USD/RUB Stays Still: What’s Next?

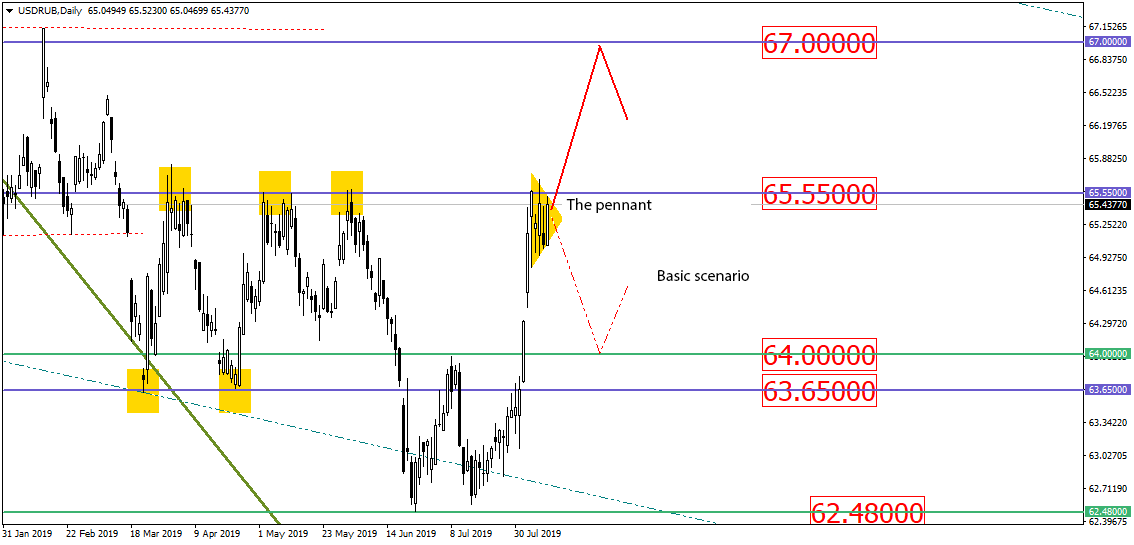

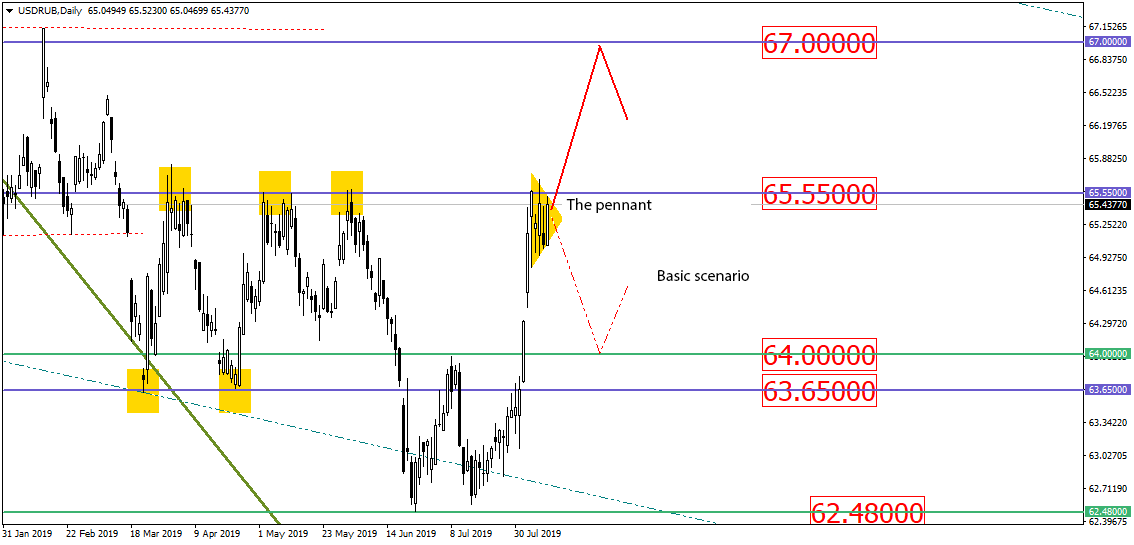

The Russian currency appears to be remaining below the resistance of 65.55. But a figure resembling a pennant with a very long handle is currently forming in the daily chart. The double bottom is there as well. So, we assume that the level of 65.55 will eventually get broken through:

Based on the latest reports by COT CFTC, large operators have shortened both long and short positions on the Russian currency. It can signify a potential growth of the Russian ruble. Shortening the long positions at their maximum levels can make the currency pair USD/RUB jump and break the abovementioned pennant through:

The U.S. Dollar index measuring the value of U.S. dollar relative to the basket of top six currencies closed with a shooting star in the weekly chart and formed the black candle or evening star. The evening star touched the broken uptrend and horizontal resistance level of 98.40. We assume that U.S. dollar could drop market wide although it can act totally different along with some local currencies:

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.