meeting to come overnight. The bank is widely expected to keep rate son hold though many players are looking for a more hawkish tone. The heavy decline in JPY over the last six months has prompted plenty of chatter round interventions risks, though none has emerged yet. Last week, we heard Japanese Fin Min Katayama signalling that joint action with the US could even be used if necessary. Against this backdrop, traders are expecting the BOJ to use some verbal prompts to help shore up JPY with an outside risk that the bank takes action this month to benefit from catching traders off-guard.

Japanese PM Comments

JPY has weakened again today after PM Takaichi note that the government has reversed its FY26 view from a surplus to a deficit, noting that it will look at budget balance over a few years instead of just a single year view. The PM also noted that it continues to see a mild economic recovery underway with better wage growth prospects and better consumer sentiment. It is precisely these better wage growth prospects, alongside recent JPY depreciation, which set the stage for a more hawkish BOJ this week. If the bank does signal that firmer action is coming, this should help cap the rally in USDJPY for now. However, it might prove the case that verbal intervention alone wont be enough, with USDJPY vulnerable to a fresh push higher if traders are unmoved by the BOJ’s guidance at the meeting.

Technical Views

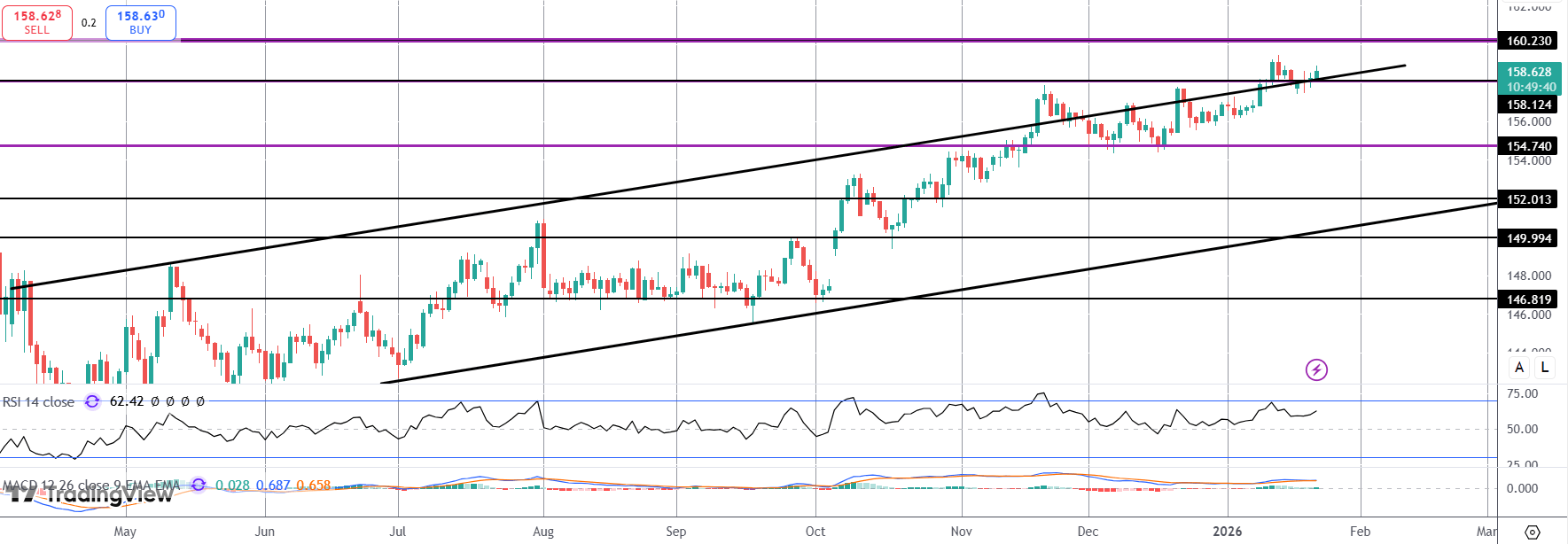

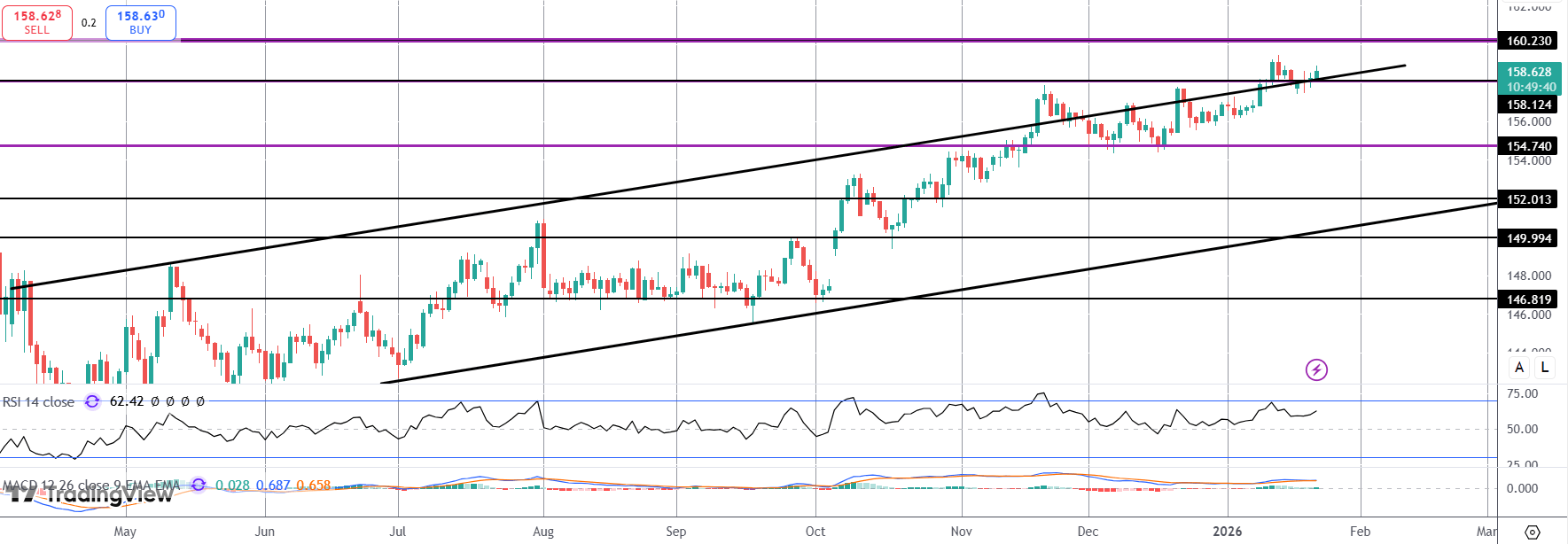

USDJPY

For now, USDJPY remains above the bull channel highs, supported by the 158.12 level. While this area holds as support, focus is on a continuation higher and a test of the 160.23 level next. To the downside, 154.74 is the big support to watch if we do turn lower near-term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.