鲍威尔杰克逊霍尔演讲临近,美元逃离关键看跌通道

美国劳工统计局将美国年度就业增长下调 30.6 万,低于一些专家的预期,周三美国债券利率从高位回落,预测预计将减少 50 万。 债券市场的反应似乎有些过度,其特点是所有期限的收益率下降了约 10 个基点。 不过,它再次强调,美国就业增长目前是美联储政策最关键的宏观经济变量之一。 即使在消费者通胀趋势发生逆转的情况下,如果劳动力市场保持强劲且消费者支出继续稳步增长,通胀向2%目标水平的移动可能会持续更长的时间。

因此,今天的市场对失业救济申请数据非常敏感。 首次索赔增长速度低于预期(230,000 人,预测为 240,000 人),长期索赔也积极超出预期。 这使得美元重新测试关键的中期阻力线:

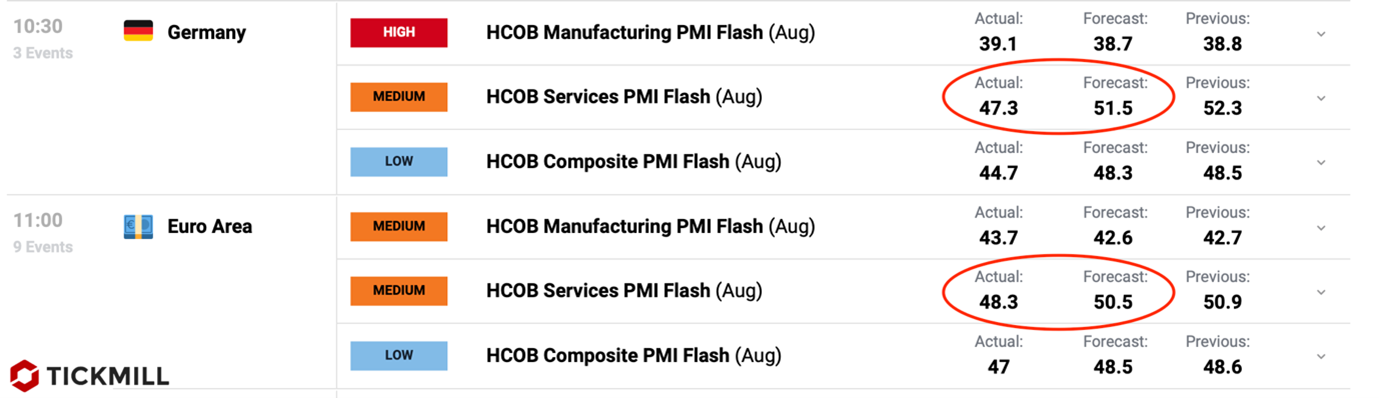

The fundamental backdrop for the euro worsened somewhat after the release of PMI indices for the service sector yesterday. The data showed that activity in the service sector in the key economy of the eurozone and in the EU as a whole contracted compared to the previous month:

The euro's trade-weighted exchange rate fell by 0.5%, and the two-year EURUSD swap rate (which reflects the expected interest rate differential between the US and the EU) increased by 10 basis points to 145 bps. This is the highest level since March and clearly has negative implications for EURUSD. The pair tested the 200-day moving average yesterday, and if it weren't for the negative revision in the pace of US job growth, we would likely have seen a test of the 1.08 level for the pair. It's evident that after the release of leading economic activity data in the Eurozone, market confidence in another rate hike from the European Central Bank has diminished, which cannot be said for the Fed. Therefore, risks for the pair are certainly tilted towards further decline, as indicated by the dollar index breaking out of the bearish channel, signaling strong overall dollar positions.

Tomorrow, the markets await Powell's speech at the Jackson Hole symposium, where it is expected that the head of the central bank will provide insight into whether the recent surge in Treasury yields was justified. It's clear that since long-term yields, which reflect expectations of duration not level of high interest rates, rose faster than short-term yields, the market will be satisfied with statements indicating that rate cuts should not be expected anytime soon. However, if hints are given that the Fed expects inflation to return to the target level by the end of next year and that rate cuts can be expected at that time, the retreat in long-term bond yields could be significant.

免责声明:提供的材料仅供参考,不应视为投资建议。 本文中表达的观点,信息或观点仅属于作者,而不属于作者的雇主,组织,委员会或其他团体或个人或公司。

过去的业绩不代表未来的结果。

高风险警告:差价合约(CFD)是复杂的工具,由于杠杆作用,存在快速亏损的高风险。 当与Tickmill UK Ltd和Tickmill Europe Ltd进行差价合约交易时,分别有73%和72%的零售投资者账户亏损。 您应该考虑自己是否了解差价合约的工作原理,以及是否有具有承受损失资金的的高风险的能力。

期货和期权:保证金交易期货和期权具有高风险,可能导致损失超过您的初始投资。这些产品并不适合所有投资者。请确保您完全了解这些风险,并采取适当的措施来管理您的风险。