SP500 LDN TRADING UPDATE 2/2/26

SP500 LDN TRADING UPDATE 2/2/26

***QUOTING ES1 CONTRACT FOR CASH US500 EQUIVALENT LEVELS SUBTRACT POINTS DIFFERENCE***

***WEEKLY ACTION AREA VIDEO TO FOLLOW AHEAD OF NY OPEN***

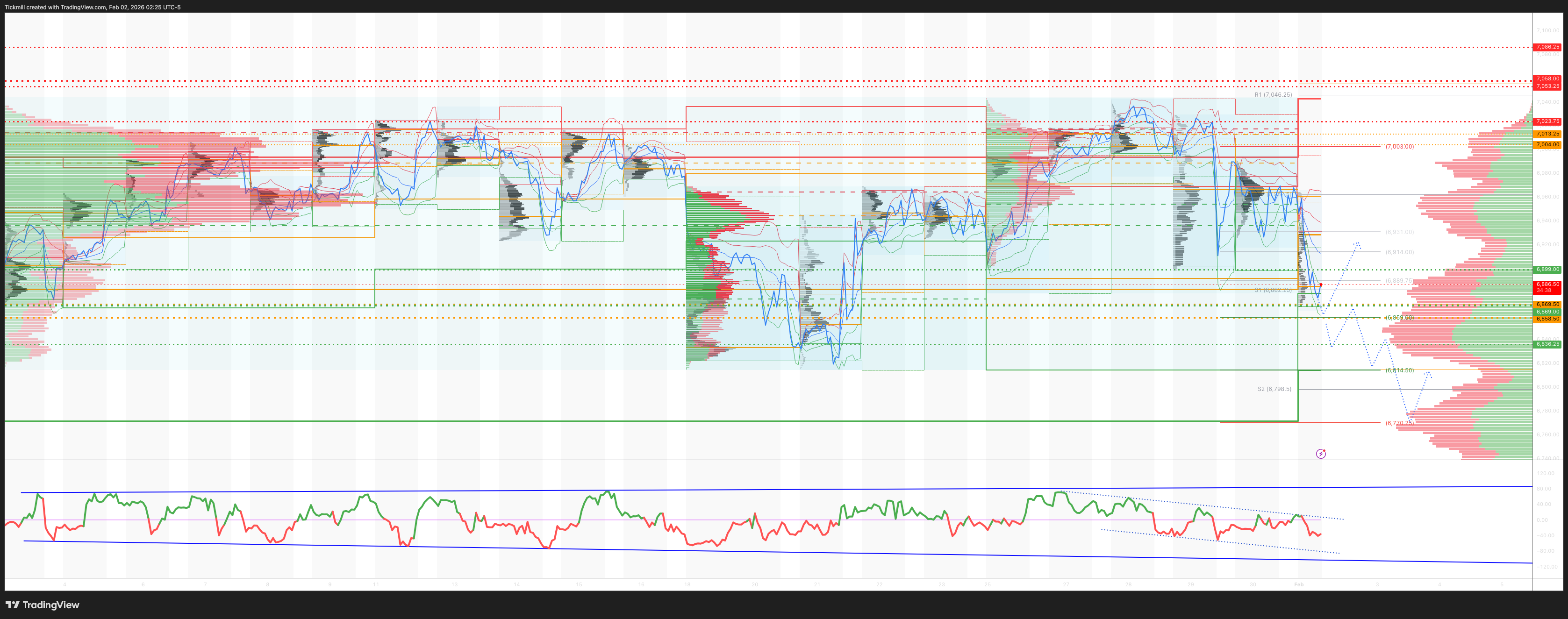

WEEKLY BULL BEAR ZONE 6859/69

WEEKLY RANGE RES 7058 SUP 6869

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

GAMMA FLIP LEVEL 6962

DAILY VWAP BEARISH 6985

WEEKLY VWAP BEARISH 6971

MONTHLY VWAP BEARISH 6894

DAILY STRUCTURE – BALANCE - 7031/6898

WEEKLY STRUCTURE – BALANCE - 7031/6822

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6822

Balance: This refers to a market condition where prices move within a defined range, reflecting uncertainty as participants await further market-generated information. Our approach to balance includes favouring fade trades at the range extremes (highs/lows) while preparing for potential breakout scenarios if the balance shifts.

One-Time Framing Higher (OTFH): This represents a market trend where each successive bar forms a higher low, signalling a strong and consistent upward movement.

One-Time Framing Lower (OTFD): This describes a market trend where each successive bar forms a lower high, indicating a pronounced and steady downward movement.

