Yen Sinks Despite Historic BOJ Rate Hike

BOJ Hikes Rates

The Japanese Yen is collapsing lower this morning despite the BOJ making the historic move overnight to tighten rates for the first time since 2007. Having lifted rates to between 0% and 0.1%, the BOJ has unwound the last central bank negative rates monetary policy regime and has also ended its Yield Curve Control (YCC) program. The move comes on the back of a significant uptick in Japanese wages which have been feeding into stronger inflation expectations. At wage negotiations earlier this month, Japanese corporations agreed to a record 5.28% wage-hike, widely seen as the final driver for the bank’s decision to hike rates.

FX Reaction

The reaction in FX markets, however, suggests some dislocation. JPY has weakened across the board while the Nikkei has surged higher. This is likely due in part to cautious signals from the BOJ which warned that the hike is unlikely to be followed quickly by further increases. Speaking at the event, Ueda warned that the bank is still monitoring downside risks in the global economy as well as weak domestic consumption.

Near-Term Outlook

Looking ahead, Ueda warned that the bank stands ready to react with monetary policy as necessary should outsized FX moves impact the bank’s outlook. Traders now await further details at the April meeting with the bank due to publish updated forecasts though, for now, JPY looks likely to remain pressured particularly if we hear any hawkishness from the Fed tomorrow.

Technical Views

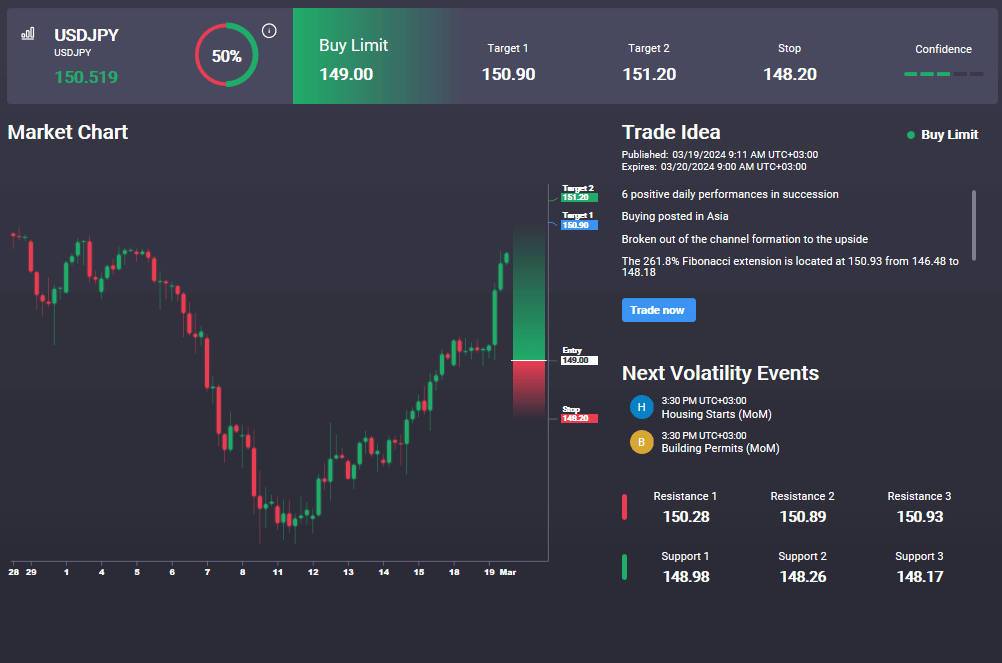

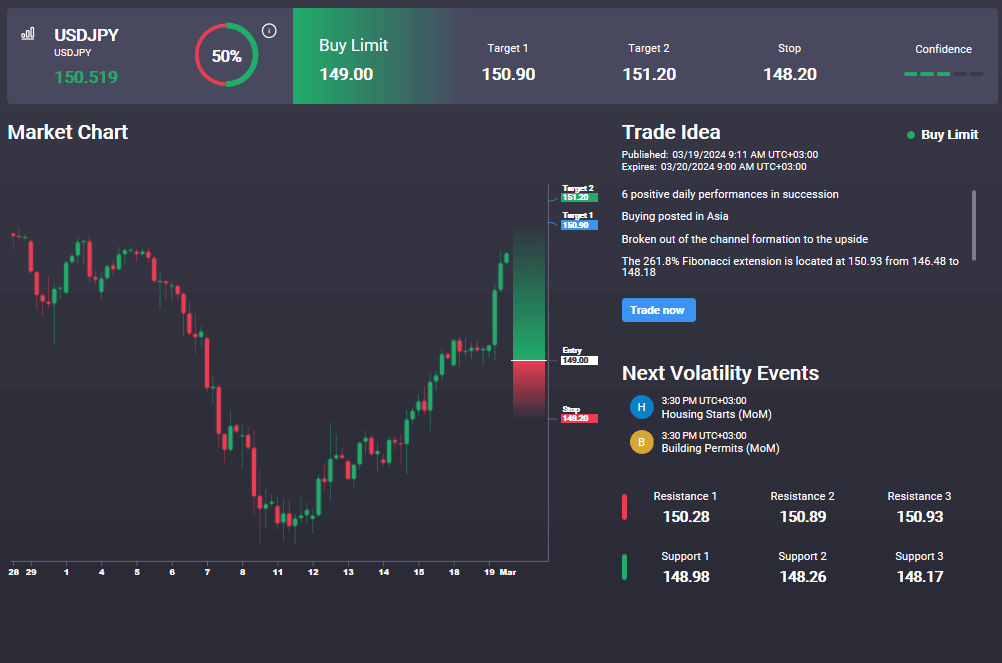

USDJPY

The rally in USDJPY has seen the market pushing back above the 148.98 level. With momentum studies moving higher, the focus is on a fresh test of 151.81 next with 155.109 sitting above as a bigger target. To the downside, 145 remains key support. In the Signal Centre today we have an active buy signal set below market at 149, suggesting a preference to buy any dips and stay long.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.