GOLDMAN SACHS TRADING DESK VIEWS

The Week Ahead from the Futures Desk (Week of February 2nd)

Date: 1 February 2026

Key Events for the Week Ahead:

February 2nd:

- German retail sales

- Eurozone and UK PMI Manufacturing (Final)

- BoE speaker Breeden

- US PMI (Final)

- Fed speaker Bostic

February 3rd:

- French CPI

- German and UK bond supply

- ECB bank lending survey

- Fed speakers Barkin and Bowman

- JOLTS

February 4th:

- Eurozone PPI

- Eurozone and UK PMI Services (Final)

- Eurozone and Italian CPI

- German bond supply

- ADP employment report

- Treasury QRA

- US PMI Services (Final)

- Treasury press conference

February 5th:

- French Industrial Production

- BoE rate decision

- ECB rate decision

- Eurozone retail sales

- Eurozone bond supply

- Weekly claims

- Fed speaker Bostic

February 6th:

- ECB forecasters survey

- German trade balance and industrial production

- Spanish industrial production

- ECB speaker Kocher

- Non-Farm Payrolls

- University of Michigan consumer sentiment

Market Commentary:

Last week, European Central Bank (ECB) commentary revealed a shift towards a more dovish tone, even from typically hawkish members such as Nagel, Kocher, and President Lagarde at Davos. The EUR/USD breaking above 1.20 has applied pressure on European rates, with ERZ6 rallying 9 bps from its low to high. The green section of the curve remains attractive as rate hikes are still priced in. German fiscal data, released Thursday, contributed to selling pressure on Bunds. For further insights, refer to the attached GIR piece on Federal expenditures.

In the USD market, the FOMC meeting was largely uneventful, with Powell signaling his intention to remain on hold until the end of his term. Key themes include reflation driven by metals rallies and USD debasement. Positioning shows consensus on short US Treasuries; however, Trump’s announcement of Kevin Warsh as the new Fed Chairman—a respected and independent figure—prompted significant unwinds in gold, silver, and EUR/USD, while USTs were bid, likely due to macro account stops. Despite stronger data on Friday, markets in both the US and Europe remained bid.

Additionally, oil exhibited a pattern of being bid toward the end of the day but selling off in the morning, reflecting ongoing geopolitical tensions between the US and Iran. The market remains jittery. Metals corrected sharply on Friday, with gold down 10%, silver down 28%, and bitcoin dropping 7% over the weekend. This raises concerns about potential unwinding of other crowded positions.

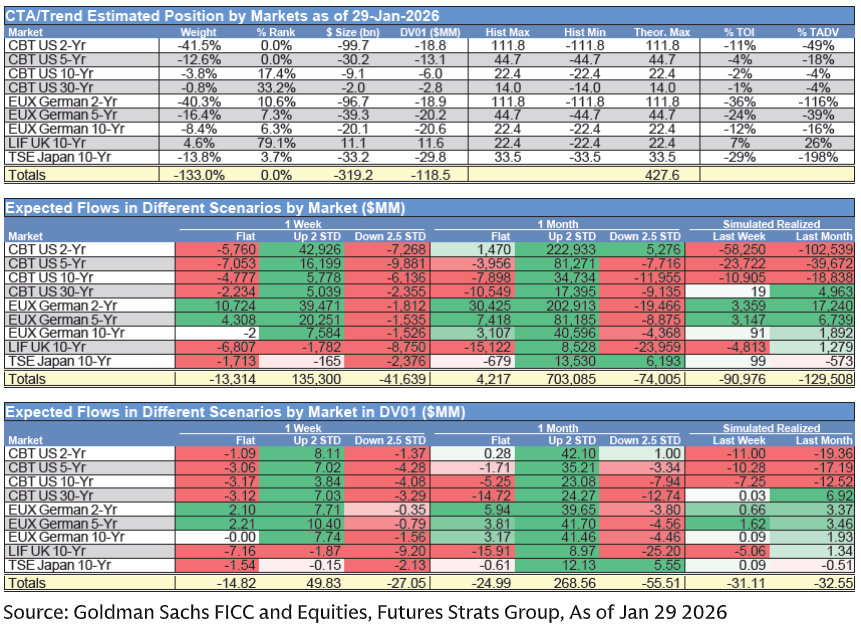

Looking ahead, there is no anticipated supply from the US, and the release of Non-Farm Payrolls next Friday may be contingent on avoiding a government shutdown. Finally, our CTA model indicates maximum shorts in 2s and 5s, continued shorts in 10s and 30s in USD, and persistent shorts in EUR. With heightened market nervousness, it will be crucial to observe if further stops occur.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!